Stocks Mixed As GDP Data, Interest Rates Take Focus

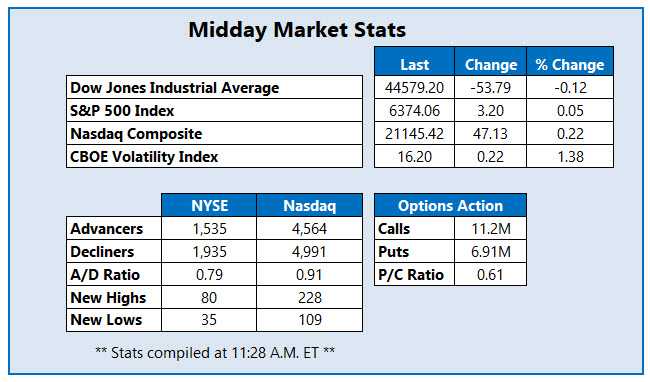

Stocks are a mixed bag this afternoon, with the Dow Jones Industrial Average (DJI) in the red as the S&P 500 Index (SPX) hangs near breakeven, and the Nasdaq Composite (IXIC) sports a modest lead. Investors were largely unfazed by a strong gross domestic product (GDP) reading for the second quarter and President Trump's 25% levy against India, as they look ahead to today's interest rate decision. Wall Street is also unpacking higher-than-expected private payrolls data, which rose 104,000 in July after a 23,000 loss in June, signaling a steady labor market.

Palo Alto Networks Inc (Nasdaq: PANW) stock is seeing unusual options activity today, with 79,000 calls and 50,000 puts traded so far, which is 7 times the volume typically seen at this point. Most active is the weekly 8/1 190-strike call, where new positions are being opened. PANW is down 6.6% to trade at $181.10 at last glance, following news it will acquire CyberArk Software (CYBR) for about $25 billion as the cybersecurity name looks to benefit from higher artificial intelligence (AI) demand. The stock is pulling back from yesterday's record high of $210.39, and has added 14% over the last 12 months.

Teradyne Inc (Nasdaq: TER) stock is at the top of the SPX today, last seen up 19.5% to trade at $108.22, after the semiconductor testing name beat second-quarter earnings and revenue expectations. The security earlier surged to its highest level since March 5, breaking past former resistance at $100 on a bounce off the 40-day moving average. In the last three months, TER has added 45.6%.

GE HealthCare Technologies Inc (Nasdaq: GEHC) stock is among the worst SPX performers today, last seen down 6.8% to trade at $72.47. While the company surpassed second-quarter earnings and revenue expectations and raised its full-year profit forecast, tariff concerns weighed. GEHC is pacing for its worst day since April 4, and earlier fell to its lowest level since June amid pressure from the 50-day moving average. For 2025, shares are down nearly 8%.

More By This Author:

S&P 500 Snaps 6-Day Win Streak As Rally Loses SteamStocks Move Lower Amid Earnings Deluge, Jobs Data

S&P 500, Nasdaq Eke Out Record Closes