Spring 2022 Investor Letter: We Have Liftoff

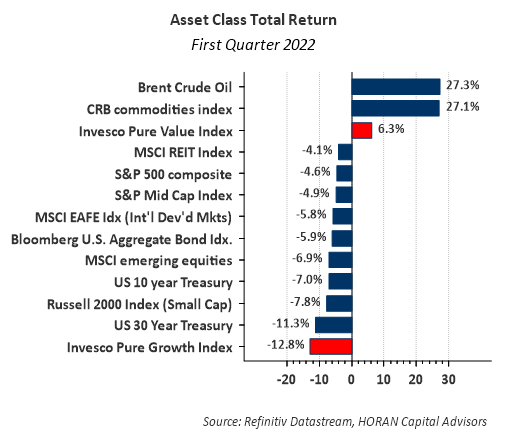

The worst kept secret in the first quarter was the Federal Reserve embarking on a tighter monetary policy. The Fed increased the Fed Funds rate by 0.25% or 25 basis points in March. There are six remaining scheduled Federal Open Market Committee meetings this year and the Fed Funds’ futures market is expecting increases at each of those meetings. In the first quarter of this year the below chart shows crude oil is up more than 27% and, as the month of March got underway, crude oil prices more than doubled from the same time a year earlier. Higher energy prices can be a headwind for economic growth as discussed in more detail in our Investor Letter.

With the Fed intent on reigning in inflation via higher interest rates and a reduction in the Fed’s balance sheet, a midterm election year and the unfortunate humanitarian crisis resulting from the Ukraine/Russia conflict, additional market volatility is likely over the next several quarters. As the Investor Letter is written, Investors should keep in mind though, nearly 63% of S&P 500 stocks are already down more than 10% from their 52-week high. The market tends to react favorably to corporate earnings growth and earnings for S&P 500 companies are expected to growth 9.6% in the next 12-months. Certainly, there is much one can be concerned with, keeping in mind though, the market likes to ‘climb a wall of worry.’

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

moreComments

No Thumbs up yet!

No Thumbs up yet!