Stocks Lower Midday As 2024 Comes To An End

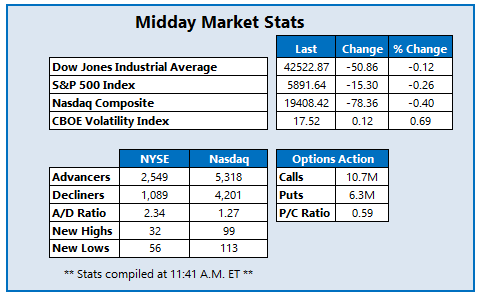

Stocks are lower midday, as Wall Street heads for its second consecutive winning year. The Nasdaq Composite Index (IXIC) is leading losses today with an 78-point drop, though the tech-heavy benchmark is outperforming the other two major indexes in 2024, thanks in part to the AI boom. Investors appear to be giving up hope on a major "Santa Claus rally" this week, with the market closed tomorrow for New Years Day.

Options traders are blasting Sangamo Therapeutics Inc (Nasdaq: SGMO) today, with 6,889 calls and 4,551 puts exchanged so far -- 7 times the average daily options volume. The January 2025 2-strike call is the most popular, followed by the January 2026 1-strike put. At last glance, SGMO was down 16% at $11.18 after coming back from much steeper losses, following news that Pfizer ended its co-development agreement with the biotech name for hemophilia A gene therapy.

FTAI Aviation Ltd (Nasdaq: FTAI) is one of the best performers on the Nasdaq today, up 16.8% at $147.76, after the company's encouraging 2025 guidance, and a price-target hike from BTIG to $190 from $180. Climbing back toward its Nov. 22 record high of $177.18, FTAI has added 218% in 2024.

Palladyne AI corp (Nasdaq: PDYN) is pulling back sharply after its recent surge, down 17.4% at $10.99 at last glance today and looking to snap a six-day win streak. In its most recent development, PDYN jumped yesterday after its drone was able to track a moving target for the first time. Since the start of December alone, the equity is up 72%.

More By This Author:

Dow, Nasdaq Shed Triple Digits As Stocks Cool OffDismal Market Sentiment Pushes VIX Higher

Stocks Eke Out Weekly Wins Despite Friday Fumble

The posts on this blog are opinions, not advice. Please read our Disclaimers.