Stocks Await Jobs

They’re back. Tomorrow morning, we get the release of the December employment report on their normal schedule. Monthly jobs data typically arrive on the first Friday of the following month, but considering that last Friday followed New Year’s Day, this is indeed typical.It’s nice to get back to a regular schedule after the shutdown-induced hiatus. Let’s see how options markets are pricing in the likely reaction to the report.

Economists are predicting tepid data. According to Bloomberg data, consensus estimates for Nonfarm Payrolls and the Unemployment Rate are 70,000 (up from 64,000) and 4.5% (down from 4.6%), respectively. Both of these would of course be slight improvements over the prior month, but hardly sufficient to declare victory on the “maximum employment” portion of the Fed’s dual mandate. The IBKR ForecastTrader broadly agrees with those assessments, with a 51% “Yes” for Nonfarm Payrolls above 50,000 and a 45% “Yes” for an Unemployment Rate above 4.5%.

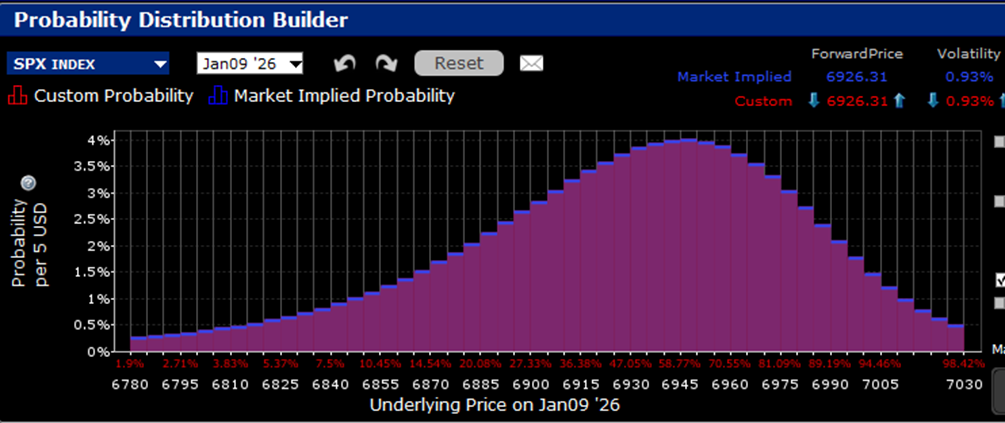

Coming into the report on the heels of an up week through Thursday morning, options traders are generally sanguine about its outcome.The IBKR Probability Lab is showing its now usual upside bias for S&P 500 (SPX) options expiring tomorrow, with a peak probability in the 6945-6950 range, about 0.3% above the current index level.

IBKR Probability Lab for SPX Options Expiring January 9, 2026

(Click on image to enlarge)

Source: Interactive Brokers

We have frequently noted short-term SPX options’ tendency to price in an index bump, most recently when we pointed out how a “Santa Claus Rally” was being priced into year-end expirations. We asserted at the time that:

It has become customary to see traders assign higher probabilities to above-market outcomes for the S&P 500 (SPX).We have posited that it might represent “FOMO insurance”, where skeptical or underinvested institutional investors utilize upside calls to hedge their risk of underperformance. Of course, it could simply be that after a three-year bull market traders simply expect that the market is more likely to rise than fall on any given day and over any given period.I suspect that both factors are at work.

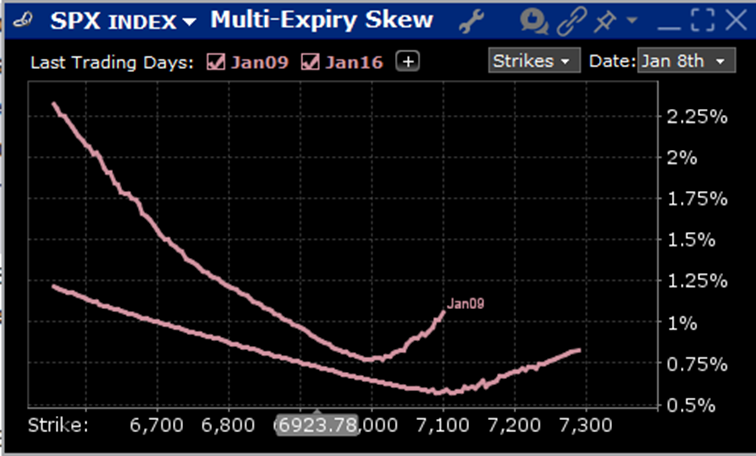

Thus, even with the distinct possibility that a disappointing report could upset the market’s mood, options traders’ relatively complacent mood extends to the relatively modest bump to implied volatilities on near-term, at-money options.We see an at-money implied daily volatility of 0.93%, only a modest bump from next week’s 0.78%.However, the relatively steep skew on tomorrow’s options does indicate at least a fair amount of risk aversion.

Skews for SPX Options Expiring January 9th (top) and 16th, 2026 (bottom)

Source: Interactive Brokers

A relatively complacent options market implies that there is a bit of room for surprises.Rate cut probabilities for the FOMC meeting on January 28th remain quite low, about 12% according to both the CME FedWatch and ForecastEx. A significant negative surprise would likely be required for a dramatic improvement in those odds, but that would then bring up the notion of “careful what you wish for.”Thus, if anything remotely in line is unlikely to sway the Fed, it is understandable why traders might be willing to overlook the risks in tomorrow’s report. We’ll know tomorrow if it sways the institutional mindset that has supported stocks in the past few days.

More By This Author:

It’s Coming From Inside The HouseAnother Year, Another Early Head Fake

Markets Finish Off The Year Sluggishly

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing ...

more