Stocks Stage Comeback As Nasdaq Reclaims 25K

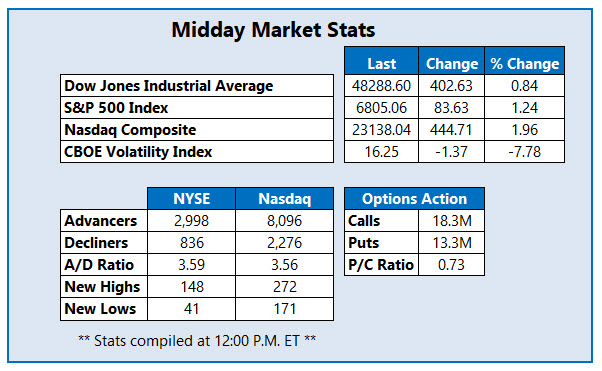

Stocks are in rally mode today, thanks to a flurry of tailwinds blowing on Wall Street. A delayed, incomplete, and softer-than-expected inflation report for November lifted sentiment, as well as lower-than-anticipated weekly jobless claims data. Tech stocks are up off the mat too, thanks to an outsized move from chip maven Micron Technology (MU). The Dow Jones Industrial Average (DJIA) and S&P 500 Index (SPX) are poised to snap four-day skids, while the Nasdaq Composite (IXIC) has reclaimed 25,000 and eyes its best single-session gain since Nov. 24

Trump Media & Technology Group Corp (Nasdaq: DJT) is getting blitzed by options traders this afternoon, after the conservative media outlet announced a merger with nuclear fusion company TAE Tech in a $6 billion deal. At last check, 234,000 contracts have changed hands, volume that's 14 times the average intraday amount. The December 14 call is the most popular, with new positions being sold to open. DJT is 36% higher today to trade at $14.25, on track for its best single-session gain since January 2024. Year to date though, the stock is down 58%.

(Click on image to enlarge)

Constellation Energy Corp (Nasdaq: CEG) is one of the best names on the New York Stock Exchange (NYSE) today, last seen up 8% to trade at $368.26. Power producers are up across the board today, after grid operator PJM Interconnection reported record prices at an auction yesterday. CEG is 65% higher in 2025, trading in a tight range since early November.

ServiceNow Inc (NYSE: NOW) stock is struggling again today, down 2.4% to trade at $152.89. The software company yesterday executed a 5-to-1 stock split, and today Oppenheimer set its price target at $230. NOW is off by 28% year to date and 11.9% this week alone.

More By This Author:

Big Tech Teardown Triggers 4-Straight Losses For Dow, S&P 500Stocks Stumble Again As Oracle Drags Tech

Nasdaq Pivots Higher As Tech Selloff Cools