SPX, Gold, Oil And G6 Targets For The Week Of February 4th

Following a trend that started at the end of 2019, market breadth kept improving and pushing the major indices higher. The low of last week’s bearish candle was never challenged, and support held as well. As a result the SPX made it all the way to the next resistance level, which is the bearish target angle:

As mentioned before, the bearish target angle is close to the 1 x 1 angle from the September ’18 high, which means that price and time are squared again. Therefore, a break above the angle is critical for continuation of the 2019 rally.

Current signals*: Daily Long, Weekly Long

For Weekly Buy/Sell pivots check the TV page which gets updated on Monday.

The projected trading range for next week for SPX is 2600-2800.

Oil remains in an uptrend, as every week since the beginning of 2019 it has managed to break above the previous week’s highs.

Current signals: Daily Long, Weekly Long.

The projected trading range for Oil for next week is 52 – 58:

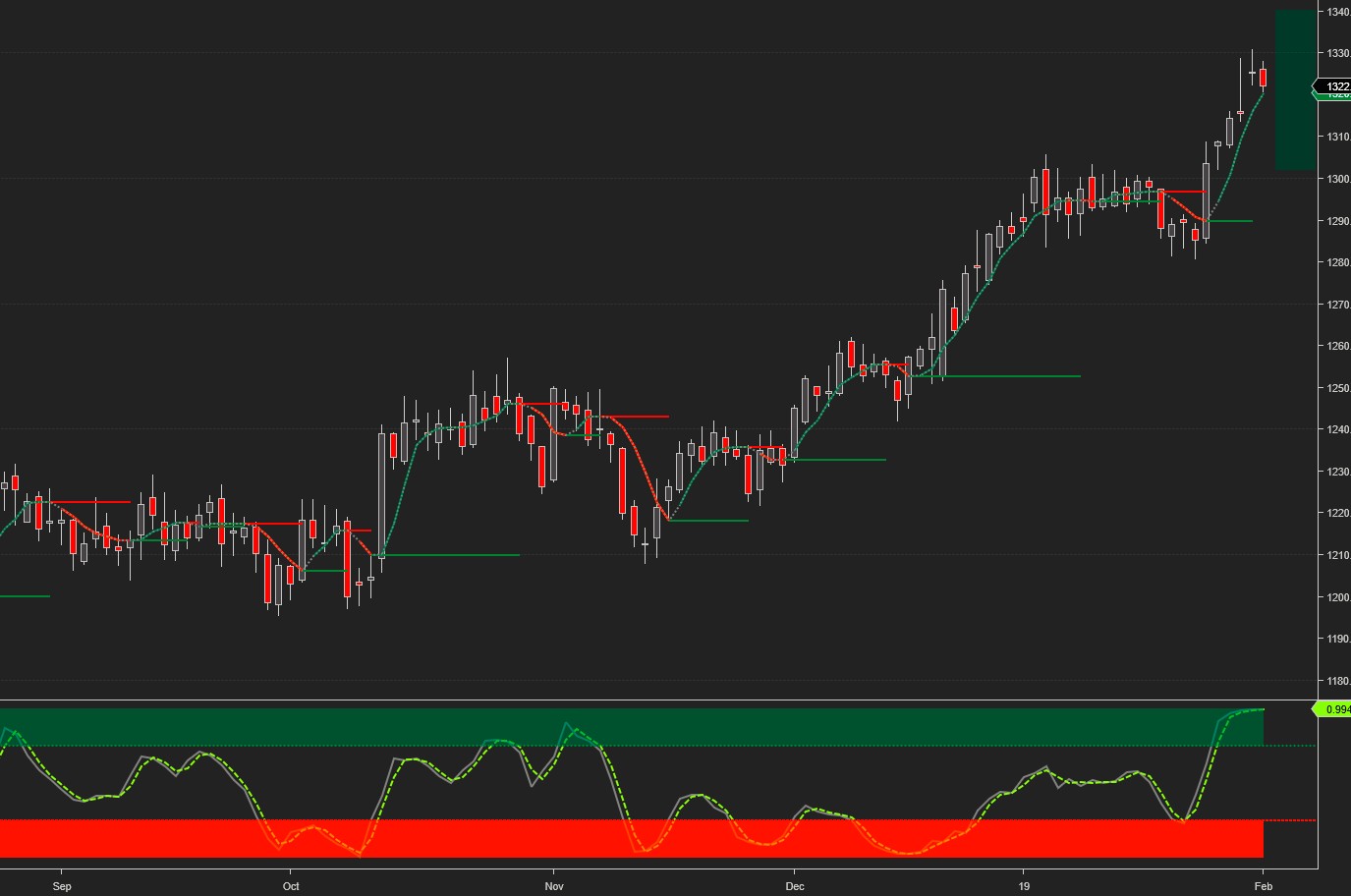

Last week we noted that the price consolidation phase for GOLD may be over, and a close above 1300 was needed to mark the beginning of a new upswing. That’s exactly what happened, and GOLD finds itself in the middle of our projected target zone for next week.

Current signals: Daily Long, Weekly Long

The projected trading range for Gold for next week remains unchanged: 1300 – 1340:

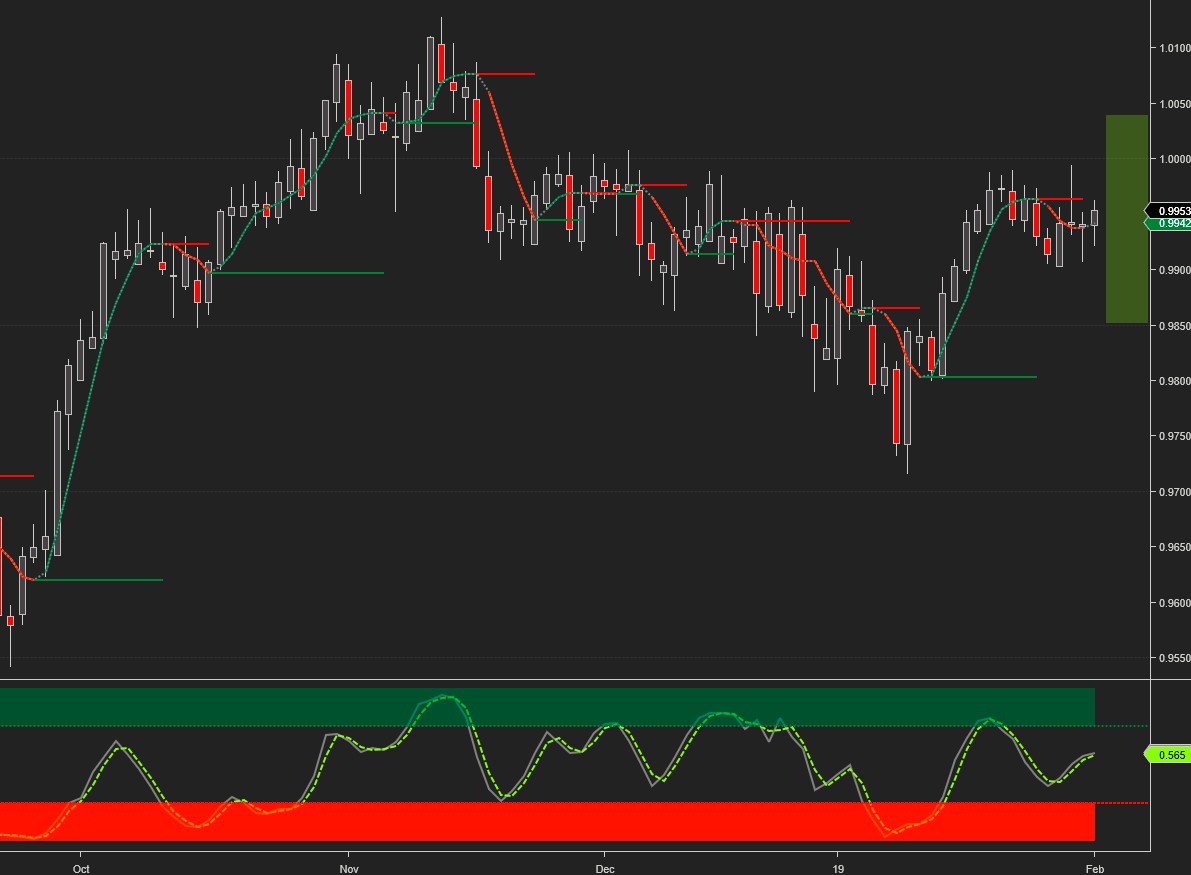

USDCHF continues to test and get rejected at parity. The weekly targets remain the same, and our key long/short pivot remains at 1.00.

The projected trading range for USDCHF for next week is 0.985 – 1.003:

USDJPY finished the week flat. As mentioned last week, it remains in an uptrend but needs to break above 110 to keep the bullish momentum alive.

Current signals: Daily Flat, Weekly Flat.

The projected trading range for USDJPY for next week is 108 – 110.35:

EURUSD reached the upside weekly target on Wednesday and, although it retreated from that level later in the week, remains in a daily and weekly uptrend.

The projected trading range for EURUSD for next week is 1.135 – 1.155:

GBPUSD spent the week consolidating following the preceding sharp advance, and tested the breakout level from the previous week several times. The weekly targets remain unchanged. The daily chart shows a well-defined triangle which is considered a continuation pattern. Support at the base of the triangle, resistance at the hypotenuse.

Current signals: Daily Flat, Weekly Long.

The projected trading range for GBPUSD for next week is 1.295 – 1.325:

USDCAD remained under pressure. After breaking below the double bottom support level at 1.318, it closed on Friday on the lower weekly target.

Current signals: Daily Short, Weekly Short.

The projected trading range for USDCAD for next week is 1.30 – 1.32:

AUDUSD continues to be on a tear following the January 3rd flash crash, and finished the week on the upper weekly target. The January 11th high now becomes support. There’s a heavy resistance band above, between 0.735 and 0.745.

Current signals: Daily Long, Weekly Long.

The projected trading range for AUDUSD for next week is 0.715 – 0.735:

*Please note that the trading signals are in effect as of the close on Friday and may change as soon as the markets re-open. When the current signal is hold, we may also include the preceding buy or sell signal (e.g. Buy/Hold or Sell/Hold). Hold signals followed by a buy/sell signal in the direction of the preceding buy/sell signal can be considered for pyramiding the position.

Charts, signals and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8

For intraday charts and update follow us on TradingView.

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more