SPX, Oil, Gold And G6 Targets For The Week Of January 7

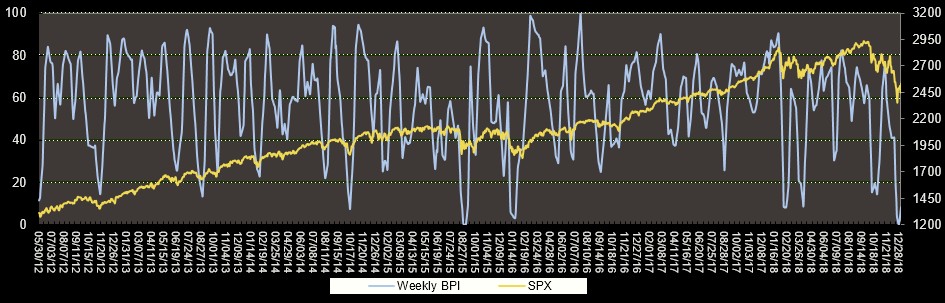

The SPX traded for less than a week but is already testing the key bull/bear zone in our 2019 forecast:

As mentioned last week, 2525 – 2550 is our primary buy/sell zone for 2019, and the SPX closed on Friday within that zone.

The overbought levels of the daily CIT bullish percent indicator correctly predicted the sideways/down phase at the beginning of the week, and once the daily and weekly trends got into sync, this resulted in the powerful 84 point rally on Friday. Currently, the weekly numbers remain oversold and this should be supportive of higher prices going forward:

The projected trading range for next week for SPX is 2400-2600.

You can follow the 2019 chart, in real-time, here.

After reaching our support zone of $42 in December, Oil started 2019 strong and closed on Friday 30 cents above our weekly upside target. Although it still trades below our $50 pivot level, we are willing to give it the benefit of the doubt.

Current signals*: Daily Buy, Weekly Buy.

The projected trading range for Oil for next week is 44 – 50:

Gold reached our upside weekly target on Thursday and sold off. It still managed, however, to finish the week above our weekly pivot at 1283, thus keeping its buy signal.

Current signals: Daily Buy, Weekly Buy

The projected trading range for Gold for next week is 1210 – 1370:

The flash crash on Tuesday lit the forex universe on fire. It is interesting to note, however, that all the currencies affected by the crash found support or closed the week at their lower weekly targets.

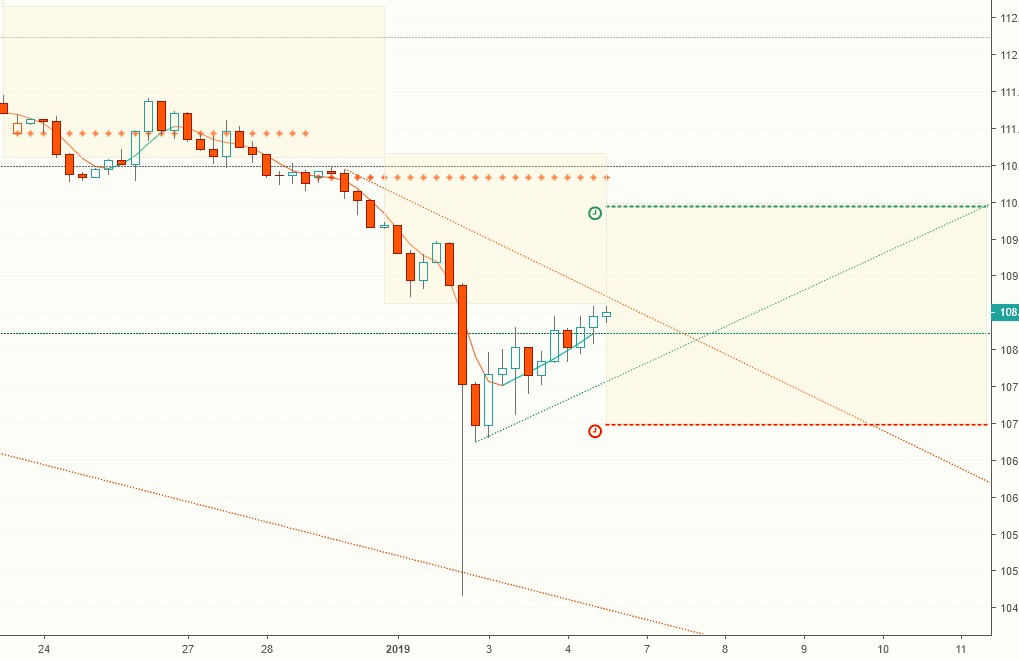

USD/JPY was hardest hit and, after an intraweek drop of more than 4.5%, managed to close on Friday just a few pips below our weekly target.

Current signals: Daily Buy, Weekly Sell

The projected trading range for USDJPY for next week is 107 – 110:

Within minutes of the crash GBP/USD pulled back to the lower weekly target. After testing this level several times it resumed its upward trajectory for the rest of the week.

Current signals: Daily Buy, Weekly Buy

The projected trading range for GBPUSD for next week remains unchanged at 1.254 – 1.285:

AUDUSD had a similar reaction to the flash crash and after bouncing off the lower weekly target finished the week a few pips below the upper weekly target.

Current signals: Daily Buy, Weekly Buy

The projected trading range for AUDUSD for next week is 0.693 – 0.721:

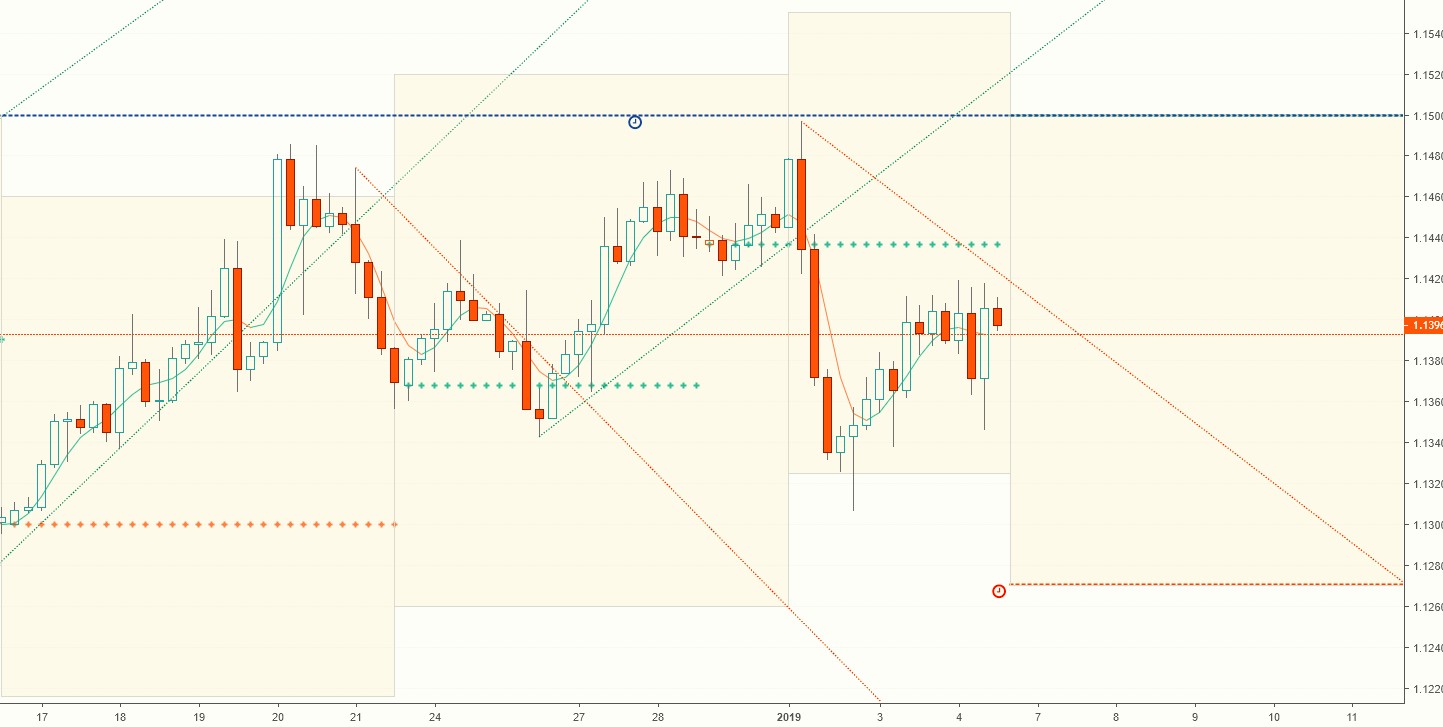

EUR/USD finally broke out of the confines of the symmetrical triangle but, as expected, met resistance at 1.15 and dropped off to the lower weekly target. The projected weekly trading range remains unchanged.

Current signals: Daily Buy/Hold, Weekly Buy/Hold

The projected trading range for EURUSD for next week is 1.127 – 1.15:

USD/CAD broke below the lower target mid-week and, after several unsuccessful attempts to regain that level, continued selling off for the rest of the week.

Current signals: Daily Sell, Weekly Sell

The projected trading range for USDCAD for next week is 1.332 – 1.36:

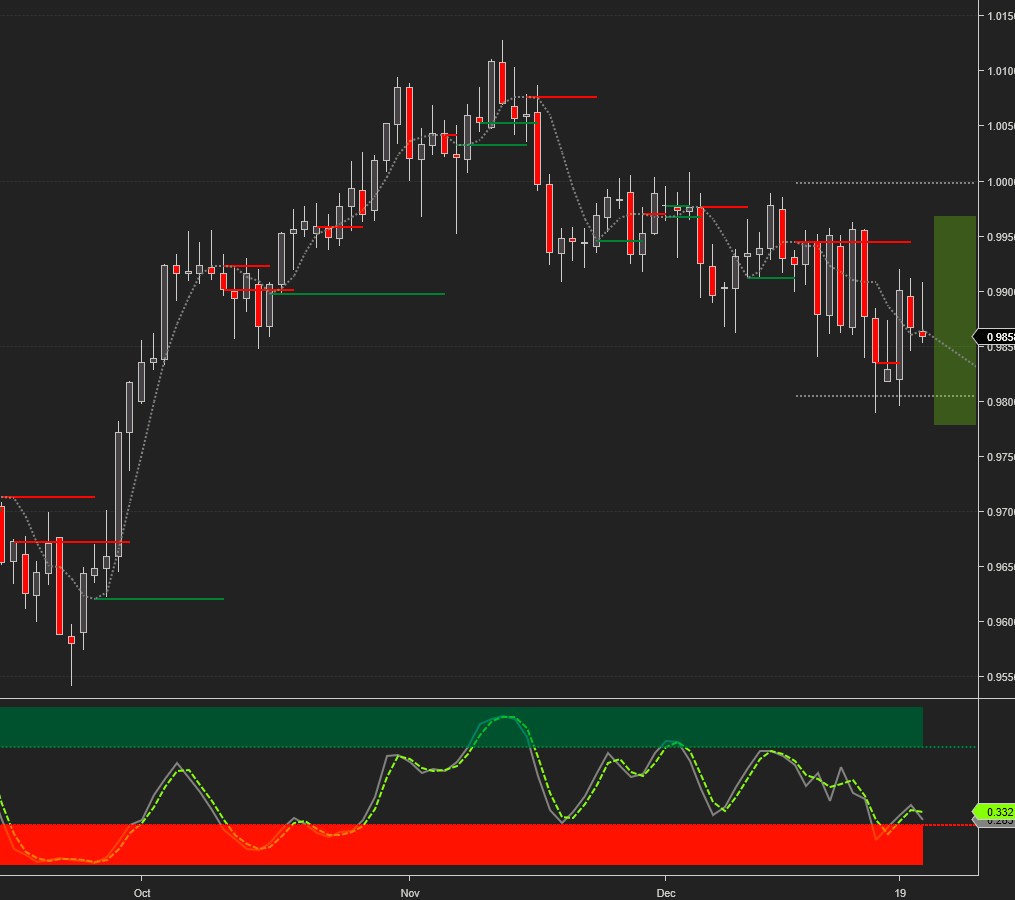

USD/CHF started 2019 mostly flat and remains stuck in a narrow trading range between 0.98 and 1.00. Therefore, our outlook and projected range remain the same.

Current signals: Daily Sell, Weekly Sell

Weekly Buy/ Sell pivot at 1.00

The projected trading range for USDCHF for next week is 0.978 – 1.00:

*Please note that the trading signals are in effect as of the close on Friday and may change as soon as the markets re-open. When the current signal is hold, we may also include the preceding buy or sell signal (e.g. Buy/Hold or Sell/Hold). Hold signals followed by a buy/sell signal in the direction of the preceding buy/sell signal can be considered for pyramiding the position.

Charts, signals and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8

Disclosure: For intraday charts, weekly buy/sell pivots and updates, follow us on

Disclaimer:Futures ...

more