Stellar Foreign Demand For Record Big 2Y Treasury Auction Despite Modest Tail

Image Source: Pixabay

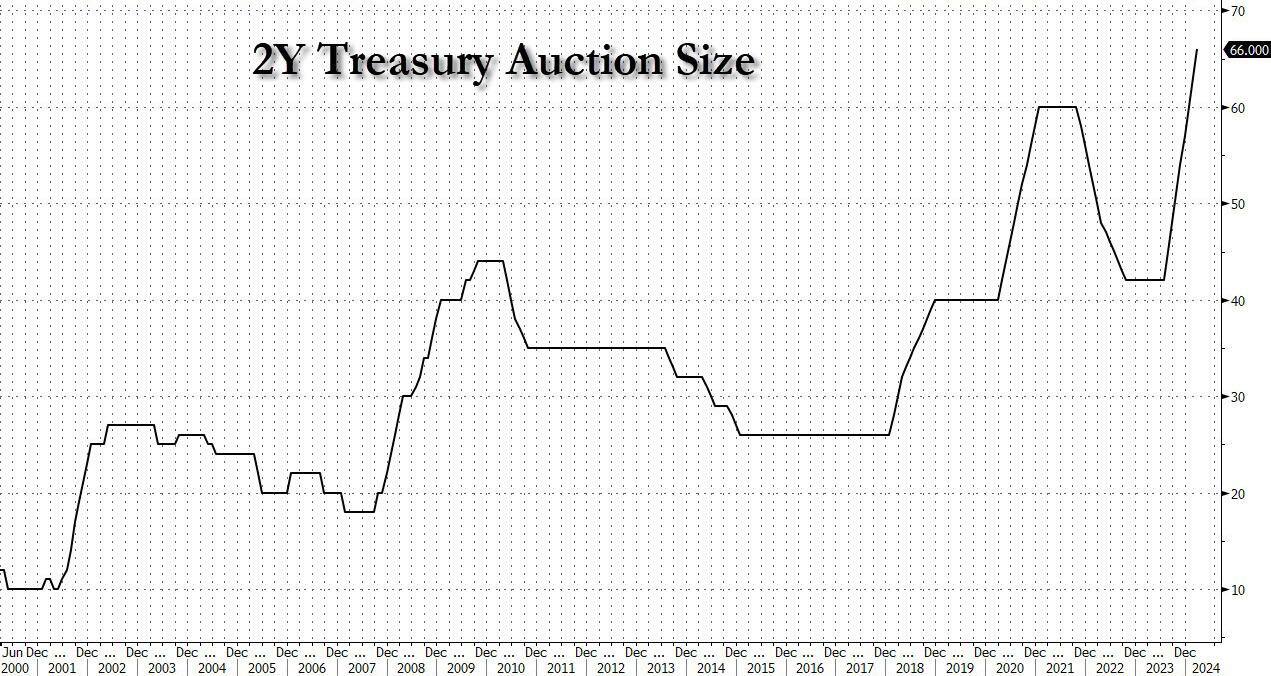

Moments ago, the Treasury concluded the first of this week’s front-loaded auctions when it sold $66BN of 2-year notes, the first coupon auction after last week's dovish Powell presser. The auction was immediately notable for one reason: upsized by $3BN from last month, at $66BN this was the largest 2Y auction on record, but it certainly won't be the biggest. With US debt issuance now exponential, virtually every auction from here until the end of the USD as a reserve currency will be "record big."

(Click on image to enlarge)

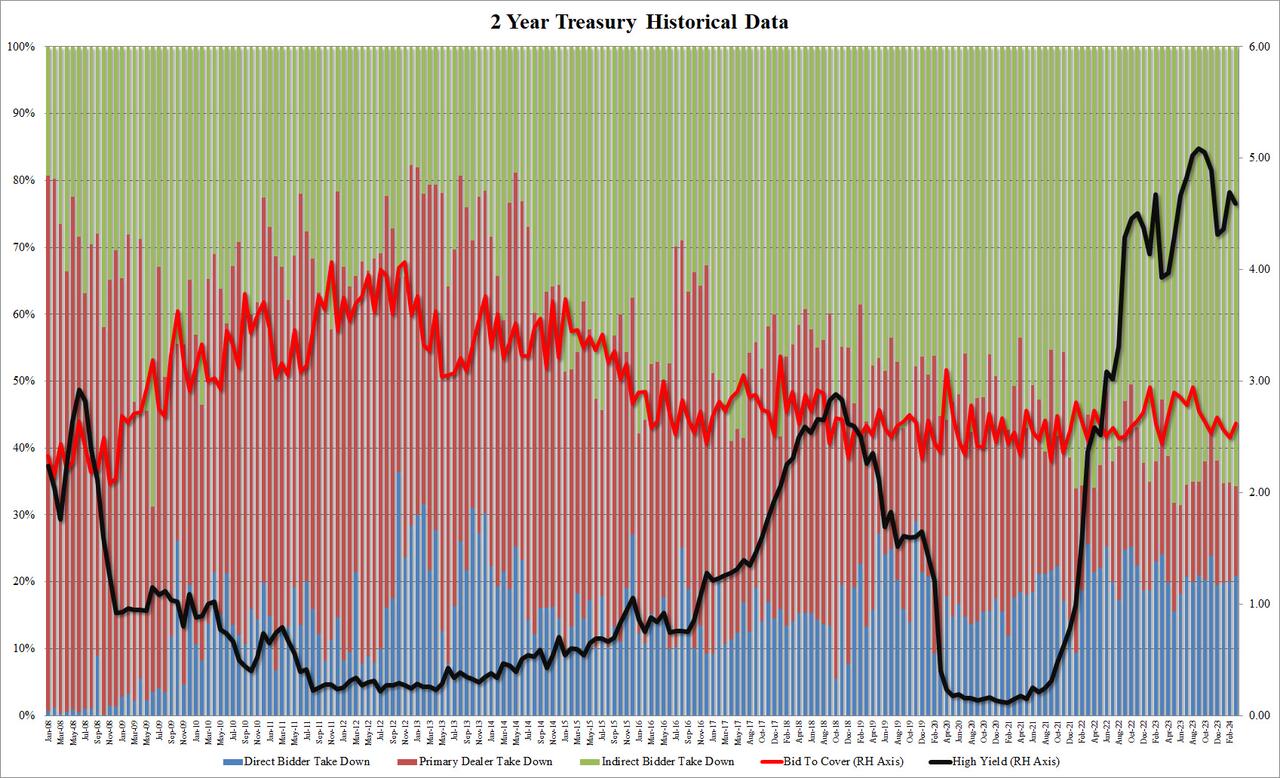

The auction stopped at a high yield of 4.595%, down ~10bps from last month's 4.691%, and tailed the 4.590% When Issued by 0.5bps, the second tailing auction in a row.

The bid to cover was solid, rising from 2.492 to 2.619 and above the six-auction average of 2.61.

The internals were also solid with Indirects awarded 65.8%, the most since June 2023 (and clearly above the recent average). And with Directs taking down 20.8%, the most since Nov 23, Dealers were left holding 13.4%, or the lowest since last June.

(Click on image to enlarge)

Overall, this was an impressive auction with solid foreign demand, with the only modest negative the slight tail despite the concession as yields ripped higher into the auction deadline.

More By This Author:

US New Home Sales Unexpectedly Dropped In Feb As Prices Tumbled

Goldman Takes A Field Trip To Tesla & Rivian

"We Have Reached A Bottom": Uranium Poised To Jump Again After 3 Month Correction

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more