Stripe: The Amazon Of Finance?

I hadn’t realised the significance of Stripe’s recent press release until I stumbled over the Stratechery write-up over the weekend. Stratechery points out that Stripe has gone from a simple merchant checkout API to a platform of platforms. The significance of that? Well, think of the Amazon of finance: that’s Stripe’s ambition.

So, what was Stripe’s announcement last week?

Stripe Treasury? What does that mean? The Wall Street Journal explains:

Stripe Inc. is teaming up with banks including Goldman Sachs Group Inc. (GS) and Citigroup Inc. (C) to offer checking accounts and other business-banking services, the startup’s latest attempt to become the internet economy’s financial supermarket.

Oh, and …

Among the early adopters of Stripe’s new banking services is Shopify Inc. (SHOP), which, starting early next year, will offer Shopify Balance accounts to many of the hundreds of thousands of merchants that use its software. Shopify Balance accounts will be held at Memphis, Tenn.-based Evolve Bancorp Inc., but Stripe is also partnering with Goldman in the U.S. and with Citigroup and Barclays PLC (BCS) internationally to store and move customer funds.

So what?

Well, as Ben points out:

It is Stripe’s partnership with Shopify, though, that is particularly compelling, and emblematic of both how powerful Treasury can be, and how extensive Stripe’s platform ambitions are.

In fact, the key here is that Stripe aims to be the financial platform of platforms. Shopify and others will sit on top of Stripe and Stripe will provide the interaction and integration of the banking system for them.

From Stripe’s press release:

For businesses today, accessing financial services can typically involve a series of bureaucratic hoops and a lengthy application process. According to recent Stripe research, setting up an account takes 5 and a half days on average (and 7 days on average for online businesses), around one in four (23%) businesses have to send a fax to open an account (what?), and over half of businesses (55%) are required to visit a branch in person to open a bank account. Financial services simply weren’t designed for the modern internet, and this is a pain point for businesses today: nearly half (46%) of companies report that their banking experience has hindered their company growth.

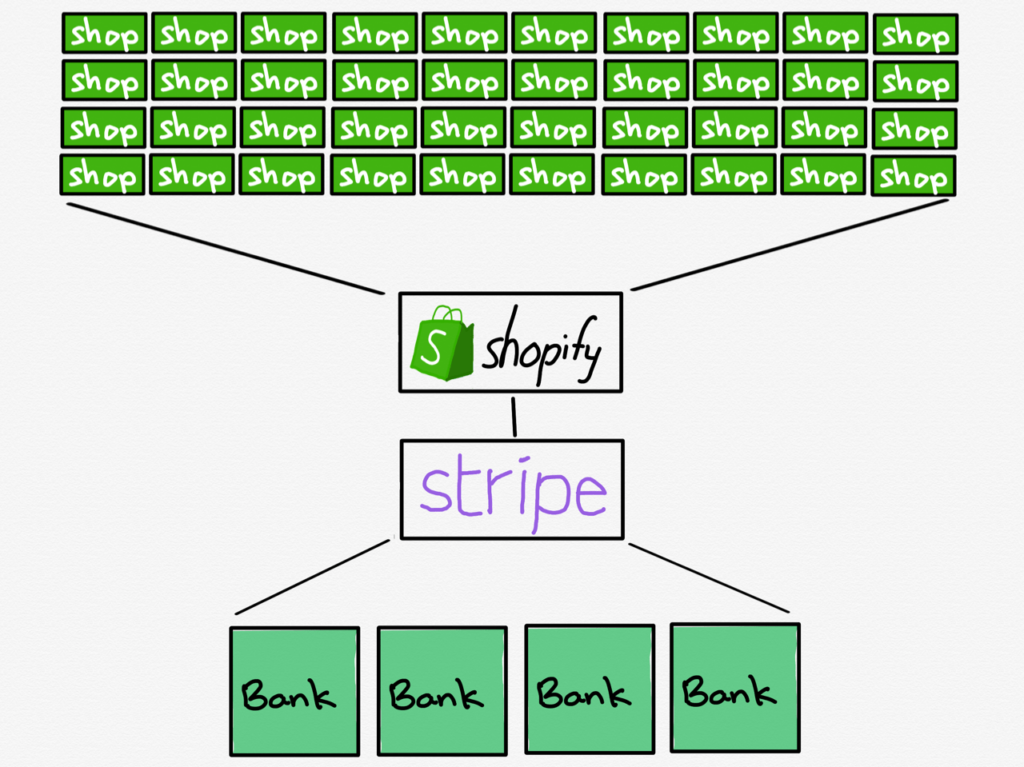

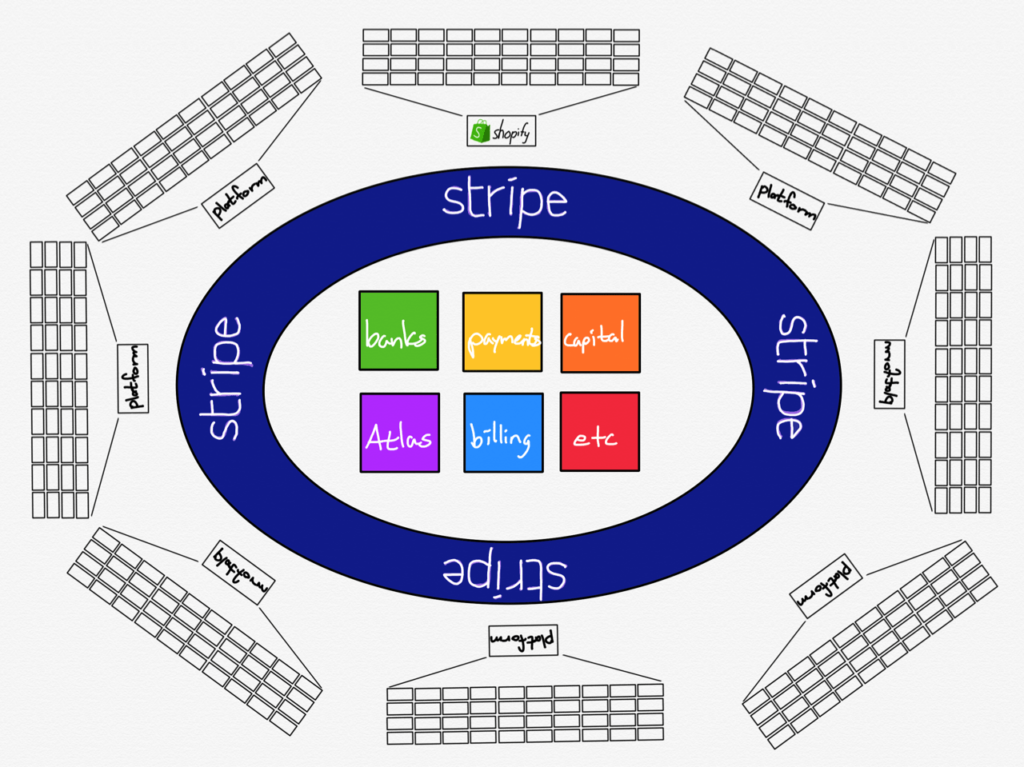

Stratechery then picks up on the fact that Stripe offers a service for access to capital too, and sees it as a platform of platforms as illustrated nicely by this chart:

Stripe does not have a customer relationship with all of the Shops on Shopify; that is exactly what Shopify is good at, so why would they? Instead, Stripe is focusing on what it is good at: providing that API layer to banks that will never have the capability to serve Shopify Shops, and exposing said layer to Shopify to incorporate into their product.

And sees the end-game being more like this:

In an interview with Stratechery John Collison, co-founder and President of Stripe, notes:

We are still very early in developing the set of Stripe products beyond the core payments engine, things like Treasury. We’re building a global payments and treasury network, and we are in November of 2020 launching the Treasury part of it, and so we are just now filling out all the acronyms in our product suite, and that’s the version one of the product. And from a growth point of view, our business is growing really rapidly in APAC and EMEA, and so we’re just early in the business trajectory with all the helter-skelter-ness that comes from that.

For those who follow my musings, you’ll know that I’m hugely impressed by Stripe, but this level of ambition is just phenomenal. Knowing the Collison brothers’ vision, I’m sure they’ll get this ambition delivered. It just makes you wonder why no bank or infrastructure provider ever came up with this? Oh … maybe not.