Stocks Slip As Traders Struggle To Push Aside Loan Fears

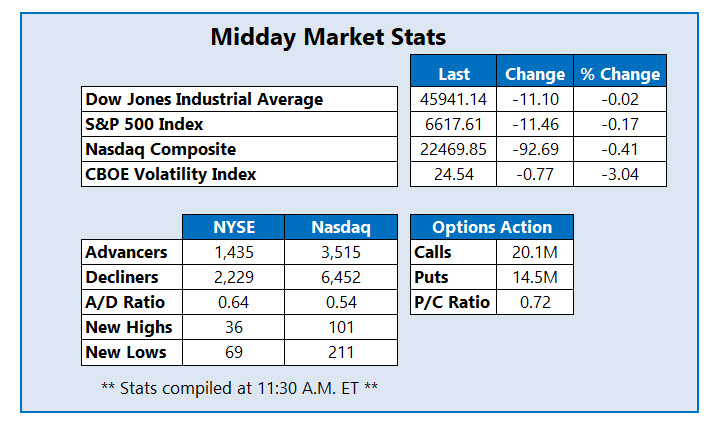

Wall Street is failing to push aside concerns around bad loans out of Zions Bancorp (ZION) and Western Alliance (WAL), with the Dow Jones Industrial Average (DJI) sitting just below breakeven at midday. The tech-heavy Nasdaq Composite (IXIC) and S&P 500 Index (SPX) are also struggling, the former down more than 90 points. Traders now have jobless data to unpack, with Goldman Sachs (GS) estimating that claims fell to 217,000 last week, below the expected 230,000. All three indexes remain higher for the week, despite government shutdown fatigue and U.S.-China trade tensions.

Rocket Companies Inc (NYSE: RKT) is trading 1.2% lower at $16.36 at last check, headed for its third-straight daily drop, after the company yesterday announced its next earnings report will be on Oct. 30. Despite its recent fall on the charts, RKT remains 53% higher in 2025, and is seeing an influx of options activity. So far today, 183,000 calls and 249,000 puts have been exchanged, 4 times the average intraday pace. The expiring October 17 call is most popular, while the weekly 10/24 14-strike put sits just behind.

Outperforming on the New York Stock Exchange (NYSE) is consumer healthcare name Kenvue Inc (NYSE: KVUE). Last seen up 8.4% at $15.30, KVUE is attempting to rebound off Thursday's steep selloff to a record low of $14.05. The equity is struggling on the back of peer Johnson & Johnson's (JNJ) lawsuit, though longer-term performance has also been subpar. Down 53% year to date, the overhead 20-day moving average is also adding pressure.

The worst performer on the NYSE today is Hims & Hers Health Inc (NYSE: HIMS) stock, last seen down 13.8% at $50.97. Today's drop is likely in relation to President Donald Trump's comments that Novo Nordisk's (NVO) weight-loss and diabetes drugs, Wegovy and Ozempic, should be reduced to $150 a month. This pullback hardly dents the shares, which sport a 111% year to date lead. Chart performance has been choppy, with the stock breaking above $60 just twice in the past two months.

More By This Author:

Stocks Reverse Gains, Settle Red As Banks Bottom OutTech-Heavy Nasdaq Continues To Climb On AI Optimism

Dow Erases Triple-Digit Gain To End Volatile Session Lower