SPY: Boost Your Exposure – But Not Too Much – Given Recent Market Trends

Image Source: Pixabay

If you need hard evidence about how investing has changed from a few years ago, just look at the stock and bond markets over the past four months. The S&P 500 is right where it was then, around 4,500. The iShares Russell 2000 ETF (IWM) is down noticeably, while the Invesco QQQ Trust (QQQ) and similar ETFs are up solidly. Then there’s the “bond market” which is my nominee for the most misinterpreted investing term of 2023.

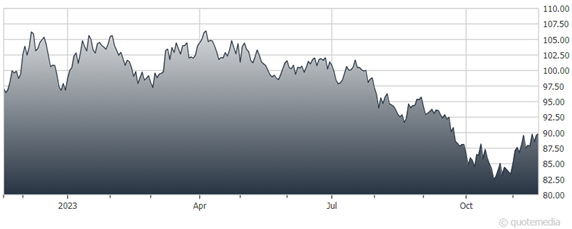

The iShares 20+Year Treasury Bond ETF (TLT) traded from $100 to $81 and recently spiked up to around $90. If listed securities were people, there would be a lot of jealous stocks right now. That’s some whipsaw!

iShares 20+ Year Treasury Bond ETF

Bottom-line: The stock market seems to want to rally into year-end, along with the 10-year US Treasury bond rate heading further south. But since I’m about reward-risk tradeoff, I say we remain in the same market climate we’ve been in since late 2021.

Rallies AND dips are not to be trusted. Keep the leash short. There have been too many “fakeout-breakouts” in both directions. That really messes with traders, especially newbies. But for those of us who are tactical but look beyond a trader’s time frame, it means something else.

You have to take what the market gives you. And right now, that means that if this industry ETF or that sector ETF can rally for a bit, don’t relax and think it won’t turn back on a dime.

Remember: Bear markets are not as simple as prices crashing. That’s a crash. Bears are about frustrating the heck out of you with rug-pulls and traditional bull market rules failing more often than usual.

Oh, and did I mention that T-bills are still the best thing going? That’s why our model portfolios start with that “core” holding, as we look to move beyond that low-risk/moderate-return class of ETFs to earn additional return. But not at all costs. Rule #1: Avoid Big Loss.

As you know if you read our special alert on November 14, we raised our ROAR Score from 10 to 25, ending a two-month stay at the 10 level. ROAR stands for “Return Opportunity And Risk” – or in other words, if my choices are stocks and cash, what percentage would I have in the stock market right now?

That means our two-ETF model portfolio is now allocated 25% to the SPDR S&P 500 ETF Trust (SPY) and 75% to the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL). The best way to characterize this upward adjustment is that, to paraphrase Fed Chairman Jerome Powell, the stock market is “thinking about thinking about” busting a move higher.

At the end of the day, we’ll need more evidence to get to and above the 50 level on the ROAR Score, which would indicate that we think investors can pursue return with more reasonable levels of risk than we’ve seen the past two years.

More By This Author:

Can The Fed Stick A Soft Landing? These Indicators Say: "Maybe Not"VICI: A Higher-Yielding Specialty REIT Worth Considering For Income

Palantir: A Tech Play With Blowout Earnings And Leverage To The AI Boom

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.