Strong Consumer Keeps US On Track For 3% GDP Growth

Image Source: Unsplash

Retail sales provided another upside data surprise and indicate a 3% annualized GDP growth rate is possible for the third quarter. However, higher consumer borrowing costs, reduced credit availability, the exhaustion of pandemic-era savings, and the restart of student loan repayments pose major challenges for fourth-quarter activity.

Retail sales lifted by Prime Day and eating out

We have another US data upside surprise from the household sector with retail sales rising 0.7% month-on-month in July versus the 0.4% consensus. June's growth was also revised up 0.1 percentage point to 0.3% MoM. Importantly, the control groups which exclude volatile autos, gasoline, food service, and building materials, rose 1% MoM versus 0.5% consensus, but here there was a 0.1pp downward revision to June's growth to 0.5% MoM. This category, historically, has a better correlation with broader consumer spending. Remember retail sales are only around 45% of consumer spending in total, with consumer services taking a greater share.

Amazon Prime Day appears to have been the main driver with non-store sales up 1.9% MoM, but there was also strength in restaurants and bars (+1.4%) while sporting goods rose 1.5%, clothing was up 1% and grocery up 0.8%. Electronics (-1.3% MoM) and vehicles (-0.3%) and furniture (-1.8%) were the weak spots. All in it points to the US being on track to report 3% annualized GDP growth in the third quarter, which will keep the Fed's language hawkish even if they don't carry through with further rate hikes, as we expect.

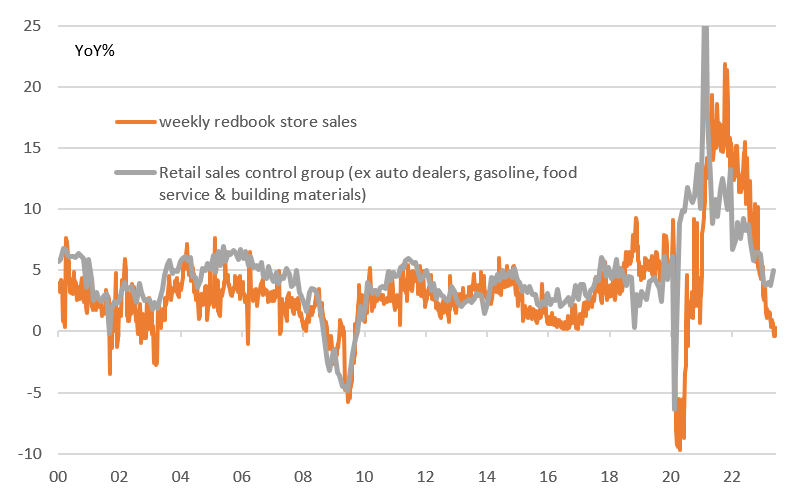

Official retail sales growth versus weekly chain store sales growth (YoY%)

Image Source: Macrobond, ING

The challenges for spending are mounting

Interestingly, there has been a bit of a breakdown in the relationship between the official retail sales growth of the control group and the weekly Redbook chain store sales numbers, as can be seen in the chart above. Maybe this is the Prime Day effect playing out and we see a reconvergence again in August. The Retail sales report is a good story for now, but we are expecting weakness to materialize in the fourth quarter.

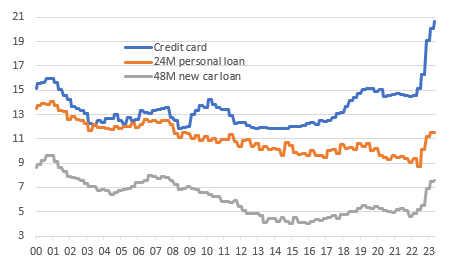

Higher market interest rates will add to upward pressure on what are already record-high credit card borrowing rates and rising auto, mortgage, and personal loan rates. With households also continuing to run down pandemic-related excess savings, as measured by Fed numbers on cash, checking, and time savings deposits, this will act as a brake on growth.

US consumer borrowing costs (%)

Image Source: Macrobond, ING

Higher borrowing costs and reduced credit availability will hurt

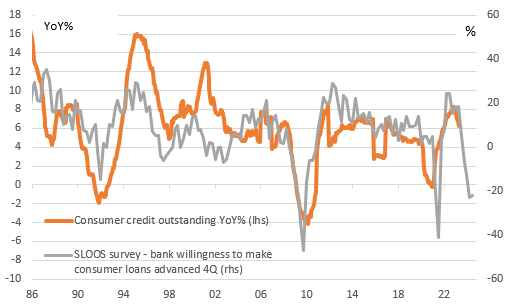

However, it is important to remember that reduced access to credit is just as important as the cost of credit in taking the heat out of the economy. The latest Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) underscores how the tightening of lending conditions will increasingly act as a headwind for activity and contribute to inflation sustainably returning to target. Banks are increasingly unwilling to make consumer loans and as the chart below shows, this has historically pointed to an outright contraction in consumer credit outstanding.

Fed's Senior Loan Officer Opinion Survey points to negative consumer credit growth (YoY%)

Image Source: Macrobond, ING

Fed to keep rates on hold

Add in the squeeze on household finances from the restart of student loan repayments for millions of households and it means further weakness in retail sales and broader consumer spending remains has to remain our base case. The concern is that it will also heighten the chances of recession, which we believe will discourage the Fed from any further interest rate increases. Instead, we expect interest rate cuts from March 2024 onwards as monetary policy is relaxed to a more neutral footing.

More By This Author:

The Commodities Feed: China Macro Data Disappoints

FX Daily: Unruly EM Currencies Keep The Dollar In Demand

Polish CPI Inflation Falls; A Rate Cut Is Surely Coming

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more