SPX & G6 Prices For The Week Of June 11th

The SPX finally broke out of the month-long consolidation, while most of the forex pairs hit our targets and reversed. Below is a brief recap of last week’s price projections, and the price targets for next week.

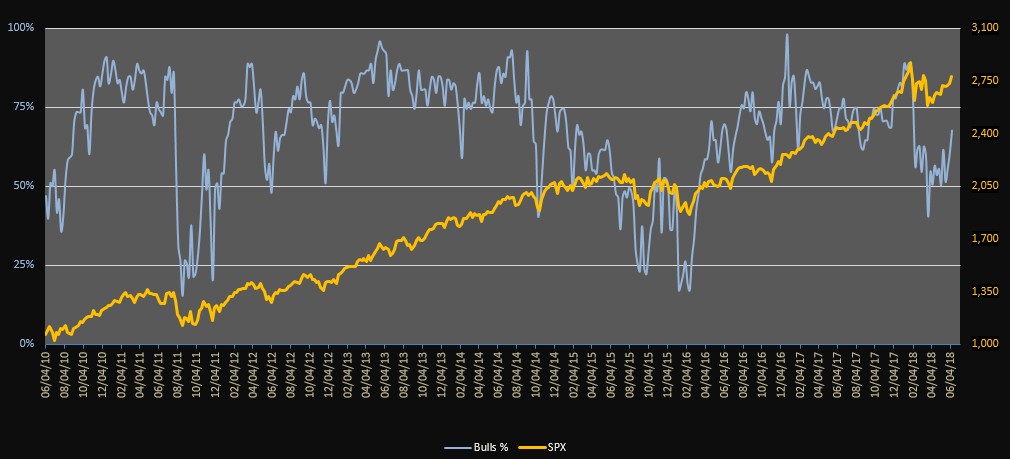

Sentiment continued improving all week long, and bulls finally got the upper hand, breaking decisively away from the 50% level:

What the above chart shows is that there’s plenty of room and time for bullish sentiment to continue improving until it reaches overbought levels.

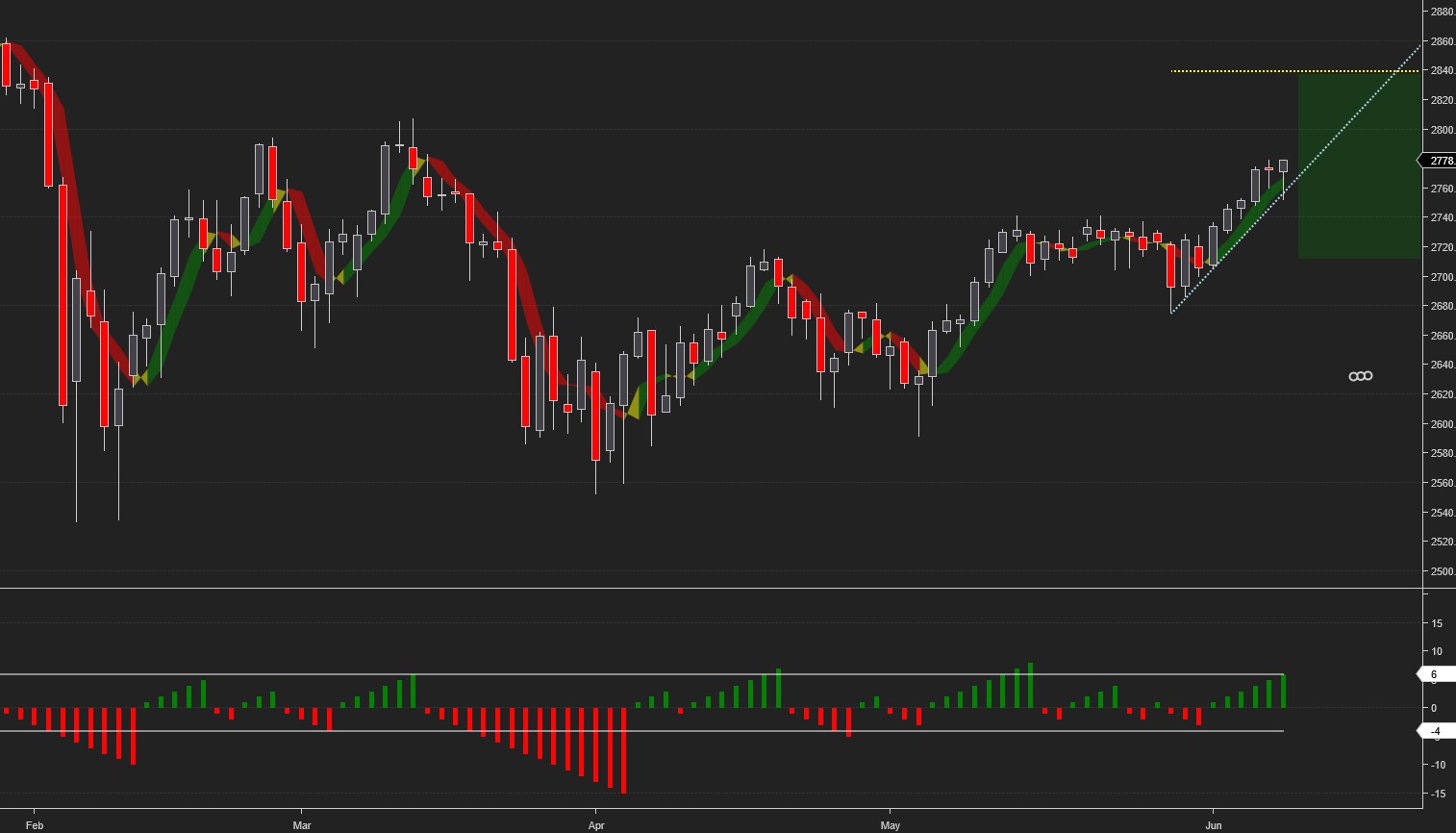

The SPX never traded below the CIT Cloud, and finished the week just five points below our upside target. Although the swing direction is up, it should be noted that following the January correction, the index hasn’t greatly exceeded its six day average swing duration. Therefore, the odds are against an uninterrupted continuation of the current upswing. As long as 2740 holds as support, however, the bullish case remains strong. Other important levels to watch are 2788 and 2800, the highs of the February and March tops.

The projected price range for next week for the SPX is 2715 – 2840:

You can keep track of our daily and intraday market updates here.

EURUSD reached our 1.18 upside target and reversed although, technically speaking, the trend remains up. A break below the CIT Cloud or the trend line will signal a swing reversal. In the context of the larger move, which started in April, the longer trend is down and the current pattern has the look of a bear flag.

The projected trading range for next week for EURUSD is 1.166 – 1.188:

The Pound came within a few pips of our upside target but lost momentum and stalled. The upswing will remain in place as long as GBP trades above the CIT Cloud and the trendline. The same bear flag pattern as in EURUSD is visible here as well.

The projected trading range for next week for GBPUSD is 1.32 – 1.36:

The USD came within a few pips of our downside target against the Swiss franc. Although swing duration time is nearing extremes, and USDCHF broke briefly above the downtrend line, it will remain in weak position until the CIT Cloud and trendline are decisively broken to the upside.

The projected trading range for next week for USDCHF is 0.973 – 0.994:

USDJPY tested our upside target of 110.15 but couldn’t break it, and reversed lower.

The projected trading range for next week for USDJPY is 108.4 – 111:

USDCAD reached our upside target and reversed immediately lower, only to finish the week flat and in the middle of next week’s projected trading range.

The projected trading range for next week for USDCAD remains the same 1.28 – 1.305:

AUDUSD tested our upside target of 0.765 all week long but couldn’t break above, and finished the week below the trendline and the CIT Cloud.

Projected range for next week for AUDUSD is 0.753 – 0.772:

Charts and data courtesy of NinjaTrader 8, Kinetick, CIT for TradingView and NinjaTrader 8

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more

Good stuff George, glad to see you here. You seem to know your stuff. What's your background?