Stocks And Precious Metals Charts - The Tendency Is To Push It As Far As You Can

Today was another whippy day in the markets. The usual suspects juiced the SP 500 markets higher in an attempt to reassert the exceptionalism of the American economy.

Alas, it was not to be. After European markets closed and before Asia opened, the powers of big money withdrew their support, and the gains of the day were mislaid.

I do not want to make too much of it, but just watching the action on the futures seems to show a series of fingerprints all over the tape.

And why not, when the stock market has become the equivalent of the economy, and of empire?Stocks are the mother's milk of inequality.

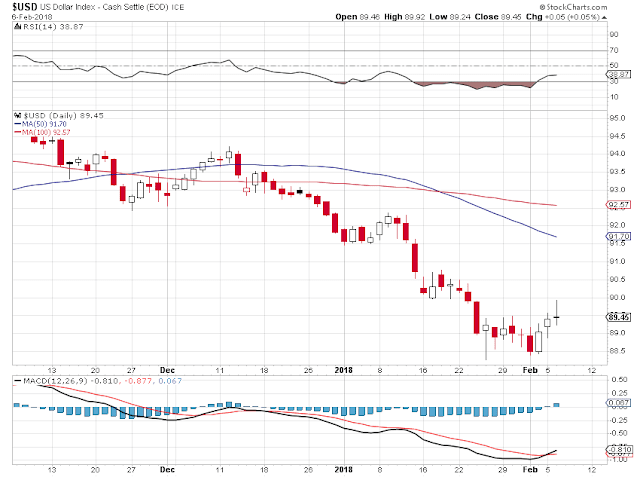

The US Dollar, la douleur du monde, rallied higher today, in what seemed to be a further technical gain from a deeply oversold condition.

Gold put in what may prove to be a tradeable bottom at 1311 today. Silver has been lagging, but at some point will act like the beta rabbit which it is and catch up in a furious pace.

But let's not get ahead of ourselves.This is far from over, and the story continues to unfold. It is engaging to watch the confusion over the deflation of yet another bubble in financial assets is causing. It seems so obvious you have to wonder why even people sitting in the best seats in the house don't seem to understand it.

I am afraid that true believers in false idols will be drinking the Koolaid of their own desires.

I am sorry, but this February 7th twitter quote was just too emblematic of the thoughts of the times not to include.

"In the 'old days,' when good news was reported, the Stock Market would go up. Today, when good news is reported, the Stock Market goes down. Big mistake, and we have so much good (great) news about the economy!"

Who could have seen it coming? Let's see what happens, when logic and proportion fails.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Video length: 00:03:31

None.

I'm no dollar bull, but it still seems like it may have some gas left in the tank (and still pretty oversold). 92's in DXY could come and test the trendline. Once rates and dollars don't hang over gold's head, it will probably be a great buy. I'm on the sidelines til then.

What are your thoughts now Louis?