Surprise, Surprise...

Key Takeaway

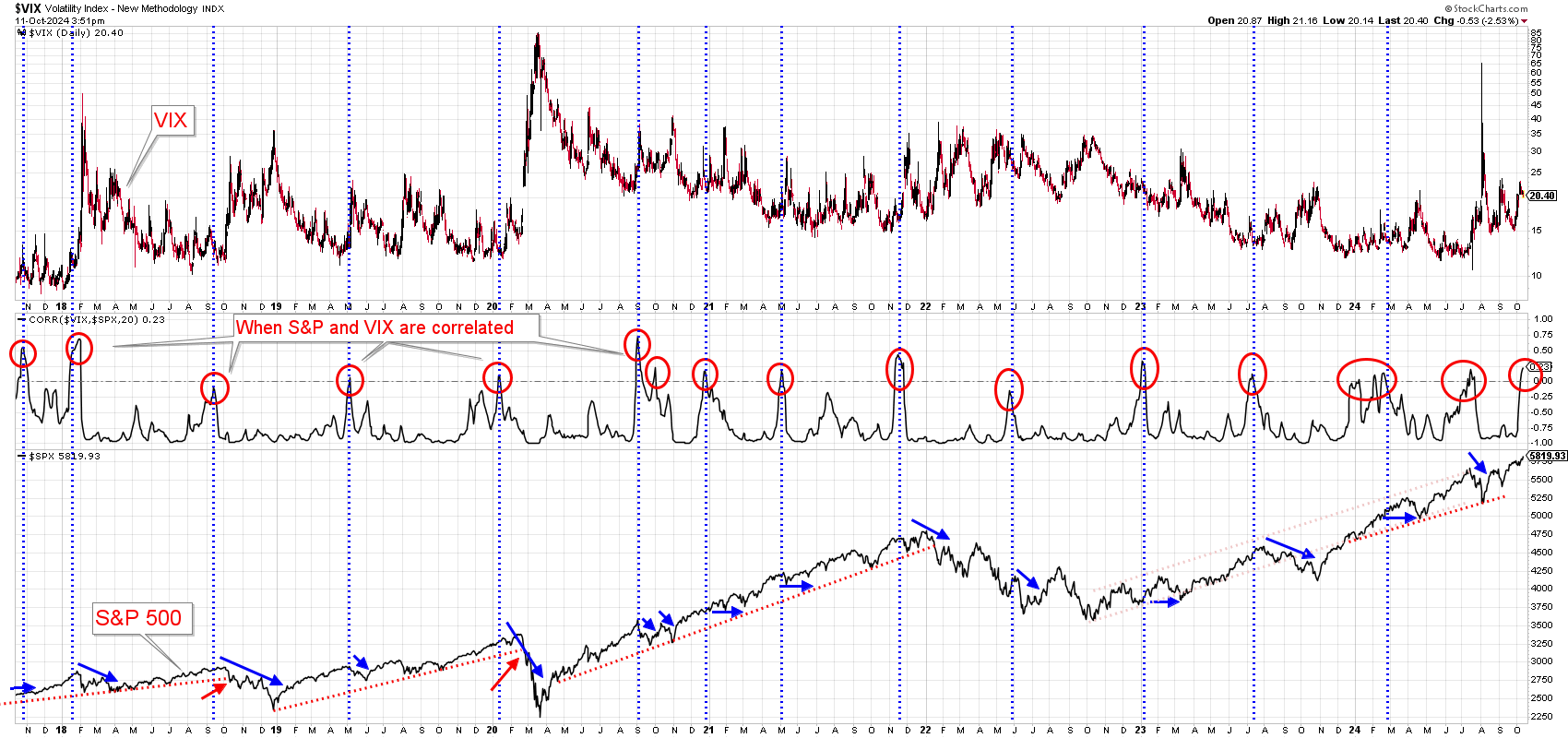

The S&P 500 is on a tear, and surprisingly seems to be defying all odds. Things just keep humming along, so we will continue to ride this trend as long as the wave continues. The chart below indicates that we may be poised for a small pull back in the not too distant future however - not sure exactly when or to what degree. Therefore, we do not plan to try and get ahead of it, but it is a data point certainly worth noting. When the VIX (fear index) and the S&P 500 are positively correlated (red circles below), it typically leads to either a consolidation of gains or a pull back in the market. Essentially this means that fear is rising and so is the market - which is contrary to logic. We obviously won't know until it happens, and again, it's not necessarily actionable at the time, but definitely worth keeping our eye on, and hopefully this relationship won't lead to a big surprise. We're watching!

More By This Author:

The Great Cash HoardMarket Pull Back - Caution?

The January Effect