Stock Market Volatility On The Rise?

V-readings are incredibly high, and market participants are no longer as bearish as they were a few weeks ago. One of the characteristics of higher V readings is that they can widen the trading ranges. In simple words, it widens overbought and oversold ranges. For example, before the surge, Dow 30K would have been considered extremely overbought, but with the move up, the extremely overbought zone would start in the 30,600 ranges.

There is nothing that states this market has to pull back firmly. However, complacency levels are rising, and whenever the masses start to throw caution to the wind, the market either pulls back sharply or asset classes they were chasing experience healthy corrections. We also need to remember that this is the market of disorder, and this means that anything can happen.

So, what should one do in such a market? Nothing has changed, it’s always prudent to take some money off the table, when bullish sentiment surges and when the markets are moving towards the overbought ranges. What happens if the stock market does not correct? Who cares? In the event, nothing happens, we continue doing what we always did. We don’t change our trading strategy based on whims and what-if scenarios. Portfolio management is key to long-term success. If the markets don’t pull back, we will continue looking for stocks that offer the best risk to reward ratio. Nothing changes, fear, euphoria, doubt are all perceptions, and the foundations for these perceptions are illusory at best.

Don’t fret if the markets don’t pull back firmly, for no one has ever gone bankrupt banking profits. There is always another opportunity in the making. Banking stocks, airline stocks, and stocks in several other sectors are either trading in the extreme to insanely oversold ranges or a close to hitting these zones. However, if the markets do experience a sharp correction, don’t hesitate to deploy your dry gunpowder. Nervous nellies are fond of stating it's different this time, well it never is for they always make the same blunder, and to justify their stupidity they have to formulate some pathetic excuse. If you want to ensure it's different this time, then do something different. If the trend is positive and the market’s pullback then embrace the correction with a bear hug, now that is doing something different, everything else falls under the category of hogwash, rubbish, or hot air.

What one needs to understand very clearly is that when the underlying trend is positive, despite all the so-called logical reasons, one and his merry pack of friends can conjure, the markets are not going to crash. They might experience a crash-like correction from time to time, but instead of running, one should jump in and back the truck up. We were one of the few publications that came out swinging and instead of panicking during the fake COVID 19 crash, we went on a buying spree; the rest is history.

Naysayers do have a purpose; their job is to drive the masses insane. These wenches work for the smart money group and will sing both ways as long as their pockets are well lined. Those that listen to these fools masquerading as a wise man were, are, and will always be in for a rude awakening. Never follow the masses, for they have the uncanny skill of doing the worst thing at precisely the right time, and sadly, generations later nothing has changed.

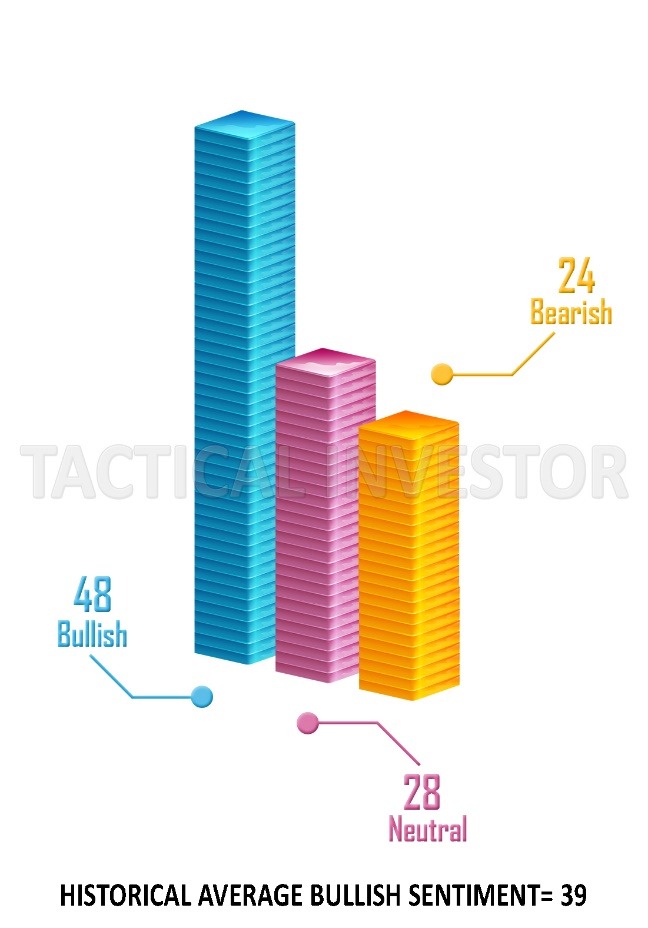

While bullish sentiment pulled back 7 points, it is still trading well above its historical average. Furthermore, the anxiety gauge has experienced another upward move. Last week's bullish sentiment readings were the highest in over 24 months. The anxiety index has experienced its fastest upward movement in almost 18 months. All in all, prudence indicates that we should proceed with caution when it comes to deploying new capital. This does not mean we are going to panic or worry; it merely means that we will aim for more conservative entry points. Remember, Tactical Investor never panic, and they never flee; they calmly finish the glass of wine, or a cup of java, etc. they are drinking and then stroll out of the room. Tactical Investors also never chase a stock; we wait for the stock to come to us.

On a positive note, neutral sentiment surged 8 points, indicating that the crowd is slowly becoming uncertain again. Uncertainty is the optimum emotion. When a group is skeptical/unsure, it is a clear indication that the stock market is going to surge significantly higher. Neutral readings of 50 or more have almost always been associated with ballistic moves. On the same token spikes in bullish sentiment have been associated with short-term tops. Look at the long-term sentiment chart below, and you can see that there is an interesting relationship between market tops and bullish sentiment. One can also state that when Neutral Sentiment spikes above 45, an opportunity is usually close at hand.

Disclaimer: The Tactical Investor (The Ultimate market timing system) does not give individualized market advice. We publish information regarding companies in which we believe our readers may ...

more