SPX, Gold, Oil And G6 Targets For The Week Of April 1st

Last week we drew attention to the fact that the SPX found support within the support/resistance band stretching back to October ’18, and that market breadth was a couple of days away from getting oversold. Support at 2800 was tested four times during the week before the market rebounded on Thursday and Friday and registered a higher weekly close.

As expected, the market breadth oscillator bottomed out mid-week and is supportive of higher prices for the beginning of April. First resistance level at 2872, support at 2800.

Current signals*: Daily Long, Weekly Long

For Weekly Buy/Sell pivots check the TV page which gets updated on Monday.

The projected trading range for next week for SPX remains unchanged at 2750-2900.

Oil remains in an uptrend although it wasn’t able to break above resistance at 60.4. The 4h chart shows that the current upswing is nearing exhaustion which makes a sustained break to new highs questionable.

Current signals: Daily Long, Weekly Long.

The projected trading range for Oil for next week is 57.75 – 62.75:

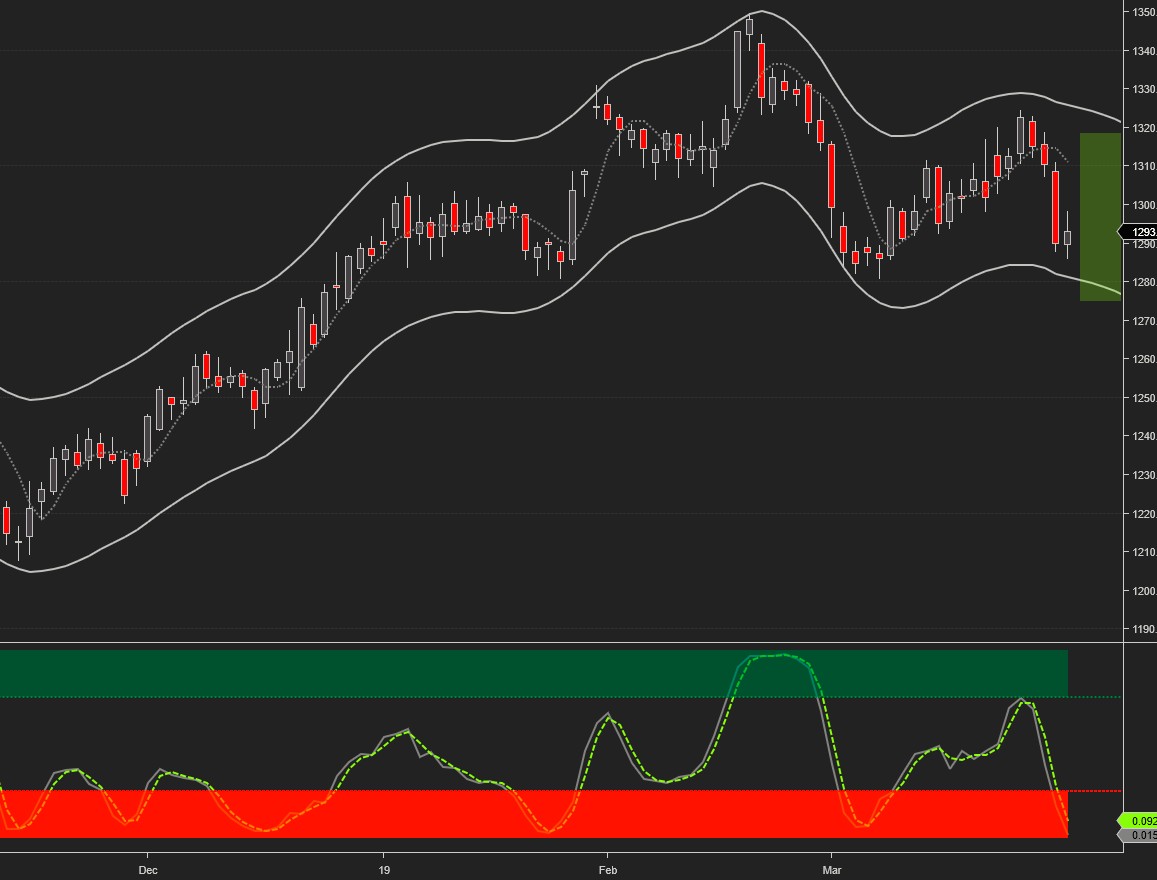

GOLD reached its upside target for the third week in a row on Tuesday, but then sold off and dropped slightly below the lower weekly target. It painted a bearish outside weekly candle in the process.

Current signals: Daily Short, Weekly Short.

The projected trading range for Gold for next week is: 1275 – 1318:

USD/CHF is consolidating following a two-week drop. There’s well-defined resistance at 0.997. Parity remains our bullish/bearish pivot going forward.

The projected trading range for USD/CHF for next week is 0.988– 1.002:

USD/JPY found support at the weekly pivot and rallied to within a few pips of the upside weekly target.

Current signals: Daily Long, Weekly Flat.

The projected trading range for USD/JPY for next week is 109.75 – 111.65:

EUR/USD continued selling off following last week’s failed breakout. It broke below the lower weekly target and is testing support at 1.1215. It remains in a well-defined zig-zag pattern and, as mentioned before, a break below 1.12 could lead to a further 8% decline.

The projected trading range for EUR/USD for next week is 1.115 – 1.13:

GBP/USD reached the lower weekly target and closed just above support at 1.296.

The projected trading range for GBP/USD for next week is 1.291 – 1.324:

USD/CAD remains in the March trading range and keeps the same targets.

The projected trading range for USD/CAD for next week is 1.325 – 1.355:

AUD/USD started the week with a strong rally, as expected. However, momentum fizzled on Tuesday, and AUDUSD finished the week with only a small gain. The well-defined triangle in place defines the key breakout/breakdown levels to keep an eye on.

Current signals: Daily Flat, Weekly Flat.

The projected trading range for AUD/USD for next week remains unchanged at 0.7 – 0.717:

*Please note that the signals are provided for informational purposes only. They are in effect as of the close on Friday and may change as soon as the markets re-open.

Charts, signals and data courtesy of OddsTrader, CIT for more