SPDR S&P 500 Hit By Coronavirus Resurgence: Keep Calm And Buy The Dip

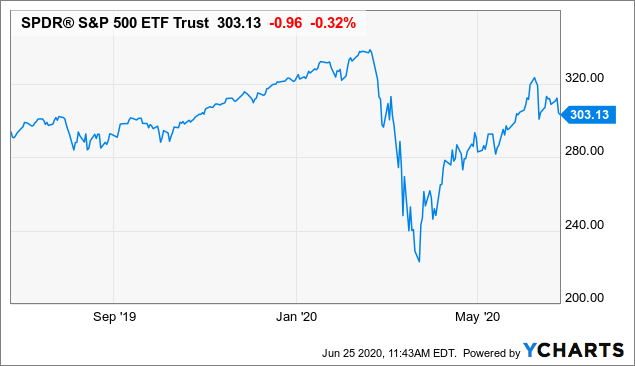

SPDR S&P 500 (SPY) suffered its sharpest decline ever during March, falling at record speed as investors panicked due to the COVID-19 pandemic. This abrupt selloff was then followed by a vigorous rally on the back of unprecedented economic stimulus programs and a favorable evolution of the sanitary crisis in key areas such as New York.

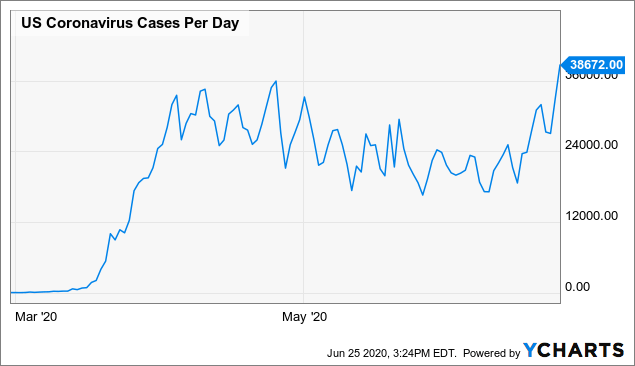

Unfortunately, there has been an increase in daily new COVID-19 cases in the U.S. over the past two weeks. This increase cannot be explained by new more testing alone, because the percentage of positive tests has not declined by much, so the most probable explanation is that we have both more tests but also more cases.

Data by YCharts

In this context, SPDR S&P 500 made a short-term top around $320 on June 8, and price action has been quite weak since them. Many investors are wondering if SPDR S&P 500 is just taking a rest after the strong rally from the March lows or if we are in the first phases of a new bearish move, perhaps even back to the lows of the year.

Data by YCharts

The future is always a matter of probabilities as opposed to certainties. We need to dynamically adjust our market view and our risk exposure depending on how the information evolves. However, based on the evidence currently available, a price correction looks much more likely than a new bear market for SPDR S&P 500.

How The Sanitary Crisis Is Evolving

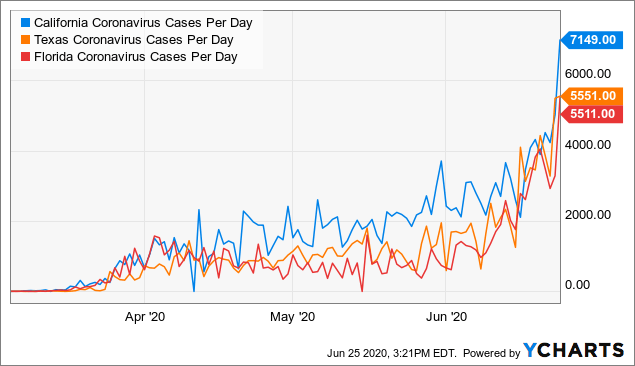

As the economy gradually reopens, and also considering the recent protests and political rallies, new waves of contagions are not something completely unexpected. It is important to note that the increases in contagions have been concentrated in areas such as California, Texas, and Florida.

Data by YCharts

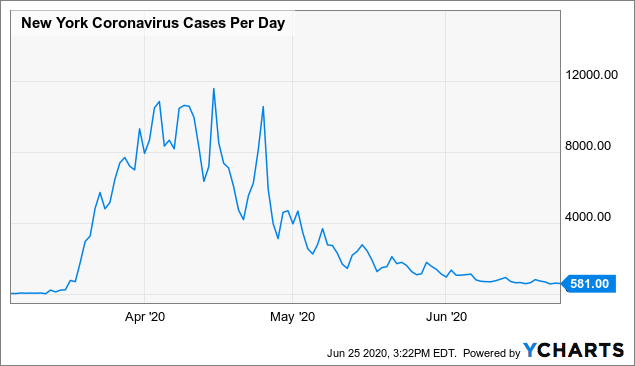

On the other hand, areas such as New York, which was the epicenter of the pandemic in the U.S. initially, are showing clear and consistent improvements.

Data by YCharts

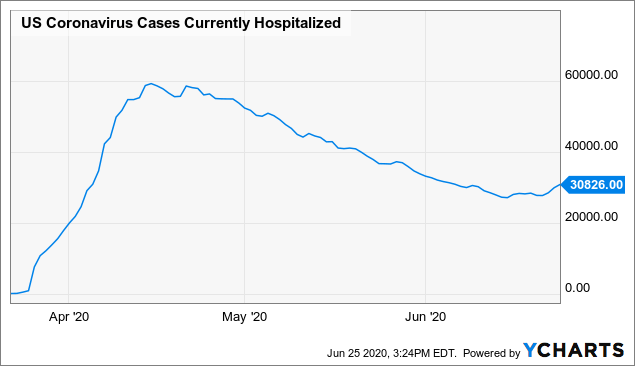

Hospitalizations have started to increase somewhat, and especially in the more affected states. This clearly deserves close attention, but the situation is not out of control at the whole country level.

Data by YCharts

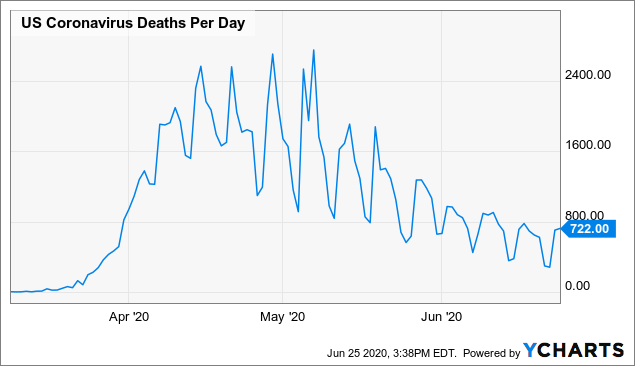

Coronavirus deaths can be a lagging indicator, and the data is obviously volatile. However, it is reasonable to say that the trend has remained quite favorable so far.

Data by YCharts

Don't get me wrong, increasing contagions in some big regions are an important factor to watch, and we can't afford the luxury of being too complacent about this. But the whole COVID-19 risk is very different now in comparison to March.

When the pandemic exploded, there were many unknowns about what the coronavirus really is, how it is transmitted, the mortality risk, and the overall measures required to control it. Now citizens are much better prepared, and perhaps both hospitalizations and deaths are evolving better than contagions because the most vulnerable groups are being particularly more careful.

Testing, the use of masks, and treatments have significantly improved, and people now have much better information to deal with this problem. Massive amounts of money and human talent are being invested in treatments and vaccines for COVID-19, and it doesn't sound like a smart play to bet against all this money and brainpower.

The probabilities are that the sanitary crisis will get much better over the next 6 to 12 months. In the meantime, it could get worse before it gets better, but if you know how to manage your risk exposure and your time horizon then some market volatility should be no reason to panic.

The Fundamental Backdrop

The economic impact from the pandemic is hard to assess, and it is far from over at this stage. However, the magnitude and speed of the economic policy response have been unprecedented too. This is why we often hear about people who are in a better financial situation due to stimulus programs during the pandemic than before the crisis struck.

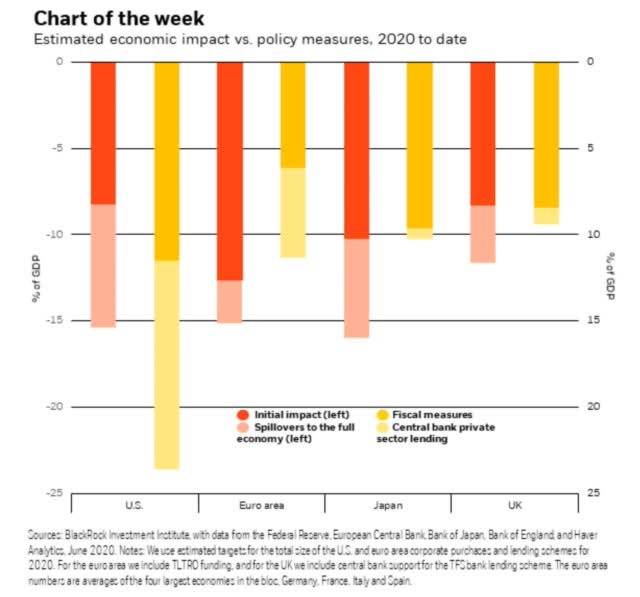

The chart from BlackRock shows the estimated economic impact of the pandemic in orange and the economic stimulus from both central banks and fiscal measures in yellow. In the U.S. the policy response has been even larger than the impact of the crisis, so it's no wonder why the markets have performed much better than expected by most analysts.

Source: BlackRock

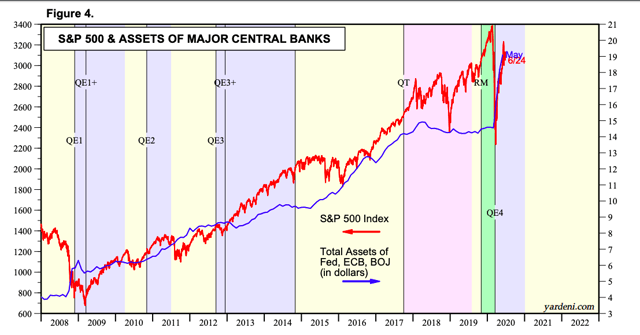

The famous phrase "don't fight the Fed" has become a cliché at this point, but this does not make it any less true. If you should not fight the Fed, then you shouldn't even think about fighting all of the central banks in the world as they are expanding their balance sheets relentlessly.

Source: Yardeni Research

The coronavirus is the "ideal enemy" for government officials and central bankers to fight. This is not a typical recession caused by economic factors, but rather a recession engineered on purpose to contain the sanitary crisis, and an exceptional situation requires an exceptional response.

The crisis has also increased the deflationary forces in the economy, and interest rates all over the world are at historically low levels. Central banks are currently more worried about deflation than inflation, so they are not planning to cut back on monetary stimulus any time soon.

There are plenty of uncertainties on the horizon, and it is hard to imagine what things will look like in terms of monetary policy and fiscal balances once the crisis is over. We still don't know if governments and central banks will be able to pull back on these measures when the time comes, and the economic medicine could have some very serious side effects in the long term.

But we need to close that bridge when we get there. For the time being, the economic stimulus is a necessity and the combined impact of pent up demand and massive economic stimulus could be a major tailwind for the market.

The Bottom Line

There are signs of excessive optimism in the short term, especially among options speculators and short term traders. In this context, a short term correction or a sideways consolidation in SPDR S&P 500 should be no surprise. Since market behavior has been quite volatile recently, investors need to get ready for the possibility of some sharp selloffs in the near term.

However, there is a major difference between a sharp selloff of 5%-10% and a 30% decline like we suffered in March. Both the sanitary situation and the economic landscape have significantly improved since then, so pullbacks in SPDR S&P 500 could be considered buying opportunities as opposed to reasons to sell.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more

Many thanks Andres Cardenal...