Stellar 20Y Auction Stops Through With Best Metrics Of 2025

Image Source: Pixabay

After another night of soaring bond yields in Japan, and a move higher in the yields of US paper since this morning, some were concerned today's 20Y reopening could have difficult finding demand. It did not, and instead demand was brisk with the biggest stop through since June 2024.

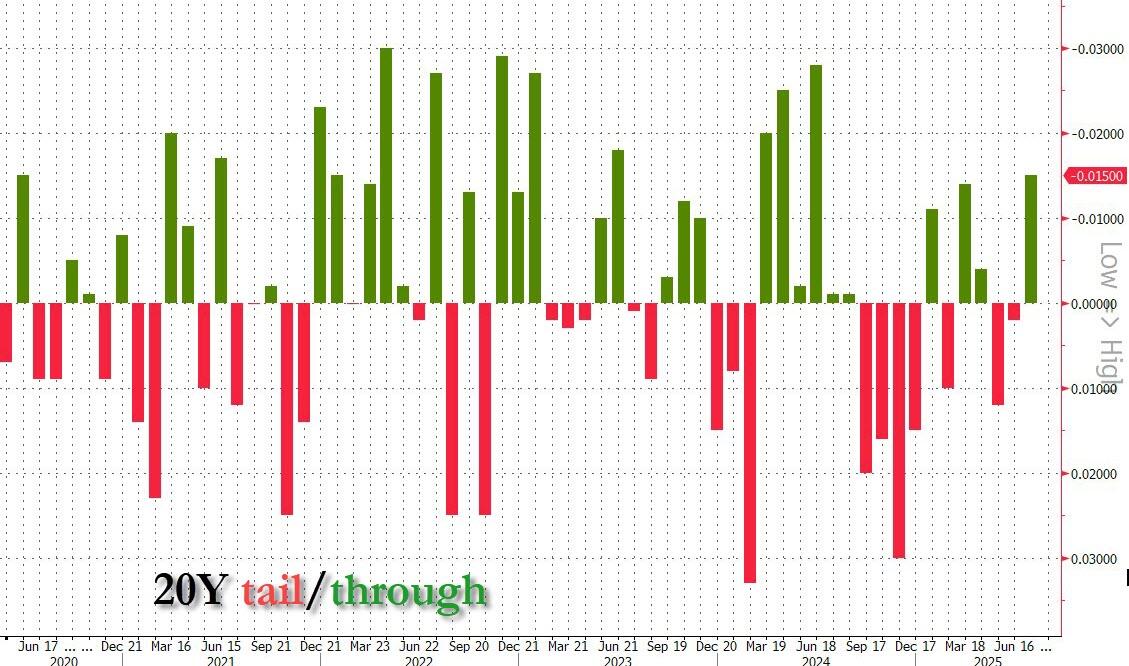

Starting at the top, the auction priced at a high yield of 4.935%, down from 4.942% last month and the lowest clearing yield since April. The auction also stopped through the 4.951% When Issued by 1.6bps, the biggest Stop Through since June of 2024.

(Click on image to enlarge)

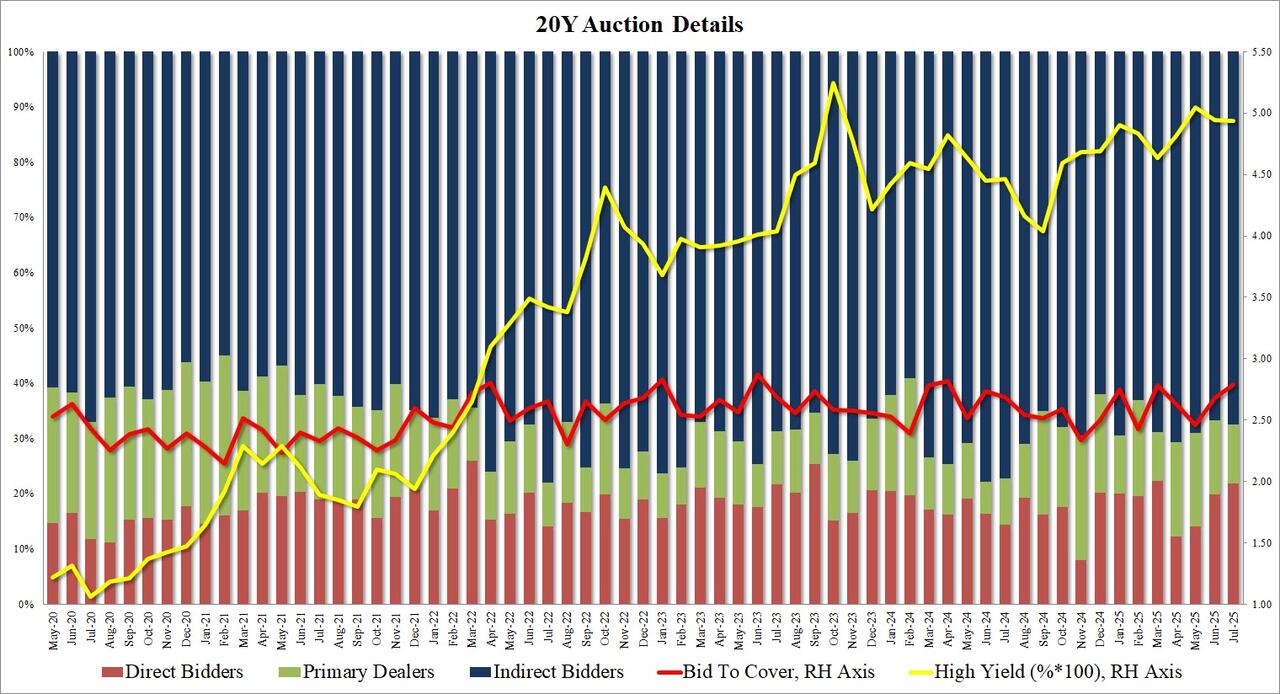

The bid to cover was als impressive, shooting up to 2.79 from 2.68 in June, and the highest since April 2024 (clearly, it was well above the six-auction average of 2.62).

The internals were solid, with Indirects awarded 67.4%, up from 66.7% last month and in line with the recent average of 68.0%. And with Directs awarded 21.9%, or the most since March, Dealers were left holding 10.7%, the lowest since March.

(Click on image to enlarge)

Overall, this was a stellar 20Y reopening auction, and easily one of the best coupon auctions of the summer, yet one wouldn't know it by the secondary market because even though 10Y yields dipped after news of the auction hit the tape, yields across the curve have since resumed their gradual melt up higher.

More By This Author:

Nil, Baby, Nil; WTI Extends Losses Despite Big Crude Production Drop, Inventory DrawTrump Announces "Largest Trade Deal Ever" With Japan, Sets Tariffs Rate At 15%; JGBs Plunge

GM Slides 7% After Beating Q2 Earnings Despite $1 Billion Tariff Hit, Warns Of Steeper Impact Ahead

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more