Stocks Shrugs Off China Second Wave Fears, Asian Clashes, Rise On Stimulus Hopes

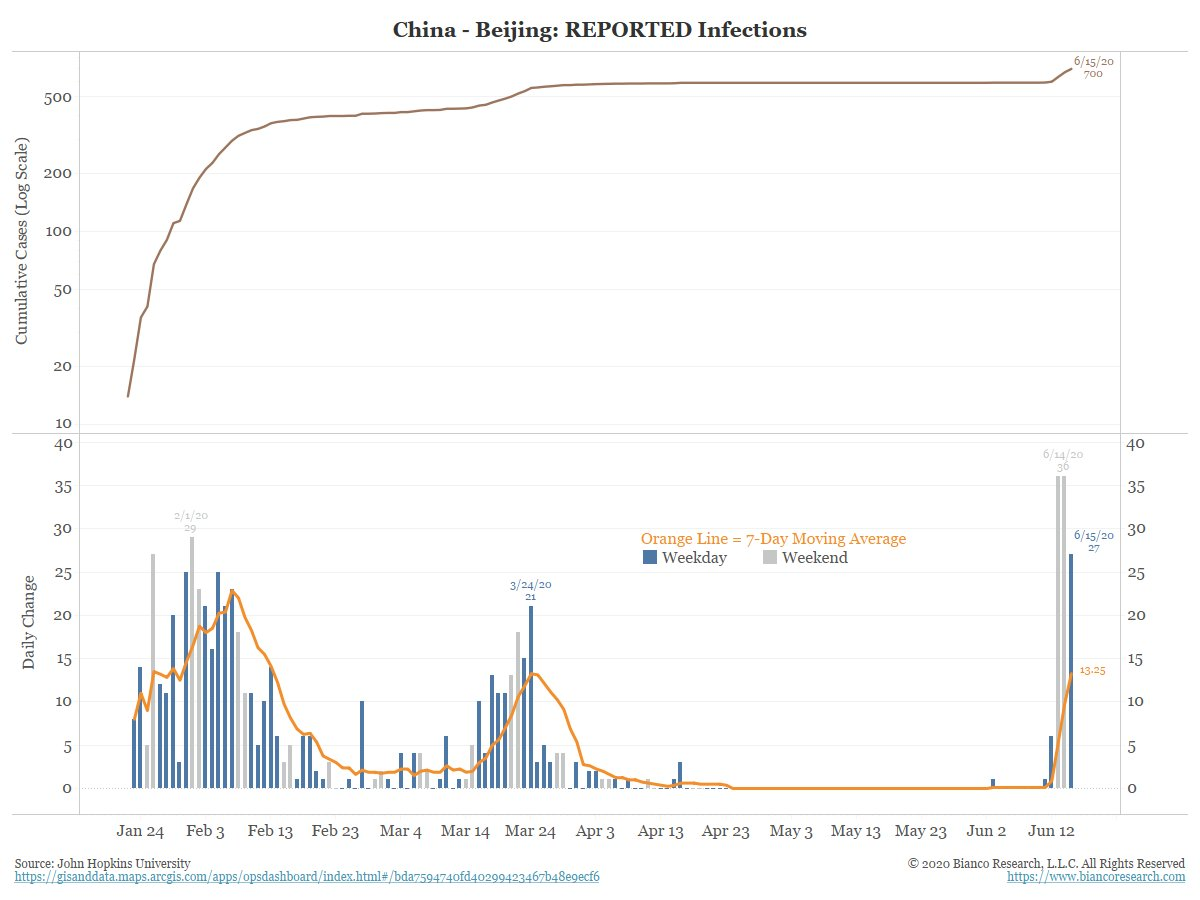

For the third day in a row, global markets have shrugged off concerns about rising global coronavirus cases and that China is set to suffer a "second wave" as much of Beijing is once again under lockdown, with US equity futures advancing and European shares adding to their best gains in almost a month thanks to continued government and central bank stimulus and hopes of a rapid economic recovery.

(Click on image to enlarge)

As we accurately previewed earlier, Tuesday data showed US retail sales enjoyed a record 17.7% rebound in May, but new infections have hit record highs in six U.S. states, Brazil infections surged by a record 34,918, Iran warned it may need a new lockdown, and China cut flights and closed schools to contain a fresh outbreak in Beijing and a clear second wave in the country.

(Click on image to enlarge)

The theme of a strong global economic rebound "will need to be balanced against the 2nd wave COVID risks which are more difficult to assess, and we would argue investors have assumed to be perhaps more modest than in reality," said MUFG’s Head of Research Derek Halpenny quoted by Reuters.

Geopolitical tensions also remain rife with India reporting 20 of its soldiers were killed in clashes with Chinese troops at a disputed border site, while North Korea rejected a South Korean offer to send special envoys and said it would redeploy troops at the border. However, in a world where only central bank liquidity matters, all geopolitical concerns were quickly forgotten.Sentiment was also boosted after a simple, cheap steroid, dexamethasone, used to reduce inflammation in other diseases such as arthritis, reduced death rates by around a third among the most severely ill COVID-19 patients admitted to hospital.

“It is one of the best pieces of news we’ve had through this whole crisis,” Britain’s Health Secretary Matt Hancock said.

As a result, MSCI’s index of World shares rose 0.2%, having climbed 2.2% the previous day to reclaim a good portion of the ground it lost last week. European shares rebounded, after early gains of 1% were trimmed in half but with increases in real-estate and construction-firm shares brought fresh momentum to the Stoxx Europe 600 Index.

Asian equities saw a modest move higher except for shares in South Korea, which were volatile in the wake of rising tensions with North Korea, with the won currency sliding against the dollar.Most other markets in the region were up, with Thailand's SET gaining 1% and Australia's S&P/ASX 200 rising 0.8%, while Japan's Topix Index dropped 0.4% after jumping almost 5% on Tuesday for its biggest daily gain in three months.The Topix declined 0.4%, with Toho System and Enigmo falling the most. The Shanghai Composite Index rose 0.1%, with China Building Test and Nanjing Iron & Steel posting the biggest advances.

As Bloomberg notes, investor optimism toward risk assets is reflecting bets that new virus outbreaks won’t lead governments to pull back from gradually reopening their economies, even though Fed Chair Powell said the U.S. economy has a long way to go before it reverses the substantial damage done by the pandemic.

"Global markets could remain stretched between a health situation likely to remain a threat in several regions for some time on the one hand, and a stream of positive macro figures confirming that we have passed the low point on the other," said Xavier Chapard, a global macro strategist at Credit Agricole. He added that "the Fed’s priorities are shifting from emergency actions aimed at preventing a market melt-down to long-lasting actions to support the fastest possible recovery in the real economy", although we kinda disagree with that considering the Fed strategically re-announced the launch of its bond buying operation just as the market was about to drop below its gamma neutral level on Tuesday.

“There is little doubt that the global economy bottomed in April and is poised to post record-high growth rates over May and June, strongly lifting 3Q GDP above its 2Q trough,” wrote economists at JPMorgan. “But questions about the extent of lasting damage will have to wait for a number of months before being resolved.”

In rates, 30Y rose 2bps at 1.55%, having risen by the most in a month on Tuesday, and 10-year German Bunds led a flurry of similar rises in Europe ahead of a 5 billion euro bond sale. “The tension between better economic data and rising COVID-19 cases continues to drive market volatility,” said Antoine Bouvet, senior rates strategist at ING in London.

In FX, the Bloomberg Dollar Index swung between small gains and losses, though the upside seemed capped by the 200-DMA; the greenback advanced versus most Group-of-10 peers, though most traded in confined ranges. Risk-sensitive currencies were little changed against the dollar after earlier being weighed down on concern over the resurgence of the coronavirus outbreak, particularly in China. The euro reversed an early London-session gain; German bunds declined, with the oversubscription rate falling at an auction. The pound slumped; it had earlier bounced back from a slight decline after U.K. inflation data came in at its weakest since 2016, increasing expectations for more BOE stimulus.

In commodities, gold was stuck at $1,725 and well within the $1,670/$1,764 range of the past few weeks. Gains in oil prices slowed amid an increase in U.S. crude inventories. They had climbed 3% on Tuesday after the International Energy Agency (IEA) raised its oil demand forecast for 2020. Brent crude futures swung 1% higher to $41.35 a barrel, while U.S. crude ticked up 16 cents to $38.54.

Expected data include housing starts, mortgage applications reported earlier rose to the highest level since 2009.

Market Snapshot

- S&P 500 futures up 0.9% to 3,155.75

- STOXX Europe 600 up 0.8% to 366.28

- MXAP up 0.2% to 158.71

- MXAPJ up 0.5% to 511.09

- Nikkei down 0.6% to 22,455.76

- Topix down 0.4% to 1,587.09

- Hang Seng Index up 0.6% to 24,481.41

- Shanghai Composite up 0.1% to 2,935.87

- Sensex up 0.7% to 33,846.95

- Australia S&P/ASX 200 up 0.8% to 5,991.80

- Kospi up 0.1% to 2,141.05

- German 10Y yield rose 6.2 bps to -0.365%

- Euro up 0.06% to $1.1271

- Italian 10Y yield fell 6.1 bps to 1.269%

- Spanish 10Y yield rose 1.8 bps to 0.551%

- Brent futures down 0.3% to $40.82/bbl

- Gold spot down 0.2% to $1,722.58

- U.S. Dollar Index up 0.2% to 97.12

Top Overnight News from Bloomberg

- President Donald Trump’s trade chief, Robert Lighthizer, will tell U.S. lawmakers Wednesday that the time has come to renegotiate America’s fundamental tariff commitment at the World Trade Organization

- Beijing reported new virus cases Wednesday, having closed schools and canceled more than 1,200 flights as authorities grapple with stemming the outbreak without sealing off the city

- The European Commission on Wednesday will unveil a set of proposals to bolster local industries in fighting back against companies that receive aid from foreign governments. The plan could ban these non-EU firms from making acquisitions, or force them to divest assets, and allow the commission to impose fines

- Italian Prime Minister Giuseppe Conte will likely seek parliament’s approval for about 10 billion euros ($11 billion) in extra spending soon, government officials said, in the latest step to revive one of Europe’s most vulnerable economies

- South Korea warned North Korea against further provocations, after Kim Jong Un’s regime pledged to dismantle the last remnants of President Moon Jae-in’s legacy of rapprochement and move troops into disarmed border areas

- The U.K. published its negotiating objectives for a trade deal with Australia and New Zealand, which the government said could boost exports by about 1 billion pounds ($1.3 billion) as it seeks to expand trade links after Brexit

Asian equity markets failed to fully sustain the positive handover from Wall St with regional bourses indecisive amid geopolitical tensions, COVID-19 fears and with early underperformance in Japan due to a firmer currency and weaker than expected trade data. ASX 200 (+0.8%) and Nikkei 225 (-0.6%) traded mixed as upside in consumer stocks and tech kept the Australian benchmark afloat, while sentiment among Tokyo exporters was subdued by a firmer currency and after the latest trade data showed a larger than expected slump in Exports Y/Y, with Japan’s US-bound exports at the fastest pace of decline since March 2009 and its trade surplus with the US at a record low. KOSPI (+0.1%) swung between gains and losses on increasing tensions in the Korean peninsula after North Korea demolished its inter-Korean liaison office in Kaesong yesterday and is reportedly to deploy the army to Kaesong and Mt. Kumgang. There were also criticism from North Korean leader Kim’s sister on South Korean President Moon which prompted a response from the Blue House that it will not tolerate North Korea's senseless remarks anymore and the Defense Ministry warned that North Korea will pay the price if it takes actual military action. Hang Seng (+0.6%) and Shanghai Comp. (+0.1%) conformed to the non-committal tone after another net liquidity drain by the PBoC and amid concerns regarding the outbreak in Beijing where the city government raised its COVID-19 emergency response to level II from level III and resulted to the cancellation of 1255 flights. In addition, deadly clashes between India and China at the Himalayan border where 20 Indian soldiers were killed also contributed to the ongoing geopolitical concerns. Finally, 10yr JGBs were slightly higher after having rebounded off support just below 152.00 although the underperformance of Japanese stocks and BoJ’s presence in the market only provided marginal gains for JGBs.

Top Asian News

- Citi Sees Higher Chance of Possible Default for Hilong Bonds

- RBA Saw Australian House Prices Falling 7% Over the Next Year

- Foiled Kidnapping Hurls Publicity-Shy Tycoon Into Spotlight

- Yes Bank Is Said to Plan $1 Billion Public Share Offering

European equities had a tame start to the session as bourses opened with very modest gains following a mixed APAC handover, before the region edged higher since the cash open. Europe has since given up early gains [Euro Stoxx 50 +0.1%] to return to levels seen around the cash open. Peripheries lag with Spain’s IBEX (-0.9%) is the marked underperfomer thus far and Italy’s FTSE MIB (-0.1%) also in the red – potentially heading into the European Council meeting with pessimistic rhetoric from Chancellor Merkel and European Council President Michel on the likelihood of a concensus on the Recovery Fund being reached on Friday. The periphery could also be seeing jitters of a second wave having been hit hard by the initial outbreak. Sectors are mixed with defensives overall faring better than cyclicals, whilst the breakdown sees Travel & Leisure the laggard amid fears of further disruptions to operations due to a second wave. On that front, Carnival (-3.5%) shares continue to deteriorate alongside the update from Norwegian Cruse Line – who cancelled all voyages until October. Elsewhere, European Auto names and part makers remain under pressure as May car registrations slumped 57% YY, with Renault (-1.2%), Daimler (-1.1%), Continental (-1.8%) and Ferrari (-1.5%) all at the foot of their respective bourses. HSBC (+0.1%) trades choppy but just about holds onto gains amid reports the group is poised to cut headcount by some 35k over the medium term; however, the firm could be further embroiled in politics, with Global Times stating that some observers have said the Anglo-Sino bank may experience more severe consequences for their collusion with the US against Huawei.

Top European News

- U.K. Inflation at Weakest Since 2016 Adds Pressure on BOE to Act

- German CabinetOkays $70 Billion in Debt to Combat Recession

- Brexit Heartlands Are Paying the Highest Price for Coronavirus

- Forget This Year’s Highs for European Equities, Strategists Warn

In FX, a rather muted start to the midweek EU session, as the Dollar consolidates following yesterday’s revival on encouraging US economic recovery leads via retail sales. However, the DXY remains relatively underpinned within a narrow 97.264-96.796 band amidst similarly tight ranges vs major counterparts in the run up to Fed Chair Powell’s 2nd semi-annual testimony and more data that could provide further evidence for or against the circa April COVID-19 trough theory in the form of housing starts and building permits.

- NOK/SEK/AUD/CHF/NZD - The Norwegian Crown continues to rebound from Monday’s deep risk aversion and crude retracement lows, with Eur/Nok testing support ahead of 10.7000 awaiting further confirmation from the Norges Bank tomorrow that benchmark rates have hit the lower (zero in this case) bound. Meanwhile, the Swedish Krona has also regained some poise amidst mixed NIER GDP forecast revisions and jobs data, as Eur/Sek hovers near 10.5100 compared to a high just shy of 10.5800. Similarly, the Aussie and Kiwi have regrouped after more volatile trade overnight and Tuesday’s even sharper swings to revisit 0.6900 and pivot 0.6450 against their US peer respectively, and with the latter now looking for independent inspiration from NZ GDP tonight. Elsewhere, the Franc and Loonie are both meandering, around 0.9500 and 1.3550, eyeing the SNB on Thursday and Canadian CPI later today.

- JPY/GBP/EUR - Marginal G10 underperformers, with the Yen still restrained below 107.00 in wake of a wider than expected Japanese trade deficit on weak internals and stymied by decent option expiry interest at 107.25 (1.1 bn), while Cable topped out ahead of 1.2600 and the 200 DMA again, albeit holding around the 100 DMA (1.2526) after little reaction to in line/softer UK inflation metrics. The Euro is also fading from a test of round number/psychological resistance at 1.1300, and testing support through the 50 DMA (1.1233) that sits close to recent sub-1.1230 lows and stops said to be residing on a break of 1.1228.

- EM - Broad sentiment is notably more fragile against the backdrop of several geopolitical hotspots that could spiral given recent developments, and on that note the Lira is underperforming as Turkey steps up its offensive against PKK/YPG targets in Northern Iraq, with Usd/Try back over 6.8500 at one stage in contrast to flat/fractionally softer trade in Usd/Zar and Usd/Mxn.

In commodities, WTI and Brent front-month futures initially grinded higher in early European trade, having had somewhat of a lacklustre APAC session with the complex pressured by Beijing curbing some 60% of its flights in a bid to stem a second virus outbreak, whilst a surprise build in Private Inventories added to the downside factors. Nonetheless, the complex has given up recent gains as traders eye the release of the OPEC Oil Market Report for June alongside the start of the JTC meeting, and against the backdrop of heightened geopolitical tensions. Tomorrow’s JMMC meeting will see the committee (composed of Saudi, Russia, Iraq, UAE, Kuwait, Nigeria, Algeria, Venezuela and Kazakhstan) reviewing secondary source data alongside current market fundamentals before proposing policy recommendations – no policy will be set at this meeting. In terms of compliance, reports note that Iraq is aligning its cuts with the OPEC+ pact, shipping data and industry sources suggest the second largest OPEC member’s exports have declined some 300k BPD thus far in June. WTI July reliquinshed the USD 38/bbl to the downside (vs. 37.21/bbl low) whilst Brent August similarly lost its USD 41/bbl handle (vs. 40.03/bbl low). In terms of other scheduled events, the weekly DoEs could provide some volatility (in the short term at least) – with headline crude stocks seen drawing 152k barrels (vs. Private Inventory build of 3.9mln barrels). Elsewhere, spot gold succumbs to a firmer Buck as the yellow metal prints fresh session lows. It’s worth noting for precious metals that ETFs increased holdings gold holdings for a fifth consecutive session in which it added almost 48k oz yesterday to bring this year’s net buying to 18mln oz. Copper prices see modest gains well within yesterday’s ranges amid the indecisive APAC tone – prices remain north of USD 2.50/lb but just under USD 2.60/lb.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 9.3%

- 8:30am: Housing Starts, est. 1.1m, prior 891,000; MoM est. 23.46%, prior -30.2%

- 8:30am: Building Permits, est. 1.25m, prior 1.07m; MoM est. 16.79%, prior -20.8%

DB's Jim Reid concludes the overnight wrap

This morning we are hurtling deep into the 21st century here at DB Research as we have launched a new trial video research format. In this first trial you’ll see me talk through June’s market sentiment survey for four and a half minutes. It might be worth watching just to see the results of my wife’s attempts to style and pimp my WFH set up. We have guitars, books and a copy of an old master on an easel. The painting on the easel was a creative way of blocking out light from a window which is a bit of a VC nightmare. The painting was left over from my last house where we commissioned art students in Russia to paint replicas of old paintings at a very reasonable price and make them look old. Not obvious pieces but nice ones. Given my wife went to Art College she hated this philistine approach from me but I said I wasn’t prepared to pay for many antique oils. If anyone can recognise the painting then I’ll be very impressed!! Here is the link to the video. Let us know if the format is interesting to you and what you’d like to see on it from DB Research (link here).

In another WFH appearance from my crib, this Thursday (12:30pm London time) I’m taking part in a small fireside roundtable webinar on China, commodities and the reflation trade organised by our mining and metals team but containing macro content from our Chinese economist, China strategist, our commodities strategist and also myself. Feel free to register here.

While we are in full advertising mode, yesterday Henry Allen on my Thematic team put out a report that we’ve been working on looking at what might be the next massive tail risk after Covid-19, looking at events including further pandemics, volcanoes, solar flares, wars and earthquakes. The main takeaway is that there’s a one-in-three chance that the next decade will see at least one of a major flu pandemic killing more than 2m people; a globally catastrophic volcanic eruption; a major solar flare; and a global war. So some pretty striking stuff. You can read the full report here.

The most exciting thing today is the return of the English Premier League. I’m not sure I’ll ever be so happy to see Aston Villa vs Sheffield United or indeed ever watch that fixture again. Hopefully one of the tail risk disasters mentioned above won’t come before Liverpool are crowned champions within the first few games of the restart. In terms of markets, yesterday felt like one of those children’s football matches where one minute everyone rushes up the pitch towards the opposition’s goal to try to score before the other side then do exactly the same at the opposite end thus ensuring no formation, no structured defending and no tactics. Just an end to end slug fest. Indeed markets went from bullish, to worried, to extreme bullish to worried and back to bullish again.

By the end of the session, the S&P 500 was up +1.90% in its 3rd straight move upwards, with every sector moving higher on the day and only 35 stocks down. The VIX volatility index continued to unwind from its intraday peak early yesterday morning London time (44.44) with a further -0.73pts fall to close at 33.67. Energy stocks led the move higher in the US, with WTI up +2.67% and Brent crude up +2.79%. The latter closed above $40/barrel for the first time since risk assets dropped sharply last Thursday.

So going through the bewildering array of headlines, let’s begin with the pandemic. The good news yesterday was that an Oxford University trial reported that the steroid dexamethasone was found to reduce coronavirus deaths by a third in patients who required ventilation. In fact it was described by England’s Chief Medical Officer on twitter as “the most important trial result for COVID-19 so far.” On the other hand, there were some less positive developments elsewhere, with Beijing announcing that schools would be shut and online classes resuming for all grades, following a new cluster of cases in the city, that has also seen them raise their Covid-19 emergency response to the second-highest level. Further, the city has also ordered that people will have to be tested for the virus before being allowed to leave the city and has imposed restrictions on visits to all residential compounds with those in areas with medium and high-risk areas being barred from accepting visitors.

Over in the US the news wasn’t exactly positive either as the case numbers in certain states continued to move in a concerning direction. In Florida they reported a +3.6% rise in cases yesterday, above the 7-day average of +2.5% and the most absolute cases reported in a day since the pandemic started. While in Texas, which has been something of a hotbed recently, the number of virus hospitalisations rose by +8.3%, the most in nearly 2 weeks. Cases in the state rose by +3.7% - the most in week - with the absolute number (3,358) the largest during the pandemic. California new cases rose by +2.3%, above the weekly average of 2.1% while confirmed hospitalisations rose by 7.5% to 3,335 across the state, the most since the first week of May. Much like we’ve previously highlighted in the Corona Crisis Daily in countries like the UK and France, there appears to be a Tuesday effect in some US states, where the Sunday and Monday reporting is slightly lower and then cases rise more sharply on Tuesday. Texas, California, Arizona, and Florida all have seen a noticeable rise in case growth on 4 out of the last 5 Tuesdays when compared to the 2 days prior. Remember our usual case and fatality tables are in the full report today. Click on “view report” at the top.

Against the worrying virus backdrop, a stunningly strong US retail sales report for May offered further hope to investors that the economy might be able to bounce back quicker than many had expected. The headline figure saw an increase of +17.7%, more than double the +8.4% expected, while the previous month’s decline was revised to show a smaller -14.7% contraction (from -16.4%). Autos dragged up the overall number, with vehicles and parts seeing a +44.1% rise in May, but even the ex-auto number at +12.4% (vs. +5.5% expected) came in stronger than anticipated, with increases in every category on the month. President Trump expressed his approval, tweeting that “Wow! May retail sales show biggest one-month increase of ALL TIME, up 17.7%. Far bigger than projected. Looks like a BIG DAY FOR THE STOCK MARKET, AND JOBS!”

We also saw a couple of geopolitical flare-ups yesterday, which in another world could have easily blown the rally off course. Firstly, we got the news not long after going to press yesterday that North Korea had blown up an inter-Korean liaison office on their side of the border, which comes against the backdrop of escalating threats from North Korea towards the south in recent weeks. North Korea has said overnight that it will be deploying troops on its side of the border where it had joint projects with South Korea, and to the Mount Kumgang tourist area. Secondly, there was a clash between Indian and Chinese soldiers yesterday in which at 3 Indian troops were confirmed to have been killed during a fight, before a further 17 passed away from injuries according to a New York Times report. A Chinese foreign ministry spokesman said that two Indian soldiers had crossed into Chinese territory on Monday, and that “They provoked and attacked the Chinese side, leading to a severe physical brawl.” By the looks of things it seems as though both sides are trying to de-escalate the situation, but this is nevertheless a very unwelcome development in an environment not short of possible risks.

In terms of the broader market moves, as mentioned the S&P 500 saw its 3rd upward move in a row, while the Dow Jones (+2.04%) and the NASDAQ (+1.75%) also saw strong performances. European equities outperformed their US counterparts, with the STOXX 600 up +2.90%, while the DAX, FTSE MIB, and IBEX were all up over 3%. Core sovereign bonds sold off as investors moved out of safe havens, with yields on 10yr US Treasuries (+3.1) and bunds (+1.9bps) both climbing. That said, there was another notable narrowing of peripheral spreads in Europe, with the spread of Greek 10yr yields over bunds falling by -7.8bps to their tightest level since late February. 10yr BTP spreads narrowed by -8.0bps.

The rally has taken a pause overnight with bourses slightly lower in Asia. Indeed the Nikkei (-0.81%), Hang Seng (-0.03%), Shanghai Comp (-0.10%) and Kospi (-0.03%) are all in the red with only the ASX (+0.54%) currently up. The geopolitical tensions we noted above have weighed on the Korean Won (-0.71%) and the Indian Rupee (-0.24%) while yields on 10y USTs are down -2.5bps and futures on the S&P 500 are trading down -0.25%. WTI oil has also retraced 3%. In other overnight news, Japan’s trade surplus with the US dropped -97% yoy in May to $96mn, the lowest in data going back to 1979, as car shipments declined by -79% yoy.

Back to the US, and Fed Chair Powell appeared before the Senate Banking Committee yesterday, as part of the semi-annual monetary policy report to the Congress. In his prepared remarks, Powell said that in spite of indicators that pointed towards a stabilisation or a small rebound in activity, “the levels of output and employment remain far below their pre-pandemic levels, and significant uncertainty remains about the timing and strength of the recovery.” So clearly not wanting to let positive data like the jobs report let people think the economy is out of the woods yet. Given this testimony occurred only days after the FOMC this was never likely to move the dial much but Powell’s tone on corporate bond purchases were a bit confusing. He suggested that purchases will be switched from ETFs to bonds but maintaining the same dollar amount. In speaking to Craig who covers US credit and who is, to be fair, co-authoring this report today, he suggests that at face value this would suggest the Fed will buy far far less than the $250bn capacity that the SMCCF has. So far ETF purchases have averaged between $1-1.5bn per week for context. The expectation was that bond purchases would be in addition to ETF purchases and also that bond purchases would be greater given the larger available universe to purchase from. We will see if this was a misinterpretation issue or an actual policy announcement. Credit had earlier been on an almighty tear. From opening levels iTraxx Main, Crossover, US IG and HY CDX were -10, -65, -6 and -32bps tighter at their spread lows for the session before closing a slightly more subdued close at -6, -33, -1 tighter and +2bps wider respectively. Cash did seemingly have a better day however, with US HY and IG spreads in particular 47bps and 12bps tighter respectively.

Powell was not the only Fed speaker yesterday as Fed Vice Chair Clarida weighed in on the inflation debate citing the pandemic as a deflationary shock. He indicated that the Fed is placing a high priority on keeping inflation expectation anchored, amidst risks of long-term inflation expectations falling due to the economic fallout. He admitted that these are not new concerns saying, “that measures of longer-term inflation expectations were, when the downturn began, at the low end of a range that I consider consistent with our 2% inflation objective and, given the likely depth of this downturn, are at risk of falling below that range.”

Wrapping up with yesterday’s other data now. The industrial production numbers from the US weren’t quite as positive as the retail sales figures, though they did show a +1.4% rebound in May (vs. +3.0% expected). That said, the NAHB’s housing market index rose to 58 (vs. 45 expected), so all eyes will be on today’s housing starts and building permits data to see if that rebound in housing is evident in other releases. Here in the UK meanwhile, the headline unemployment rate for the 3 months from February to April unexpectedly remained at 3.9% (vs. 4.7% expected). However, digging further into the labor market data showed things weren’t quite so rosy. The number of weekly hours worked fell to the lowest seen since 2013, while the number of vacancies in the more up-to-date March-May period fell to 476k, the lowest since 2012.

To the day ahead now, and we’ll hear from Fed Chair Powell once again today before the House Financial Services Committee, while the Fed’s Mester will also be speaking. On the data front, we’ll get a bunch of data releases out for May, including UK CPI, EU27 new car registrations and the final Euro Area CPI reading. Over in the US, there’ll also be housing starts and building permits, while Canada will also release their CPI.