Strong Finish May Have Come A Day Early For Indices

Image Source: Unsplash

It was a good day for bulls and I wish it was banked on Friday rather than today so that weekly candlesticks had a good finish. Instead, tomorrow will be a bit of a nail-biter to ensure by close-of-business markets finish as good as, if not better, than they did today.

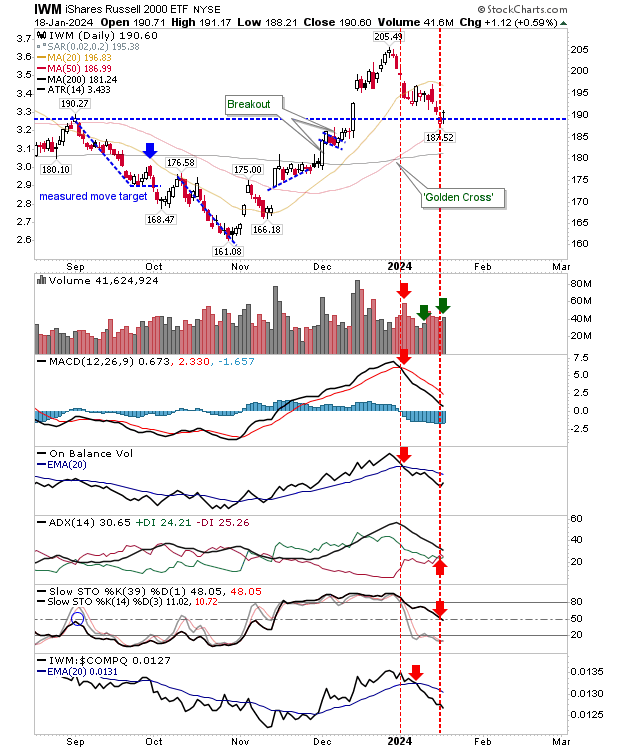

The Russell 2000 ($IWM) might offer the best chance for bulls. Yesterday delivered a positive test of the 50-day MA, but today's rally closed with an indecisive doji. It was a bit disappointing to see this kind of doji so soon in a bounce. Volume climbed to register as bullish accumulation but the trend indicator ADX, has switched to a new 'sell' trigger as had intermediate term stochastics, following earlier 'sell' triggers in the MACD and On-Balance-Volume to leave technicals net bearish. The relative underperformance of the index to the Nasdaq accelerated. What I do like that the index found support defined by the September swing high.

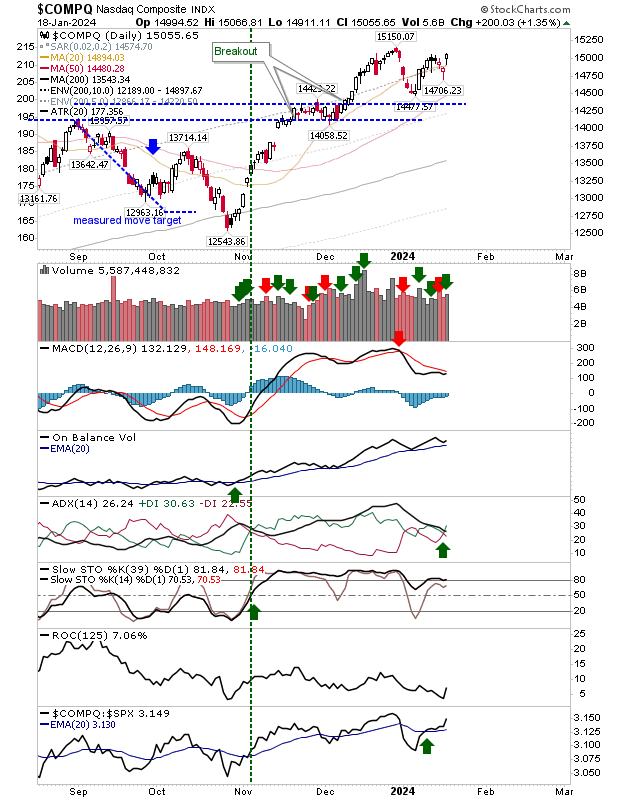

The Nasdaq had an unsual candlestick. The bounce off the swing low finished as a "hammer", not one you typically see following a swing low as a candlestick like this is usually *the* swing low. As with the Russell 2000, today's volume ranked as accumulation, and technically, there is still a working MACD trigger 'sell'. The index is outperforming the S&P.

The S&P has shaped a more traditional consolidation and today's action did conform to a more traditional candlestick commonly seen in "bullish morning star" reversal. The index did enjoy a day of confirmed accumulation, but there was a new 'sell' trigger in On-Balance-Volume. Of the three indices I track, this is the one most likely to breakout tomorrow.

I haven't mentioned the Semiconductor Index in a while. It gapped higher in what could be said to be an "island reversal" - a generally bullish pattern - except it occurred near the end of the rally rather than the start. The trend has been strongly bullish and is once again outperforming the Nasdaq 100. There is a good chance for a test of the December high tomorrow which may see a pause in the advance.

For tomorrow, I will be looking for the S&P to be the main performer, although the Russell 2000 ($IWM) has good potential to continue its recovery.

More By This Author:

An Expected Weak Start Leaves Indices Primed For Further SellingWeekly Charts Offer Optimism, But Weak Finish For Indices On Friday

S&P Approaches Highs As Russell 2000 Treads Water

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more