Stocks Choppy As Wall Street Searches For Catalysts

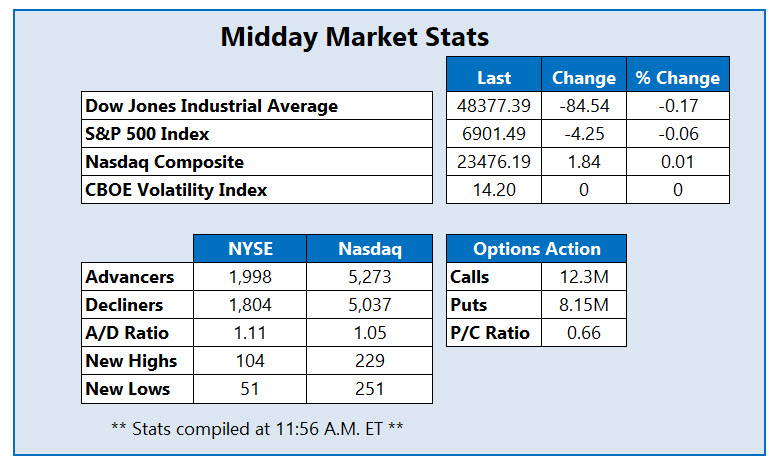

Stocks are a mixed bag as 2025 winds down, with the tech sector particularly choppy. The Dow Jones Industrial Average (DJI) was down triple digits at its session lows but has since pared some of those losses. The Nasdaq Composite (IXIC) and S&P 500 Index (SPX) pushed into the black after a lower open, as all three indexes look to avoid a third-straight loss. Despite light trading volume, investors are still eyeing the Fed's meeting minutes at 2:00 p.m. ET, hoping for clues about the central bank's dot plot.

Under Armour Inc (NYSE: UAA) stock is seeing unusual options activity today. At last check, over 4,668 calls have changed hands-- volume that's six times the average intraday amount and nearly 11 times the number of puts exchanged. The January 2026 5-strike call is the most popular, while new positions are being bought to open at the February 6 call. UAA is up 5.7% to trade at $5.05 today, marking its highest level since early October. For 2025, however, the retailer is down 39%.

Molina Healthcare Inc (NYSE: MOH) is near the top of the New York Stock Exchange (NYSE) today, last seen up 3.7% to trade at $172.70. The insurer rose after Big Short investor Michael Burry compared the company to Warren Buffett's big Geico bet in 1976. MOH is down 40% in 2025, but is trading at its highest level since an 11.3% post-earnings bear gap on Oct. 22.

PulteGroup Inc Inc (NYSE: PHM) stock is on the other side of the coin, last seen down 1.2% at $117.25. Construction stocks are broadly lower, after the S&P Case-Shiller home price index rose past estimates for October year-over-year. Although, for 2025, PHM is up 7.9%, and is testing a historically bullish trendline.

(Click on image to enlarge)

More By This Author:

Dow, Nasdaq Drop Triple Digits Amid Tech PullbackProfit Taking Stalls Wall Street's Santa Claus Rally

S&P 500 Logs Record High Amid Outperforming Week