Surprise! Another Month = Another Failed Attempt At QT

Breaking Down the Balance Sheet

The Fed has found it easier to raise rates than shrink its balance sheet. September was supposed to be the month when the Fed got serious about shrinking the balance sheet. After a few months of warming up with $47.5B monthly reductions, the Fed was going to step up in September and shrink by $95B ($60B in Treasuries and $35B in MBS).

In the prior four months, the Fed only hit the $45B target a single time – last month. It should be no surprise then that September fell woefully short of target, seeing only a $31B reduction. Even this meager run-off has created chaos in the Treasury market with the yield curve seeing pronounced volatility in recent weeks. Given the environment, how long until the Fed follows in the BoE footsteps and re-enters the market, using “crisis mode” as the excuse? Given the mathematical impossibility the Treasury faces in the months ahead, it won’t be too long!

(Click on images to enlarge)

Figure: 1 Monthly Change by Instrument

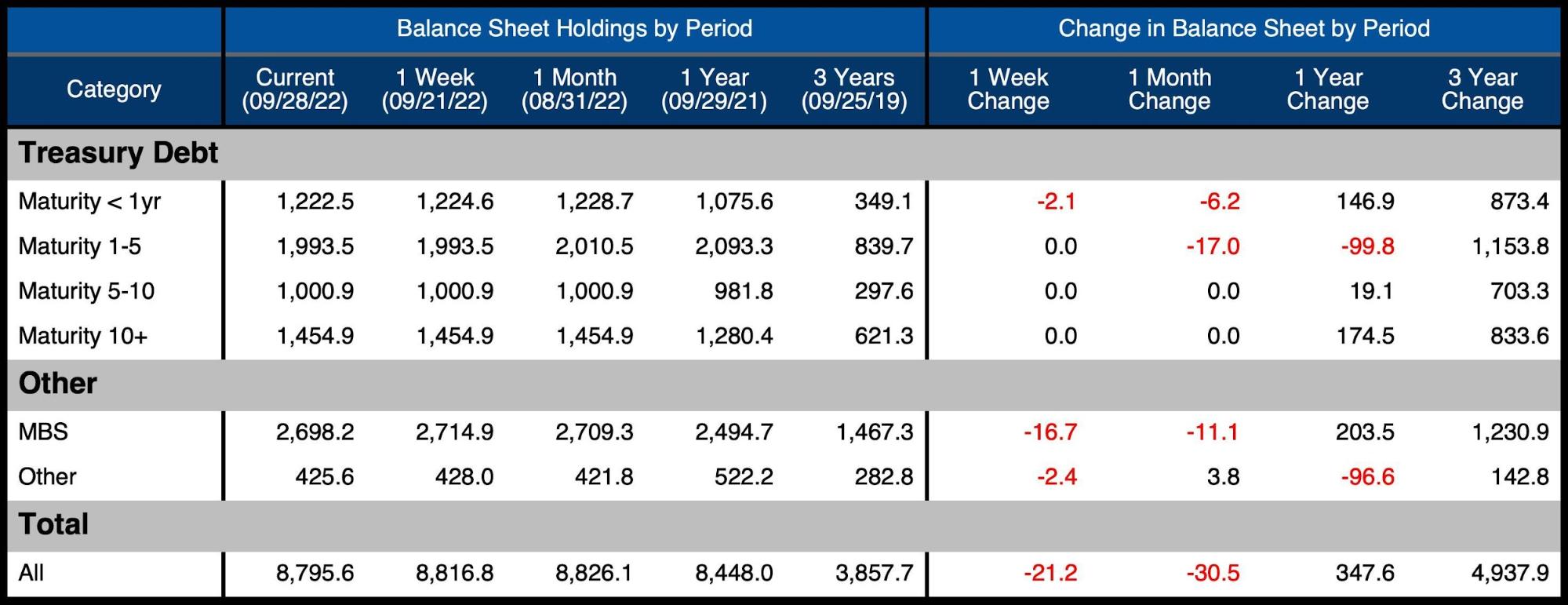

The table below details the movement for the month:

-

- The Treasury market only saw reductions in securities maturing in less than 5 years

-

- Only $23.2B rolled off, which represents 38.7% of the target

-

- MBS was even worse with $11.1B rolling off which represents 31% of the target

- The Treasury market only saw reductions in securities maturing in less than 5 years

Figure: 2 Balance Sheet Breakdown

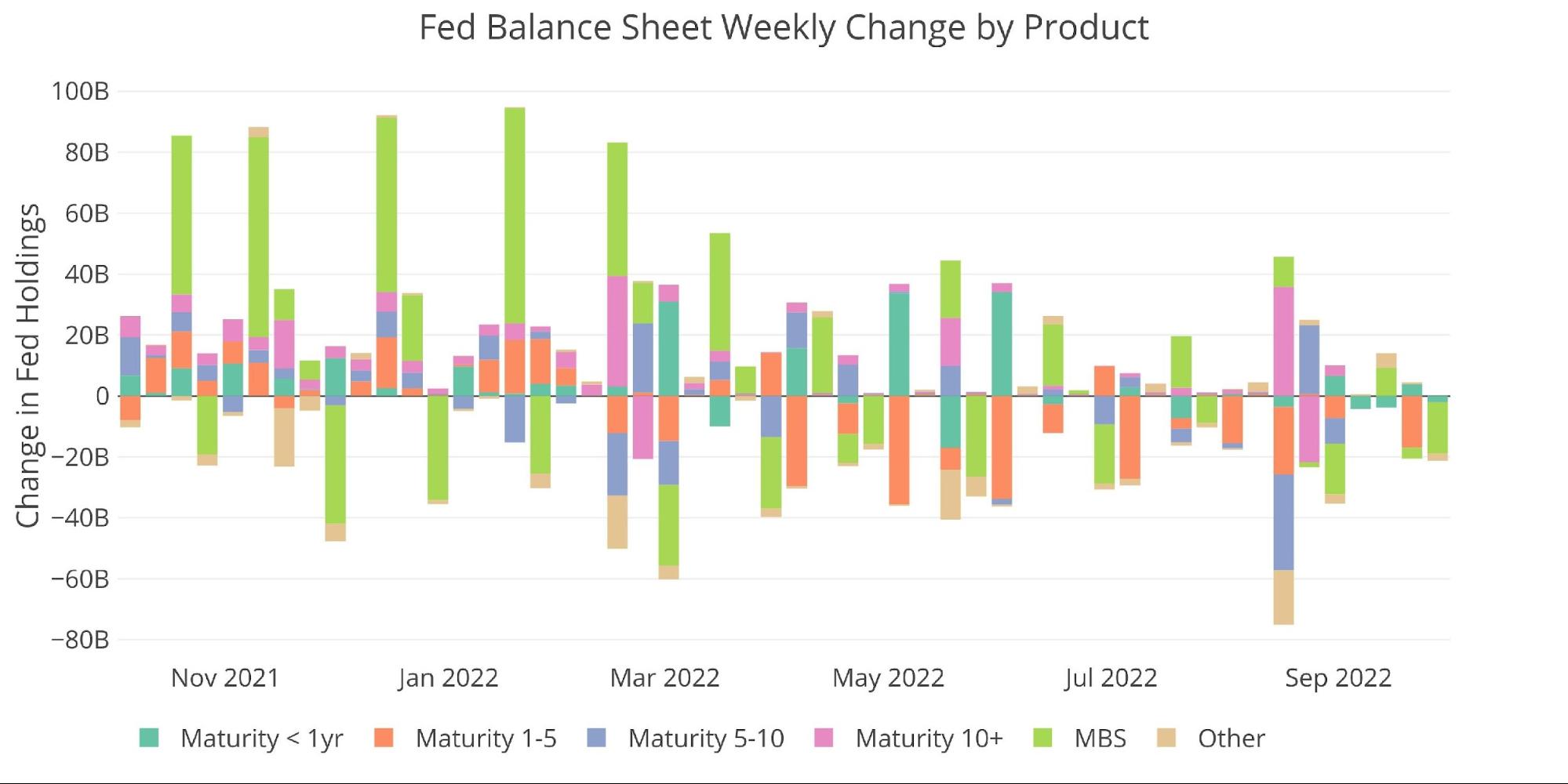

Looking at the weekly data shows that the first two weeks of September (third and fourth from the right) were extremely muted. It wasn’t until the last two weeks that the balance sheet saw any meaningful reduction.

Figure: 3 Fed Balance Sheet Weekly Changes

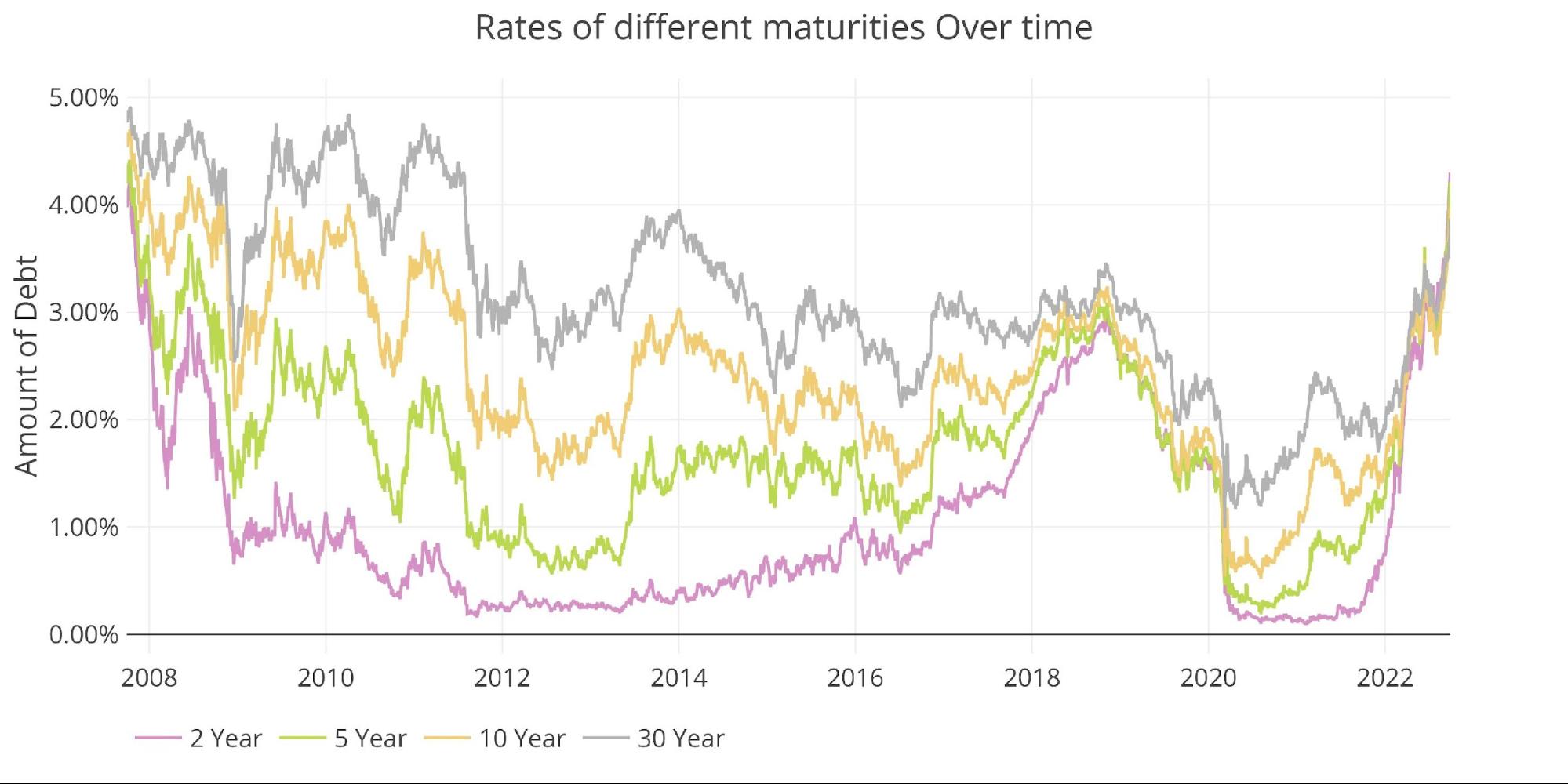

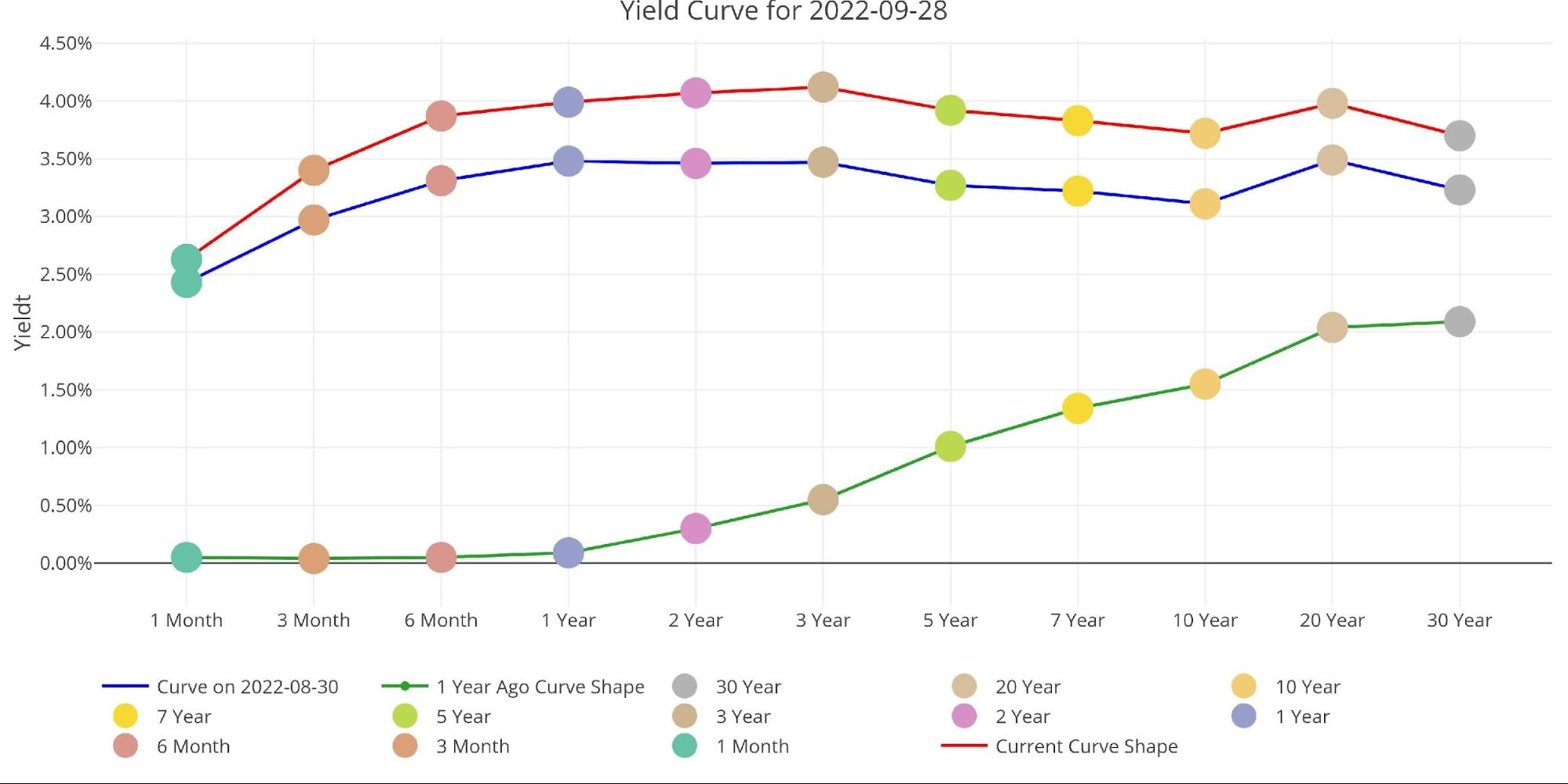

The bond market is mostly responding to the rate hikes, but the Fed’s attempt at QT will only exacerbate the carnage shown below. Things have really accelerated in the last few weeks as shown by the massive spike in yields below. This is an unprecedented move in a typically safe-haven market. And to reiterate, this is with the Fed avoiding the QT it promised to markets!

Figure: 4 Interest Rates Across Maturities

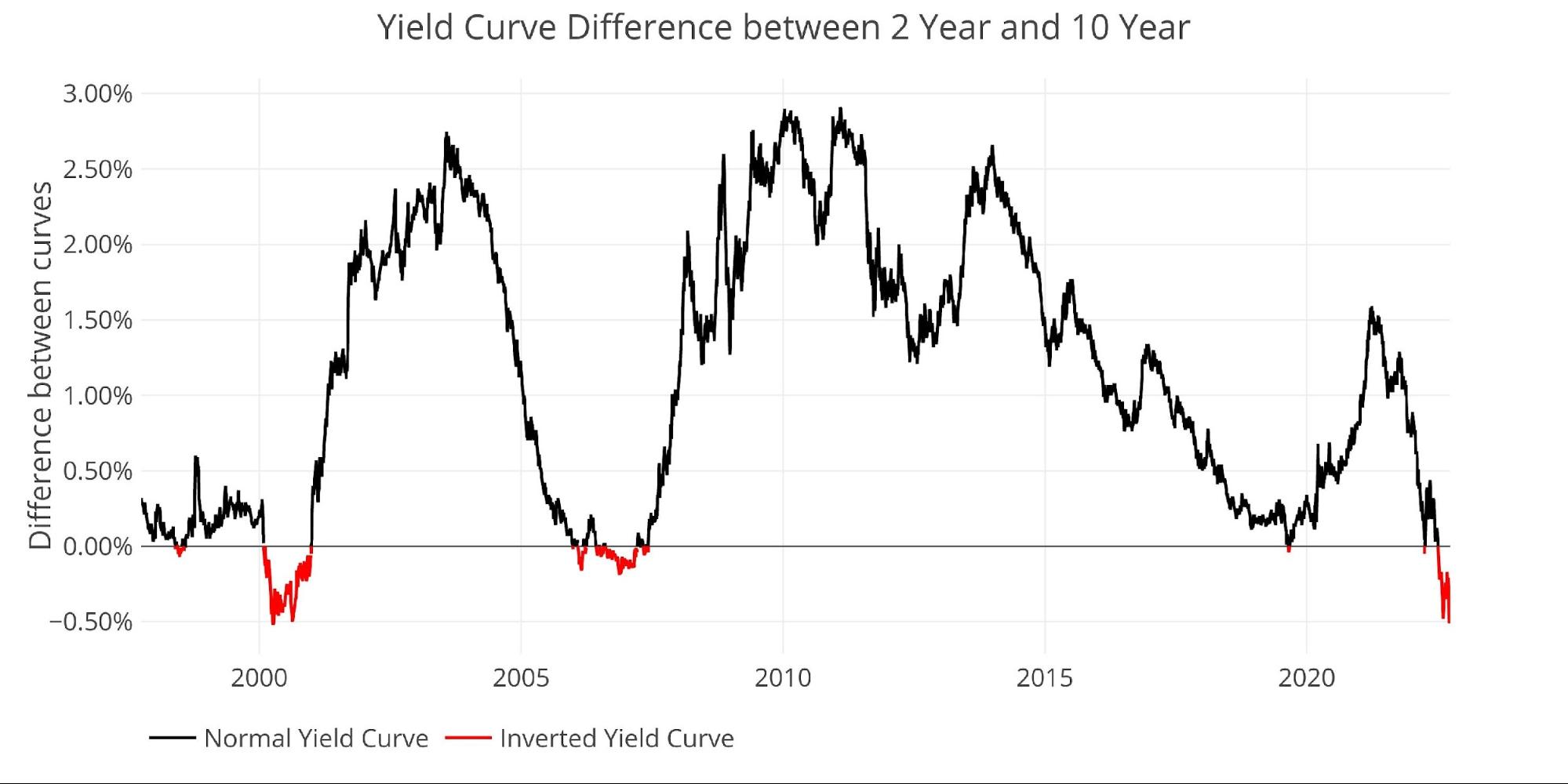

This is showing up in the yield curve spread between the 10-year and 2-year. The curve has been strongly inverted since July 4th.

Figure: 5 Tracking Yield Curve Inversion

Looking at the entire yield curve shows how much has changed over the last month and year. The entire curve has shifted up in the last month by about 55bps and is well above and flatter than the at the same point last year. Several maturities are popping above 4%!

Figure: 6 Tracking Yield Curve Inversion

Who Will Fill the Gap?

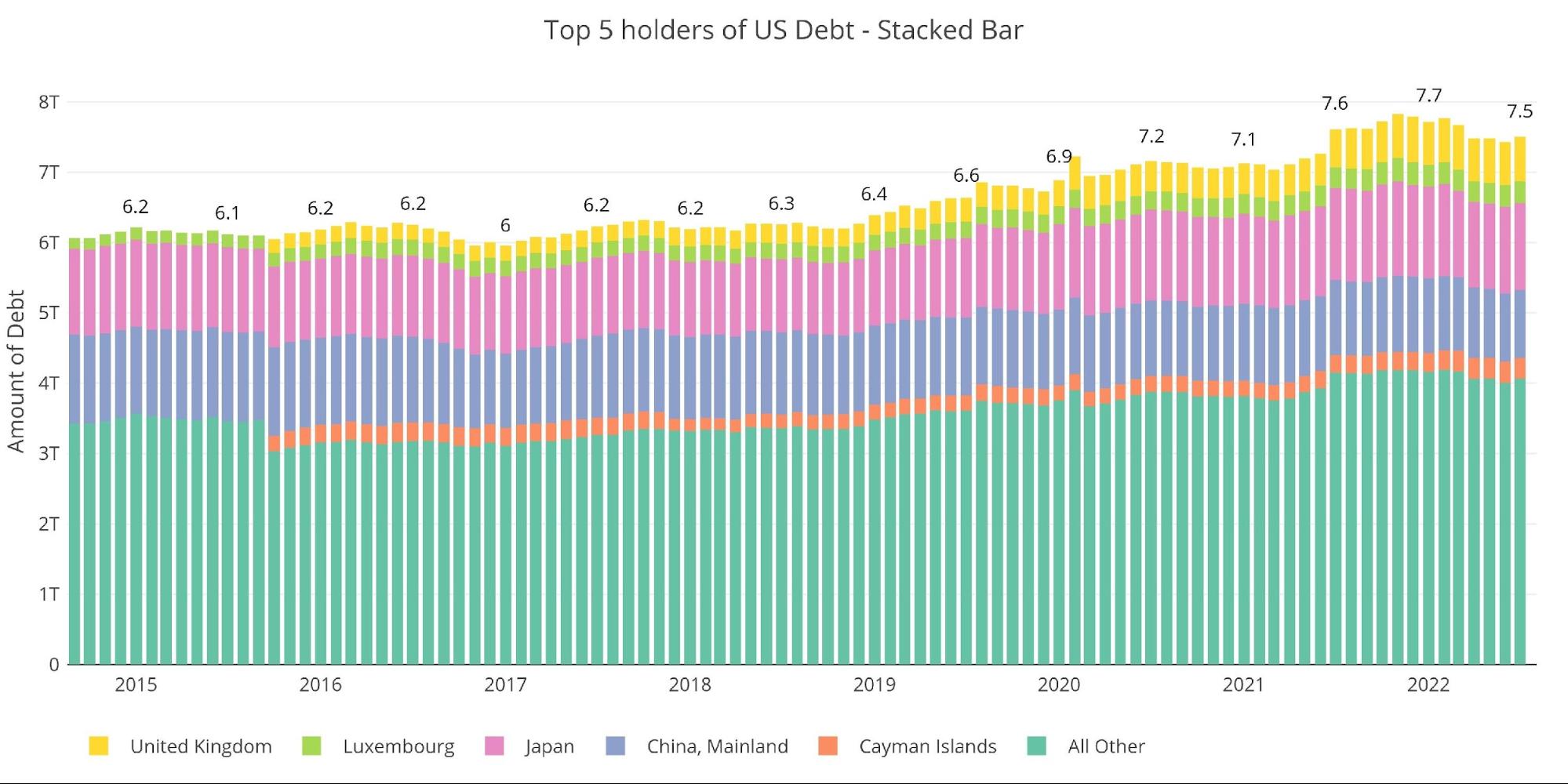

As the Fed leaves the market and enters as a seller, someone will need to step in and purchase the debt the Fed has been buying. The chart below looks at international holders of Treasury securities. International holdings continue to fall, though there was a slight uptick in the most recent month.

China is still less than $1T and Japan actually saw a very minor reduction MoM.

Note: Data was last published as of July

Figure: 7 International Holders

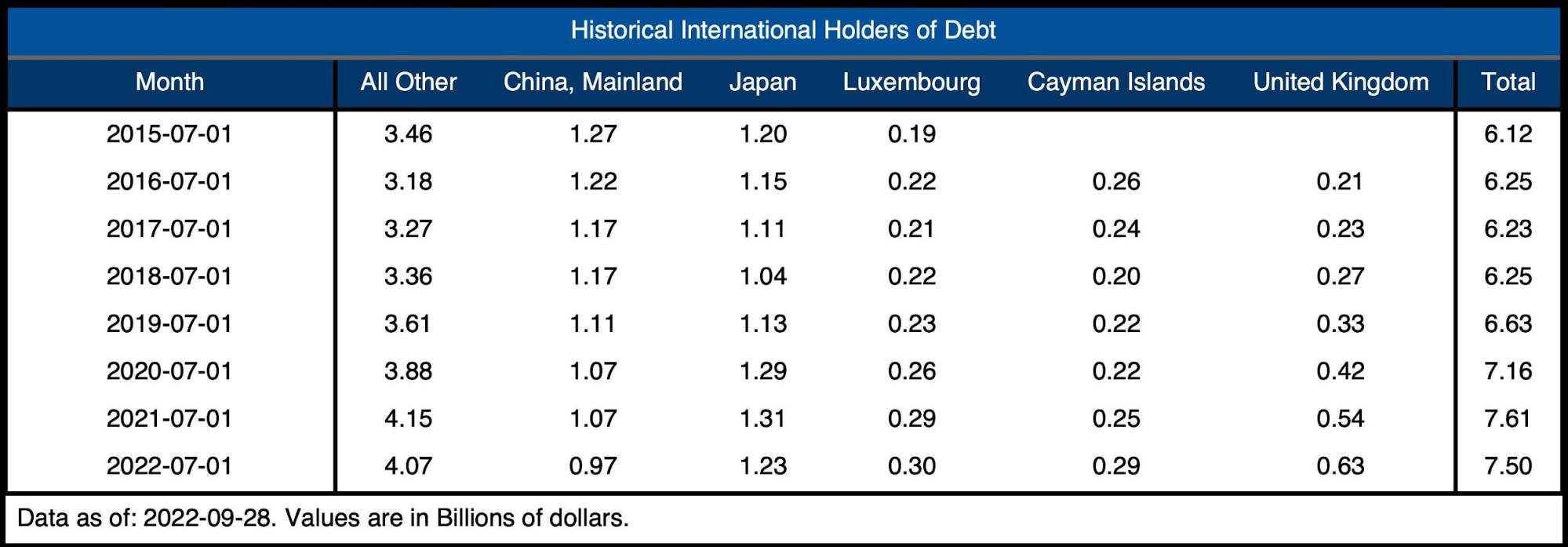

The table below shows how debt holding has changed since 2015 across different borrowers. The net change over the last year is a reduction of $100B. The YoY reduction from both China and Japan can be seen clearly below.

Figure: 8 Average Weekly Change in the Balance Sheet

Historical Perspective

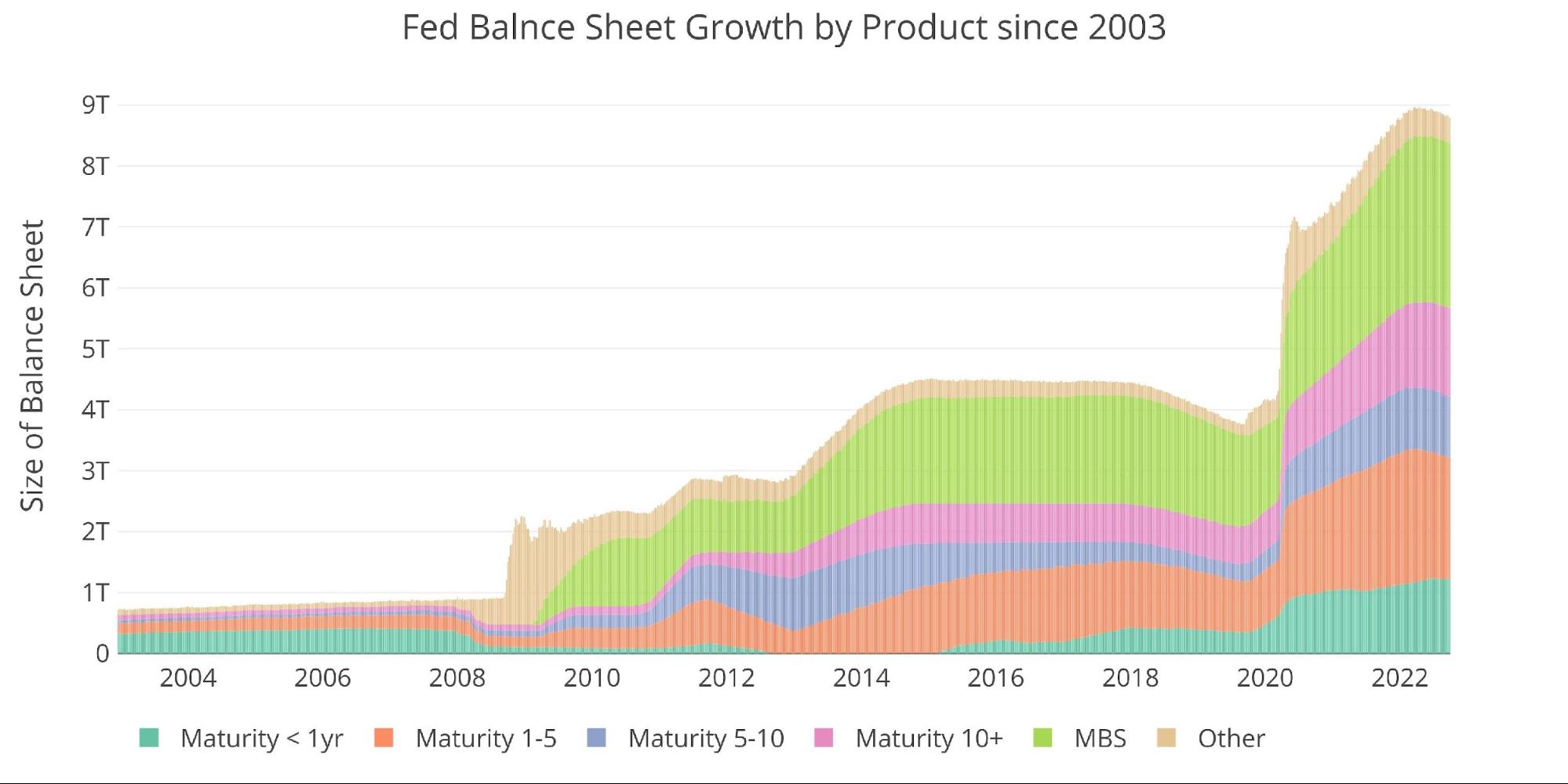

The final plot below takes a larger view of the balance sheet. It is clear to see how the usage of the balance sheet has changed since the Global Financial Crisis. The tapering from 2017-2019 can be seen in the slight dip before the massive surge due to Covid. It’s highly unlikely the new round of QT will last as long or shrink the balance sheet as much as it did in 2018. Furthermore, the current QT pales in comparison to the growth of the balance sheet seen in the latest QE binge.

During the last QT period, the Fed shrunk its balance sheet by ~15%. A similar reduction would be $1.34T. Even if QT hits full speed at some point, it would take more than a year. Will the Fed continue QT as the economy flounders in recession and potentially dips into depression territory?

Figure: 9 Historical Fed Balance Sheet

What it means for Gold and Silver

The Fed has continued to talk tough and deliver on promised rate hikes. Quantitative Tightening has been a different story though. The Fed has failed to deliver in 4 of the last 5 months. The bond market is an absolute disaster so it shouldn’t be a surprise that the Fed is not very trigger-happy.

The BoE stepped in this week to relaunch QE for a “brief” time until it can get back to QT. The problem is that QE is the crisis. Thus, with every new QE program, central banks will have to continue doing more or risk unleashing complete havoc.

Unlike the BoE, the Fed has escaped a major catastrophe so far. But it’s only a matter of time until something breaks. And even if a miracle does happen and no major event blows up in the next few months, the Fed will still have to contend with the Treasury entering a debt spiral.

None of this bodes well, which is exactly why the Fed will relaunch QE sooner than most think. When the Fed does pivot, gold and silver will be set to take-off. That’s when the market should finally realize that inflation is here to stay and there is nothing the Fed can do about it.

Data Source: https://fred.stlouisfed.org/series/WALCL and https://fred.stlouisfed.org/release/tables?rid=20&eid=840849#snid=840941

Data Updated: Weekly, Thursday at 4:30 PM Eastern

Last Updated: Sep 28, 2022

Interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

More By This Author:

Comex: Platinum Shorts Live To See Another Day

This Looks A Lot Like the Dot-Com Bust With One Big Difference — Inflation

Collapse In Money Supply Is Still A Major Risk For The Market