S&P CoreLogic Case-Shiller 20 City Home Price Index November 2018 Year-Over-Year Growth Slowed

The non-seasonally adjusted S and P CoreLogic Case-Shiller home price index (20 cities) year-over-year rate of home price growth decelerated from 5.0 % (initially published as 5.0 %) to 4.7 %. The index authors stated "Housing market conditions are mixed while analysts' comments express concerns that housing is weakening and could affect the broader economy".

Analyst Opinion of Case-Shiller HPI

I continue to see this a situation of supply and demand. It is the affordability of the homes which is becoming an issue for the lower segments of consumers. With the rise in mortgage rates, it is pricing more and more consumers out of the market. If mortgage rates continue to rise - we likely will see some retrenchment in home prices.

- 20 city unadjusted home price rate of growth decelerated 0.3 % month-over-month. [Econintersect uses the change in year-over-year growth from month-to-month to calculate the change in rate of growth]

- Note that Case-Shiller index is an average of the last three months of data.

- The market expected from Econoday:

| Consensus Range | Consensus | Actual | |

| 20-city, SA - M/M | 0.0 % to 0.5 % | 0.3 % | +0.3 % |

| 20-city, NSA - M/M | -0.1 % to 0.4 % | 0.2 % | -0.1 % |

| 20-city, NSA - Yr/Yr | 4.6 % to 5.2 % | 4.9 % | +4.7 % |

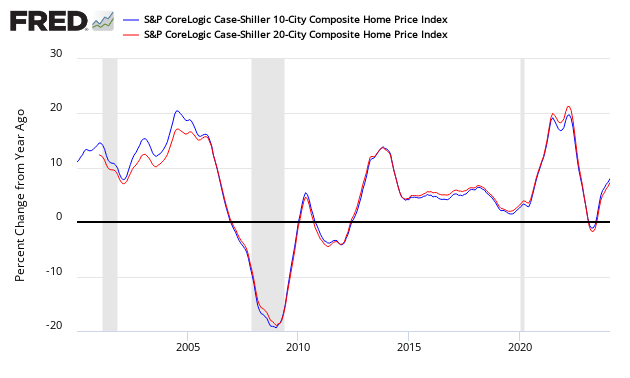

S&P/Case-Shiller Home Price Indices Year-over-Year Change

Comparing the NAR and Case-Shiller home price indices, it needs to be understood each of the indices uses a unique methodology in compiling their index - and no index is perfect.

The way to understand the dynamics of home prices is to watch the direction of the rate of change. Here home price growth generally appears to stabilize (rate of growth not rising or falling).

There are some differences between the indices on the rate of "recovery" of home prices.

A synopsis of Authors of the Leading Indices:

Case Shiller's David M. Blitzer, Chairman of the Index Committee at S&P Indices:

Home prices are still rising, but more slowly than in recent months. The pace of price increases are being dampened by declining sales of existing homes and weaker affordability. Sales peaked in November 2017 and drifted down through 2018. Affordability reflects higher prices and increased mortgage rates through much of last year. Following a shift in Fed policy in December, mortgage rates backed off to about 4.45% from 4.95%.

Housing market conditions are mixed while analysts' comments express concerns that housing is weakening and could affect the broader economy. Current low inventories of homes for sale - about a four-month supply - are supporting home prices. New home construction trends, like sales of existing homes, peaked in late 2017 and are flat to down since then. Stable 2% inflation, continued employment growth, and rising wages are all favorable. Measures of consumer debt and debt service do not suggest any immediate problems.

CoreLogic believes affordability is slowing home price growth (November 2018 Data). Per Dr Frank Nothaft, chief economist for CoreLogic and Frank Martell, president and CEO of CoreLogic stated:

The rise in mortgage rates has dampened buyer demand and slowed home-price growth. Interest rates for new 30-year fixed-rate loans averaged 4.9 percent during November, the highest monthly average since February 2011. These higher rates and home prices have reduced buyer affordability. Home sellers are responding by lowering their asking price, which is reflected in the slowing growth of the CoreLogic Home Price Index.

A strong economy helps homeowners feel confident about the value of their property. If recent declines in the stock market shakes consumer confidence in the national economy, we may see homeowners' perception of home value change and a subsequent buyers' market emerge in 2019.

The National Association of Realtors also worries about affordability (October 2018 data):

Lawrence Yun, NAR's chief economist, says current housing numbers are partly a result of higher interest rates during much of 2018. "The housing market is obviously very sensitive to mortgage rates. Softer sales in December reflected consumer search processes and contract signing activity in previous months when mortgage rates were higher than today. Now, with mortgage rates lower, some revival in home sales is expected going into spring."

"Several consecutive months of rising inventory is a positive development for consumers and could lead to slower home price appreciation," says Yun. "But there is still a lack of adequate inventory on the lower-priced points and too many in upper-priced points."

"The partial shutdown of the federal government has not had a significant effect on December closings, but the uncertainty of a shutdown has the potential to harm the market," said NAR President John Smaby, a second-generation Realtor® from Edina, Minnesota and broker at Edina Realty. "Once the government is fully reopened, I am hopeful that housing transactions will increase."

The U.S. Federal Housing Finance Agency produces an All-Transactions House Price Index for the United States:

Econintersect publishes knowledgeable views of the housing market.

Caveats on the Use of Home Price Indices

The housing price decline seen since 2005 varies by zip code - and seems to have ended somewhere around the beginning of the 2Q2012. Every area of the country has differing characteristics. Since January 2006, the housing declines in Charlotte and Denver are well less than 10%, while Las Vegas home prices had declined almost 60%.

Each home price index uses a different methodology - and this creates slightly different answers.

The most broadly based index is the US Federal Housing Finance Agency's House Price Index (HPI) - a quarterly broad measure of the movement of single-family house prices. This index is a weighted, repeat-sales index on the same properties in 363 metro centers, compared to the 20 cities Case-Shiller.

The US Federal Housing Finance Agency also has an index (HPIPONM226S) based on 6,000,000 same home sales - a much broader index than Case-Shiller. Also, there is a big difference between home prices and owner's equity (OEHRENWBSHNO) which has been included on the graph below.

Comparing Various Home Price Indices to Owner's Equity (blue line)

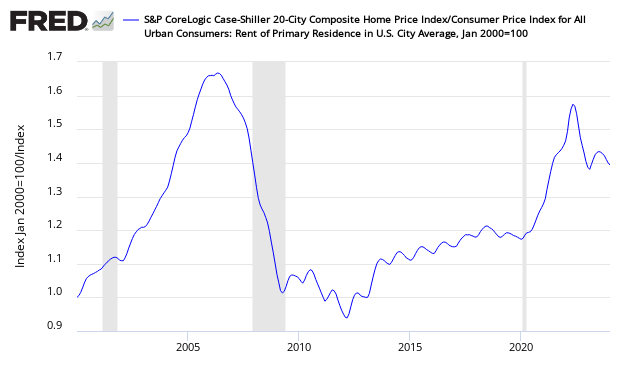

The affordability factor favors rental vs owning.

Price to Rent Ratio - Indexed on January 2000 - Based on Case-Shiller 20 cities index ratio to CPI Rent Index

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more