Stocks And Bonds Tumble After Fed's Waller Sends Rate-Cut Odds Reeling

Image Source: Pexels

At first glance, Fed Governor Chris Waller's comments were more of the same - data-dependent, mini-mission-accomplished, be careful of easing financial conditions, and the market seems over-enthusiastic about 2024 policy.

But it was the level of detail he added that colored the market's perceptions of hawkish (full speech here).

Data-Dependent...

“I am becoming more confident that we are within striking distance of achieving a sustainable level of 2% PCE inflation,” Waller said in prepared remarks at a virtual event hosted by the Brookings Institution on Tuesday.

“As long as inflation doesn’t rebound and stay elevated, I believe the FOMC will be able to lower the target range for the federal funds rate this year.”

But, Waller reiterated his support for three cuts... not six like the market wants...

"This view is consistent with the FOMC's economic projections in December, in which the median projection was three 25-basis-point cuts in 2024".

And certainly does not see the need for aggressive cuts priced into the market:

“When the time is right to begin lowering rates, I believe it can and should be lowered methodically and carefully,” he said.

“With economic activity and labor markets in good shape and inflation coming down gradually to 2%, I see no reason to move as quickly or cut as rapidly as in the past.”

He reiterated that the timing of cuts and the actual number “will depend on the incoming data", specifically calling out the surprising strength in the December jobs report as “largely noise” against a trend of ongoing moderation. He noted a number of 2023 job reports have been revised lower, and “there is a good chance December will be revised down.”

Finally, Waller made it clear The Fed is in no hurry to act:

“I believe policy is set properly,” he said.

“It is restrictive and should continue to put downward pressure on demand to allow us to continue to see moderate inflation readings.”

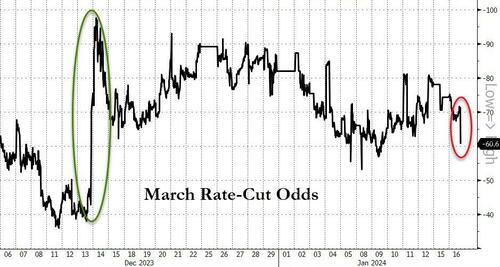

All of which sent March rate-cut odds reeling...

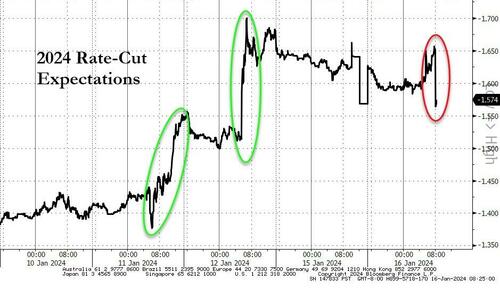

And 2024 rate-cut expectations fell, after last week's CPI and PPI-driven increases...

Sparked equity market selling...

(Click on image to enlarge)

And bond yields spiked, extending the earlier move...

(Click on image to enlarge)

It appears the message from Fed Speakers is getting through to the market slowly - don't expect more than six cuts this year and don't count on a March cut...

More By This Author:

Qatar Pauses LNG Shipments In Red Sea After US Bombs Houthis

Apple Offers Ultra-Rare iPhone 15 Discount In China Amid Sliding Demand Fears

Polar Blast Sends Power Prices Soaring, Spot NatGas Ripping, And Risk Of "Freeze-Offs"

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more