Still Talking Collateral And Implying Shortage

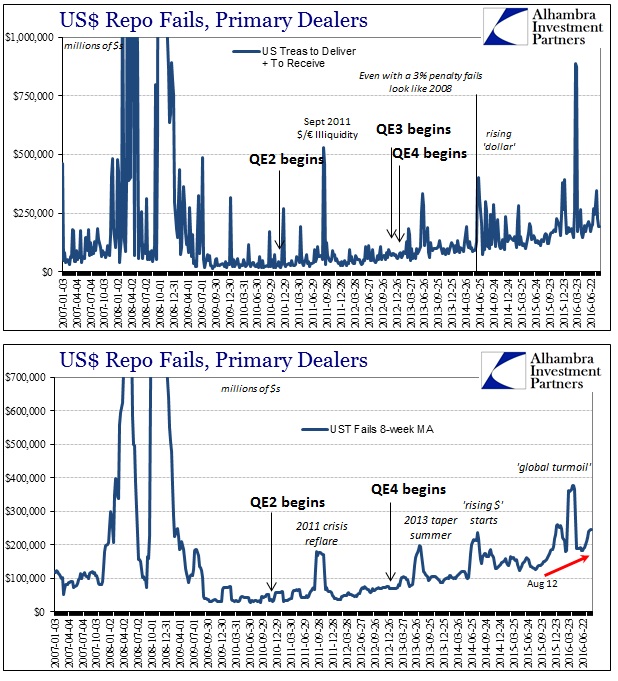

Repo fails in the past two weeks (the week of August 17 the most current figures) were both more than $192 billion. Though that level is highly elevated, those were actually the fewest fails since mid-June, and the fewest in consecutive weeks since early May. The 8-week average remains about $245 billion, a noticeable increase from even last year’s “dollar” charm.

At the end of May 2014, the 8-week average of repo fails were just more than $100 billion. Thus, since the start of the “rising dollar” period, repo fails have increased, on average, more than two and a half times, often punctuated, as mid-March, by rather alarming extremes. This is a clear, unambiguous signal of collateral problems; i.e., a shortage. Last week I examined how that could be possible considering that the repo system had been completely purged of subprime “toxic waste” years ago leaving only UST’s and surviving MBS to create a seemingly unassailable foundation.

The answer is that such markets never stand still, especially when risks are perceived the lowest no matter how artificial that low. Former Fed Governor Jeremy Stein referred to “collateral transformation” in his February 2013 speech, arguing that some serious “reach for yield” behavior in securities lending was taking place at the time. In short, money market participants were transforming through the dubious “magic” of financial laws and operative behavior junk bonds of both US corporates as well as, I believe, EM corporate junk. The result of such transfiguration, as always in these kinds of affairs, was that some as-yet significant but unknown part of the collateral pool was made up of once again collateral of very dubious quality. That Jeremy Stein was raising the issue in February 2013 was potentially indicative of the seriousness of the possible contamination.

From there it is not hard to guess the relationship between the junk-bond sell-off and increasing collateral issues in repo, leaving the repo system by this point in 2016 once more short of collateral on an overall, durable basis (even though the junk-bond selloff has paused and bonds in that space rebounded, it is in all likelihood a permanent reduction in terms of repo as haircuts, like subprime years ago, will never be the same easy terms again going forward).

Lending further weight to the theory is the fact that Jeremy Stein is still talking about it. Though he had left the Fed long ago and is now teaching at Harvard, Mr. Stein along with co-authors Robin Greenwood and Samuel Hanson (both of Harvard and, like Stein, the NBER) produced a paper for presentation at the Jackson Hole event last week that got very little outside notice; but it appears was quite influential in setting the talking points and the overall agenda for within the gathering. The topic: the Fed “crowding out” what he calls “maturity transformation.”

Aggressive maturity transformation by private-sector intermediaries can have negative consequences for financial stability: there are externalities in capital structure choice.

The authors repeatedly refer to “excessive” transformation:

Our point is not that all private maturity transformation is bad and the government should crowd out every last dollar: just that the government can play a role in curbing incentives for excessive maturity transformation.

Since we are talking about the US government through issuance and forced distribution of truly risk-free securities, the aim of the paper seems rather clear especially in relation to Stein’s 2013 reference to “reach for yield” in money dealing and securities lending. In other words, if the government was to have “crowded out” by having issued or intentionally recirculated an enormous quantity of UST’s and especially bills there would never have been any need for collateral transformation in the first place.

That he is still raising this issue, particularly with reference to “excessive” amounts, we can infer that even parts of the monetary policy apparatus are familiar with repo conditions even though I seriously doubt they would ever admit to the seriousness of them. Another way of saying all this is that it is Stein’s opinion that there is a monetary shortage in collateral that has left the system scrambling for alternatives that in the end might be both “excessive” and ultimately hold “negative consequences for financial stability.” In the bubble of monetary policy and global central banking, if it’s not a significant condition it never would have appeared especially at this particular Jackson Hole gathering.

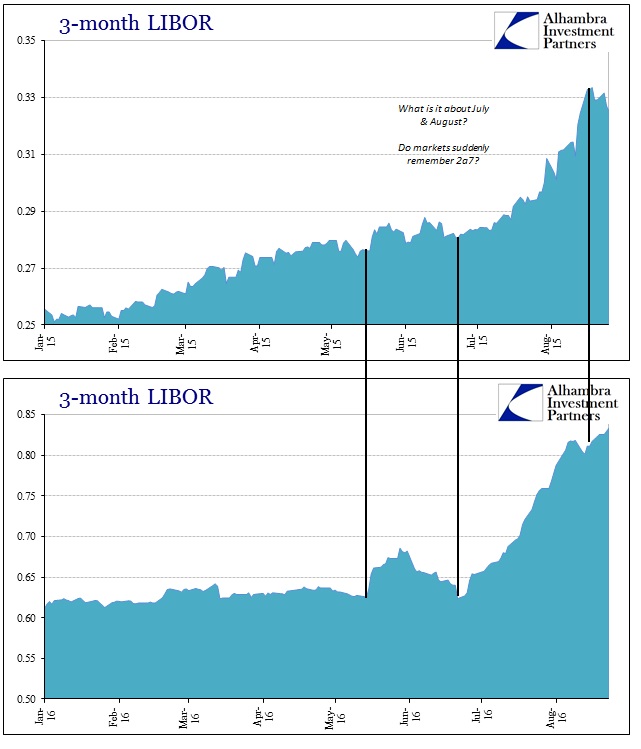

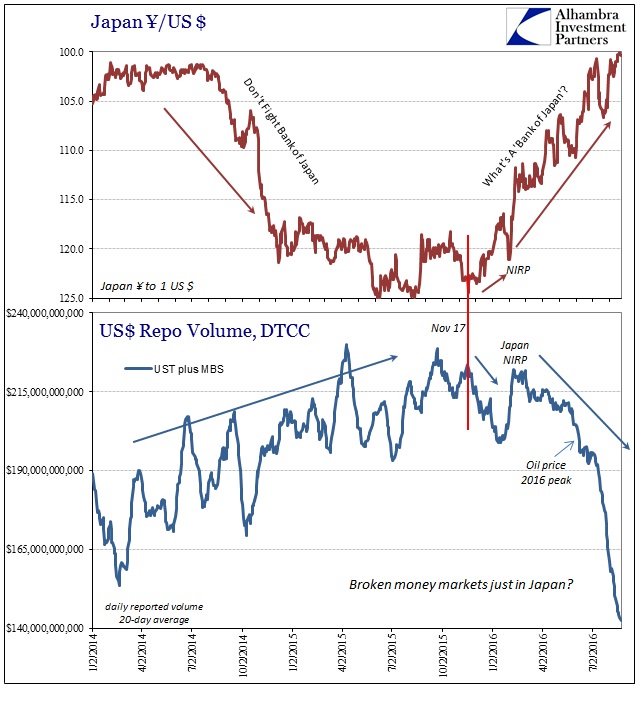

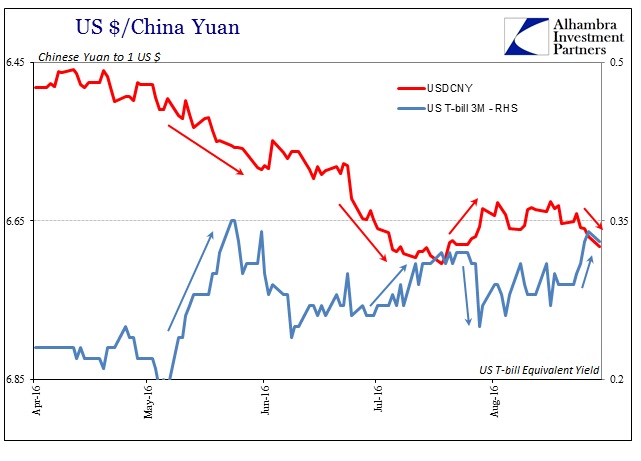

Again, I doubt he was referring to the current condition in money markets, even though there is any number of indications why he might be right about all of it even at this moment (including the apparently supernatural behavior in LIBOR repetition, meaning clearly not 2a7 or due to some other benign excuse). As repo goes, so does the “dollar.”

BONUS CHART from behind the paywall:

Disclosure: None.