Streamflation

Streamflation, a portmanteau of “streaming” and “inflation,” is an apt name for the streaming industry’s relentless pursuit of the highest price you’d ever be willing to pay for a streaming service.

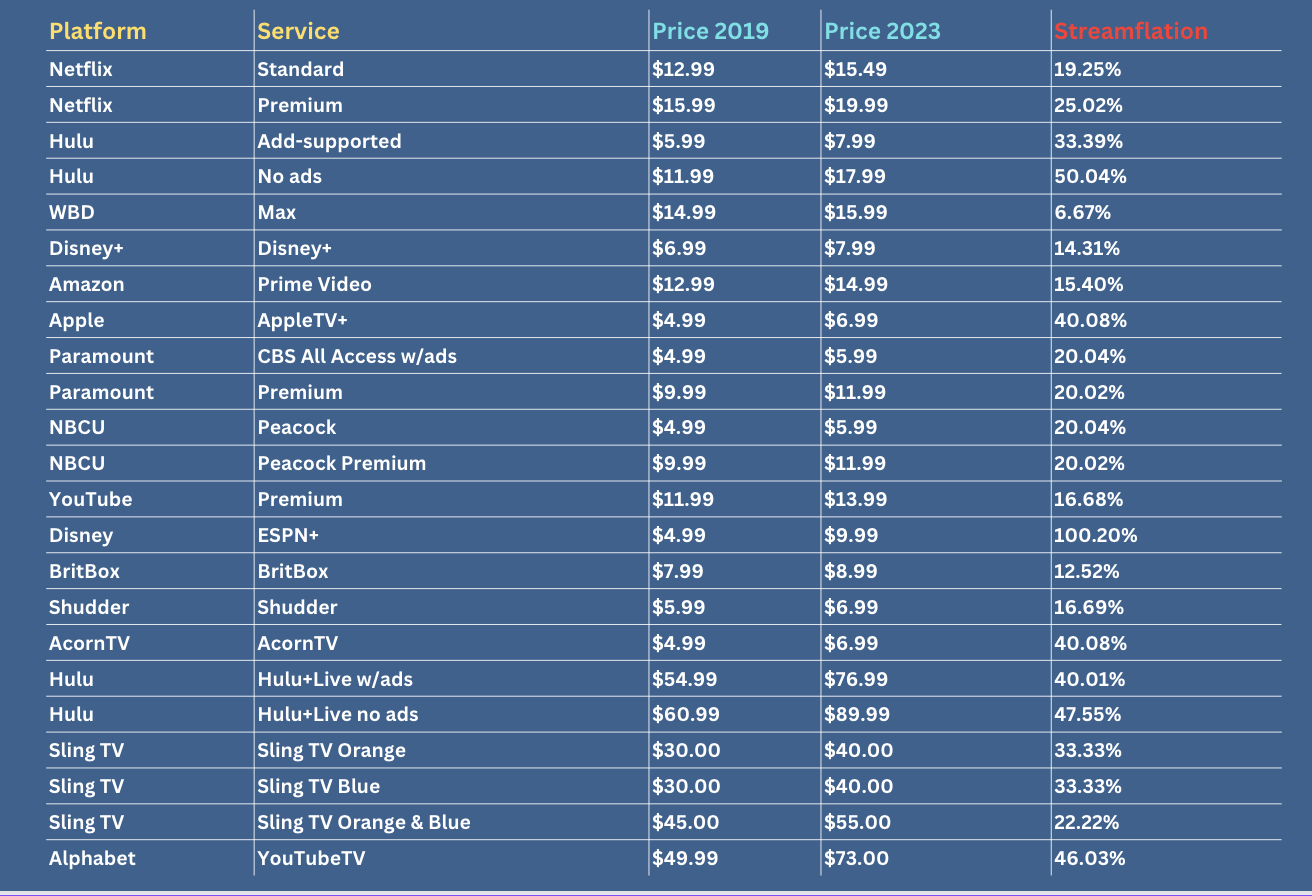

Image: Shelley Palmer

In practice, content prices never come down – so you could argue that there’s nothing to see here. But there is.

The consumer value proposition for becoming a “cord cutter” was that with à la carte pricing, you’d only pay for what you watched. Cable packages were filled with hundreds of channels you cared nothing about and could easily cost $120/month if you added a few premium channels like HBO and Showtime. À la carte pricing would be much, much cheaper. The “cord-cutting fantasy” was disputed by multichannel video programming distributors (MVPDs) as they tried to explain that the “all you can eat” pricing model was not only fair, but that you’d pay way more if you insisted on an à la carte content menu.

As prophesied by the content industry, a full set of subscriptions to all of the channels that used to be included in your cable subscription bundle now costs more than the bundle used to cost – and that’s before you pay for internet access. Let’s have a look.

Platform-Specific Price Increases

Spotify recently implemented its first price hike in over a decade, raising its premium subscription plan by $1–$2. This move mirrors similar pricing adjustments seen across the industry, with platforms like YouTube Premium, Peacock, and Netflix all following suit over the past year.

Source: Individual streaming service sites and historical pricing data from 2019.

Password Crackdowns

Streaming giants are now taking a strong stance on password sharing, signaling a shift in their approach to subscriber growth and revenue protection.

Netflix, a pioneer in the streaming industry, initiated a worldwide crackdown on password sharing in response to lukewarm subscription growth. This move resulted in an increase in subscriber numbers, surpassing the expectations of Wall Street experts. However, the immediate financial impact remains a question mark, as revenue growth fell short of projections. Following Netflix’s lead, Disney also announced plans to limit password sharing. This mini-trend suggests that other streamers will begin to prioritize profits over growth going forward.

Ad-Supported Strategies

Some streamers have decided to raise the costs of their ad-free offerings while maintaining the ad-supported rates at their current levels. Other streamers are offering FAST services (free ad-supported streaming television) which is basically traditional ad-supported broadcast television distributed over the public internet.

AVOD (ad-funded video-on-demand)

Deloitte Global predicts that “by the end of 2023, approaching two-thirds of consumers in developed countries will use at least one AVOD service monthly—a 5% increase over the prior year,” and – by 2030 – it is expected that “most online video service subscriptions will be partially or wholly ad-funded, catching up with emerging markets where ad-funded video-on-demand has always been the norm.”

The delicate balance between providing an uninterrupted, premium viewing experience and offering more budget-friendly options has become a key factor in attracting and retaining a diverse range of viewers in the competitive streaming landscape.

Everything Old Is New Again

The “new” media landscape is starting to look a lot like the “old” media landscape. Disney/ABC, Paramount/CBS, Comcast/NBCU, plus a bunch of pay or premium options like WBD/Max and newcomer, Apple TV+. How long before YouTubeTV or Hulu Plus Live or Roku replace traditional MVPDs? The ground is literally shaking under the foundations of the business – we’ll see how it goes.

More By This Author:

Now ChatGPT Can See & Speak

Amazon Promises Better AI for Alexa

Google’s Bard: Let The Copilot Wars Begin

Disclosure: This is not a sponsored post. I am the author of this article and it expresses my own opinions. I am not, nor is my company, receiving compensation for it.