Stocks Cling To Breakeven As Fed Chair Pick Remains Uncertain

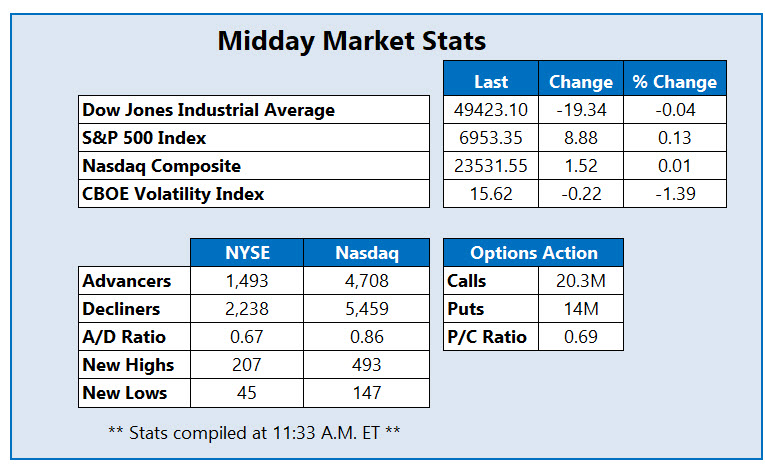

After inching higher at the open, all three indexes are flat or lower at midday, after President Donald Trump suggested National Economic Council Director Kevin Hassett might not be his pick for Federal Reserve Chairman. The Nasdaq Composite (IXIC) is clinging to breakeven and the Dow Jones Industrial Average (DJI) is inching into the red, as investors look to put to bed another volatile week on Wall Street. Weekly losses across the board look inevitable, as fears surrounding geopolitical tensions and Fed independence overshadow market optimism.

Riot Platforms Inc (Nasdaq: RIOT) is up 12.6% at $18.62 this afternoon, trading at its highest level since November after the company announced a land acquisition and data center lease with Advanced Micro Devices (AMD), worth $1 billion. Options are running red-hot in response, with 181,000 calls and 40,000 puts across the tape so far, five times the average daily volume. The January 2026 20-strike call is most popular, with the 19 call from the same series following closely behind. Over the past nine months RIOT as added 187%.

Construction name Argan Inc (NYSE: AGX) is the top stock on the New York Stock Exchange (NYSE) today, up 15.2% at $379.70 at last check. While the catalyst for today's upward momentum is unclear, the shares are nearing their Nov. 20 record high of $399.30, after a pull below the $350 level. AGX has added 117% over the past 12 months, with added support at the 80-day moving average.

Vistra Corp (NYSE: VST), is off 6.7% at $167.94, one of the worst performers on the NYSE this afternoon, falling with the broader energy sector after news broke that the Trump administration will sign off on a curb in power prices. Despite today's pullback, VST boasts a 45% nine-month lead.

More By This Author:

Stocks Finish Higher As Chip, Bank Stocks Drive OptimismSemiconductor Surge Sends Dow Over 400 Points Higher

Stocks Slide As Tech Chips Away At Broader Market