SPX, Gold, Oil And G6 Targets For The Week Of February 25th

Supported by strong market breadth the major indices keep making higher highs and higher lows. After bouncing off support at the down sloping target angle, the SPX made it to the next resistance zone anchored around 2800:

The daily SPY chart shows in greater detail how the dynamic between positive and negative market breadth changed at the end of December ’18:

There are two things to pay attention to -- the length and the strength of up-swings compared to down-swings. Until the current dynamic changes, market breadth will be supportive of higher prices.

Current signals*: Daily Long, Weekly Long

For Weekly Buy/Sell pivots check the TV page which gets updated on Monday.

The projected trading range for next week for SPX is 2650-2850.

Oil finished the week a few cents below the upper weekly target. It remains in an upswing and continues making higher highs and higher lows.

Current signals: Daily Long, Weekly Long.

The projected trading range for Oil for next week is 54 – 59:

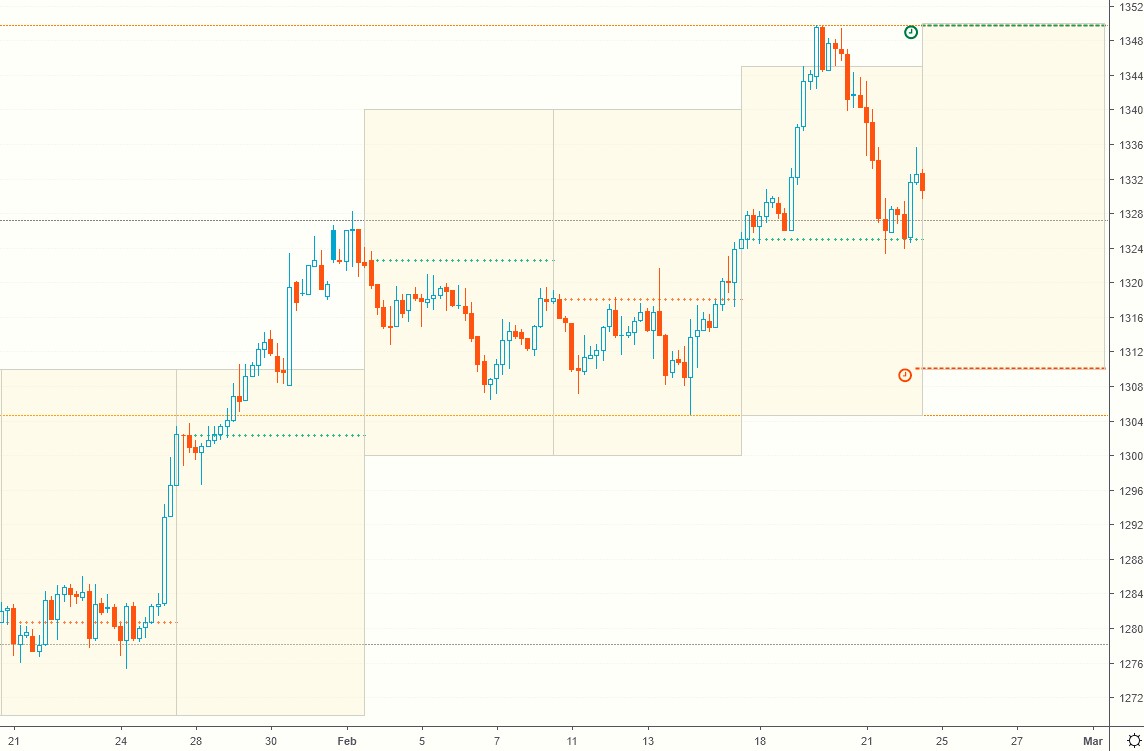

GOLD remains in an uptrend which started mid-November. It found resistance at the upper weekly target and finished the week with a small gain, just above the middle of the projected trading range.

Current signals: Daily Long, Weekly Long

The projected trading range for Gold for next week is: 1310 – 1350:

USDCHF keeps trading around parity for the third week in a row. $1.000 remains the bullish/bearish pivot going forward.

The projected trading range for USDCHF for next week is 0.9945 – 1.015:

USDJPY gained little during the week, but remains in an uptrend. The projected trading range remains the same.

Current signals: Daily Flat, Weekly Long.

The projected trading range for USDJPY for next week is 109.5 – 112:

EURUSD found resistance at the upper weekly target and sold off at the end of the week. It will remain in a weak position as long as it trades below 1.15. A break below 1.12 can lead to an 8% drop.

The projected trading range for EURUSD for next week is 1.125 – 1.14:

GBPUSD rallied from the lower target last week to the upper weekly target on Wednesday. It still remains hostage to the Brexit news flow.

The projected trading range for GBPUSD for next week is 1.29 – 1.32:

USDCAD found support at the lower weekly target, but seems determined to test the February 1st lows.

Current signals: Daily short, Weekly Short.

The projected trading range for USDCAD for next week is 1.3065 – 1.328:

AUDUSD is trying to find support within a broader congestion zone that goes back to 2016.

The projected trading range for AUDUSD for next week is 0.705 – 0.72:

*Please note that the trading signals are in effect as of the close on Friday and may change as soon as the markets re-open. When the current signal is flat/hold, we may also include the preceding buy or sell signal (e.g. Buy/Hold or Sell/Hold). Hold signals followed by a buy/sell signal in the direction of the preceding buy/sell signal can be considered for pyramiding the position.

Charts, signals and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8

For intraday charts and update follow us on TradingView.

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more