Stocks Mixed As Investors Grapple With Trade Tensions

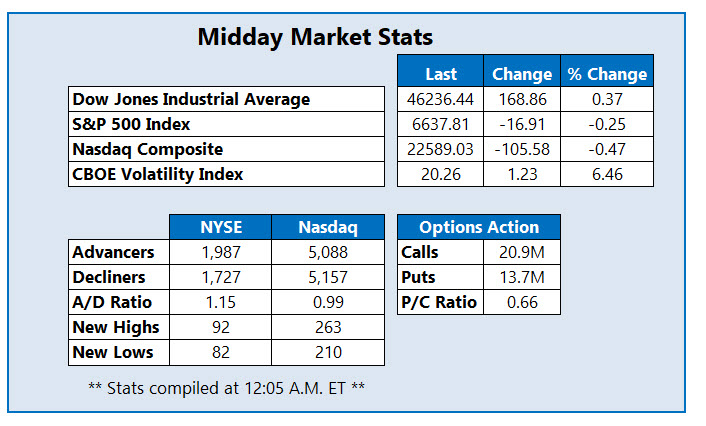

Stocks are mixed midday as trade tensions resume, after China sanctioned five U.S. subsidiaries of South Korea's Hanwha Ocean. The tech-heavy Nasdaq Composite Index (IXIC) is down triple digits as AI stocks slide once again, while the S&P 500 Index (SPX) sits modestly lower. The Dow Jones Industrial Average (DJI) is up triple digits, however, as some traders look to shake off tariff tensions. Investors are unpacking a slew of bank earnings today. Meanwhile, Wall Street's "fear gauge," the Cboe Volatility Index (VIX) is surging to its highest level since May.

Pinterest Inc (NYSE: PINS) is a favorite amongst options bulls today, with 108,000 calls exchanged so far -- 14 times the amount typically seen at this point -- in comparison to just 9,089 puts. The November 40 call is the most popular by far, followed by the November 35 call, with new positions opening at the October 35 call. At last check, PINS was up 3.4% at $33.37, though the 20-day moving average could keep a lid on gains.

Trilogy Metals Inc (NYSE: TMQ) is one of the rare earths stocks getting a lift today. The shares were up 44.1% at $9.45 at last check and trading at fresh record highs after shooting out of penny stock territory just last week. Year to date, the equity is up 763%.

Shares of carbon black producer Orion SA (NYSE: OEC) were last seen down 22.7% at $5.29, trading at all-time lows after the company's preliminary third-quarter results, which included a lowered full-year guidance. Down 42.9% in just the last month, OEC is off 66.4% since the start of the year.

More By This Author:

Stocks Charge Higher As Geopolitical Tensions EaseDow Jumps 500 Points As Tech Stocks Rebound

Stocks Secure Weekly Losses With Sharp Friday Selloff