Stocks Extend Post-Terror-Attack Gains; Oil, Bonds, & Gold Flat

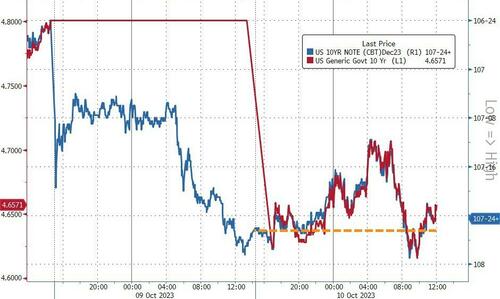

With bond traders coming back to work after yesterday's Columbus Day market closure, yields actually ended practically unchanged on the day (from where futures-implied levels closed yesterday)...

Source: Bloomberg

But since Friday's cash close, yields are significantly lower (10-14bps lower)...

Source: Bloomberg

With 2Y Yields back below 5.00% for the first time in almost a month...

Source: Bloomberg

And rate-change expectations have pushed lower after yesterday's dovish FedSpeak from Jefferson and Daly...

Source: Bloomberg

Equity markets trod water overnight and then took off again at the cash open with Small Caps leading the charge. Around 1300ET the market took a dive as headlines hit of a second carrier group being sent to Israel and also a very ugly 3Y auction which ratcheted equities lower. Things stabilized a bit but then selling pressure hit in the last few minutes...

Mostly thanks to another big short squeeze...

Source: Bloomberg

0-DTE traders aggressively faded today's rally...

For context, the Nasdaq and Small Caps are up over 4% from Friday's post-payrolls lows..

Energy stocks are the best since Friday's close and Banks the worst, but all sectors are green...

Source: Bloomberg

Nasdaq Composite topped its 50- and 100-DMA but was unable to hold them today...

VIX was squeezed back to a 16 handle

The dollar continued its recent leak lower - back at one week lows...

Source: Bloomberg

Bitcoin pushed back lower today after an overnight bounce, back to payrolls lows...

Source: Bloomberg

Oil prices were modestly lower from yesterday's surge higher after Israeli attack with WTI holding above $85...

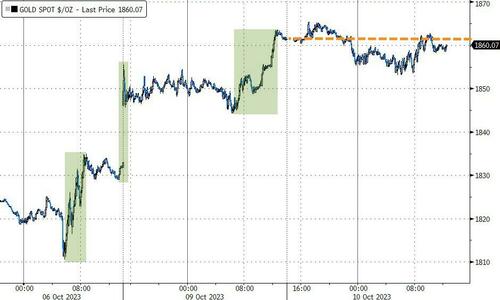

Gold was basically flat on the day holding post-payrolls gains...

Source: Bloomberg

Finally, two interesting regime shifts.

Tighter financial conditions suggest stocks should be considerably lower...

Source: Bloomberg

...and the decline in reverse repo utilization (and reserves at The Fed) suggest the S&P should be notably higher...

Source: Bloomberg

...perhaps the former tightening is ruining the flow from the latter's shrinkage and pushing them into Bills not Big Tech.

More By This Author:

NY Fed Survey Finds Surge In Household Delinquency Expectations, Worst Since April 2020 Covid CrashStrikes Hit General Motors Plants In Canada As Contract Talks Fail In Last Hour

Stocks, Bonds, Gold And Oil Soar As Dovish Fed Comments Trample Israel War Fears

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more