Stocks Rise As EU Breaks Trade Deal On Trump Comments

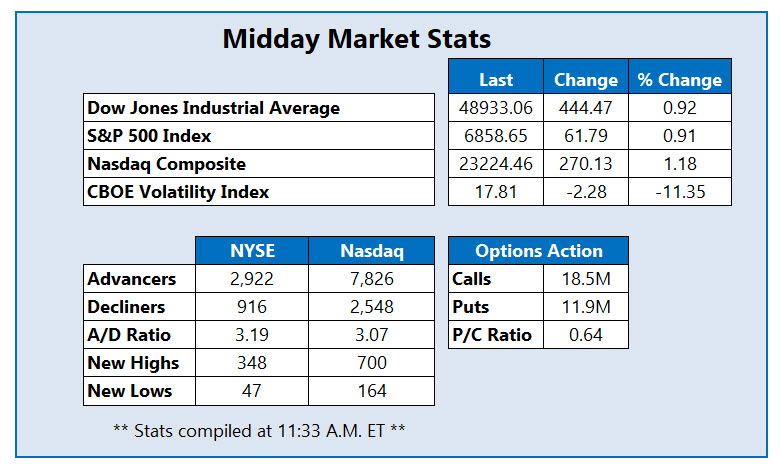

Following President Donald Trump's speech at the World Economic Forum, in which he stated the U.S. will not take Greenland by force, all three indexes turned higher by midday, including the Dow Jones Industrial Average (DJI). Trump also said he will reiterate his intention to implement a 10% credit card cap to Congress.

Recent geopolitical tensions have mounted between the U.S. and Europe in the wake of Trump's attempts to takeover Greenland. In response, the European Union (EU) today halted its trade deal with the U.S., which was established in July. Today's noise is pushing aside big name earnings reports, including from 'Magnificent Seven' powerhouse Netflix (NFLX).

Progress Software Corp (Nasdaq: PRGS) is moving higher, up 15.3% at $44.52 this afternoon, after the company posted a better-than-expected first-quarter outlook and fourth-quarter profit. This surge has shares breaking above the 120-day moving average for the first time since July. Options have been hot in response, with 5,200 calls and 2,545 puts across the tape, nearly 20 times the average daily pace. Most popular are the February 47.50 call and 45 put from the same series.

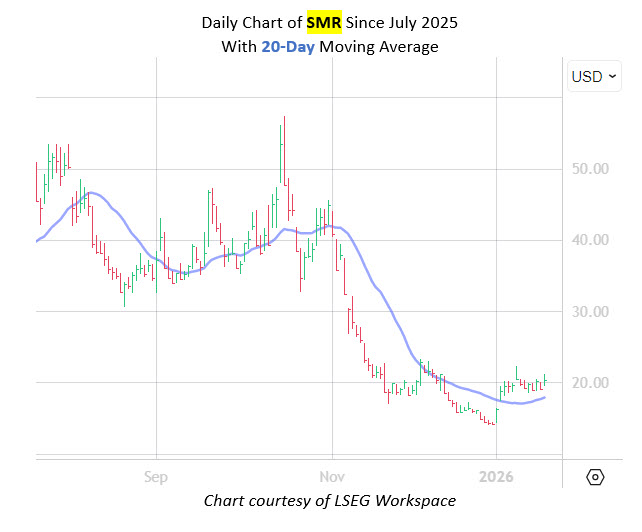

Utility name Nuscale Power Corp (NYSE: SMR) is near the top of the New York Stock Exchange (NYSE), up 6.3% at $20.22 at last glance, after President Trump said his administration supports the word of nuclear energy. The shares maintain a presence at the $20 level, however, attempting to chip away at its 24% year-over-year deficit. Emerging as support is the 20-day moving average, which was a point of resistance as recently as Jan. 2.

One of the worst NYSE performers this afternoon is Reddit Inc (NYSE: RDDT), the online thread forum last seen off 5.9% at $211.81. The catalyst for today's move is unclear, but the shares are continuing on a downtrend after topping out at a nearly four-month high around $260. RDDT is maintaining its 13% year-over-year gain, with the 140-day moving average moving in as support.

More By This Author:

Dow Marks Worst Day Since October Amid Tariff ThreatsGeopolitical Tensions Extend Broader Market Losses

Stocks Finish Quietly Lower Amid Fed Independence Questions