Stocks Pivot Lower On Trade Fears, Manufacturing Data

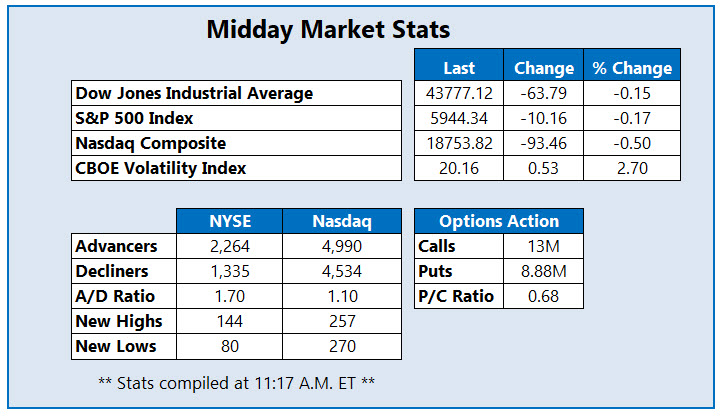

Despite earlier indicating a strong start to March, stocks are lower this afternoon amid trade war concerns. The Dow Jones Industrial Average (DJI), S&P 500 Index (SPX), and Nasdaq Composite (IXIC) are looking to extend their February losses, as investors eye President Donald Trump's tariffs, which could go into effect this week. Also weighing on today's sentiment is the Institute for Supply Management (ISM) manufacturing index, which showed a smaller-than-expected reading of 50.3 for February.

Options bulls are targeting TG Therapeutics Inc (Nasdaq: TGTX), with 12,000 calls traded so far today, which is 10 times the volume typically seen at this point. The March 36 call is the most active contract, with new positions being bought to open there. TGTX was last seen up 13.9% to trade at $34.28, after the biotech concern reported a top- and bottom-line win for the fourth quarter and issued a strong revenue forecast for 2025. The equity is on track for its best single-day percentage gain since August, and sport a 112.2% nine-month lead.

Las Vegas Sands Corp. (NYSE: LVS) shares are leading the New York Stock Exchange (NYSE) today, last seen up 6.1% to trade at $47.44. The casino sector is enjoying tailwinds today, after Macau saw a rise in gambling revenue for February. LVS is on track for its third-straight daily gain and its biggest single-day percentage pop since Jan. 30. The security has added over 21% in the last six months, and is today eyeing its first close above the 40-day moving average since December.

More By This Author:

Wall Street Logs Weekly, Months Losses Despite Friday Surge

Nasdaq, S&P 500 Head for Worst Weekly Losses Since September

Wall Street Struggles As Trade, Economic Uncertainty Linger