Stocks Move Higher With Rate-Cut Hopes

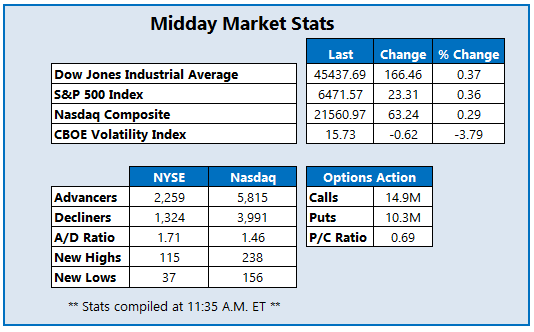

The Dow Jones Industrial Average (DJI) is up 166 points midday, looking to snap a three-day losing streak despite Salesforce (CRM) stock's slide on disappointing revenue guidance. The S&P 500 Index (SPX) and Nasdaq Composite Index (IXIC) are firmly higher as well, as investors continue to weigh this morning's weak ADP private payrolls data.

Wall Street sees the report solidifying chances of a rate cut at the upcoming September meeting, with CME's FedWatch tool now showing a 97.6% chance the central bank cuts rates in two weeks. Meanwhile, the ISM services purchasing managers index (PMI) came in at 52, above estimates of 50.8.

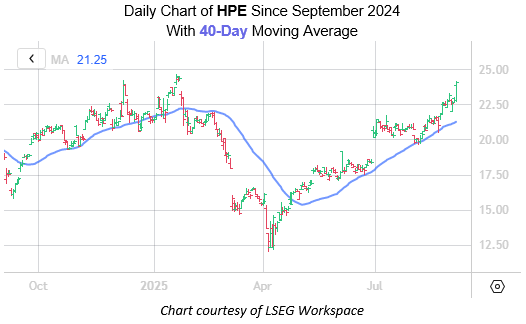

Options bulls are targeting Hewlett Packard Enterprise Co (NYSE: HPE) after the company's upbeat fiscal third-quarter earnings report, which included record revenue amid strength in its AI systems. So far today, HPE has seen 114,000 calls and 38,000 puts exchanged -- already 3.2 times times the overall average daily options volume. The October 24 call is the most popular, with new positions being opened there. At last look, HPE was up 5.3% at $24.03 and trading at its highest levels since January. Underlying support at the 40-day moving average has provided a base since May.

Software stock Ciena Corp (NYSE: CIEN) is near the top of the New York Stock Exchange (NYSE) today, last seen up 23.1% at $116.76 and trading at roughly 25-year highs. Today's pop comes after company posted better-than-expected fiscal third-quarter results amid AI connectivity demand, raised its current-quarter forecast, and announced plans to lay off up to 5% of its workforce. Since the start of the year, the equity is up 37%.

Neonode Inc (Nasdaq: NEON) is at the bottom of the Nasdaq, down 75% at $5.40 at last glance. The shares are brushing off what appeared to be good news, after the company announced it expects $15-20 million from a Samsung Electronics patent settlement. Falling to 52-week lows, NEON is now down 27.4% year-to-date.

More By This Author:

Nasdaq Adds 218 Points; Soft Job Openings Weigh On DowTech Sector Surge Continues As Dow Swims In Red Ink

Stocks Fall Sharply To Kick Off A Seasonally Bearish Month