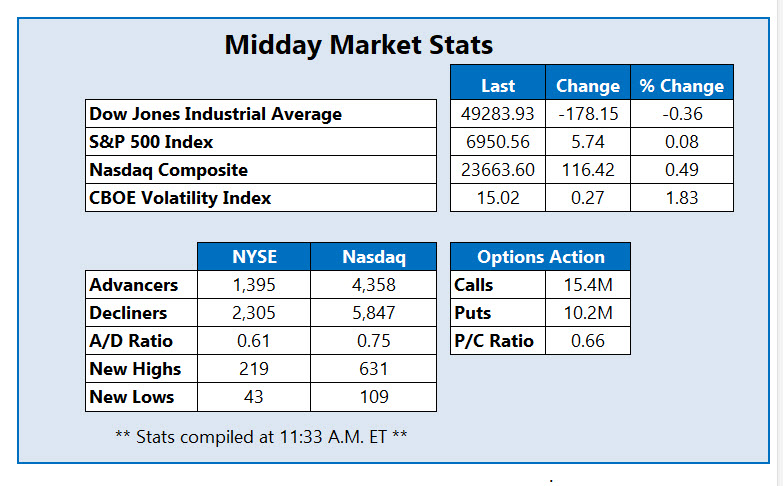

S&P 500 Taps Another; ISM Services Data Shows Expansion

The Dow Jones Industrial Average (DJI) is pulling back this afternoon, last seen down double digits following yesterday's record close. The S&P 500 Index (SPX) managed to tap another record this morning, now sporting a modest gain alongside the Nasdaq Composite (IXIC). Investors are digesting news from President Donald Trump that the U.S. will sanction 30 to 50 million barrels of crude from Venezuela indefinitely, at market cost.

ADP private payrolls data is also in focus, which came in at 41,000 for December, missing expectations but higher than November's drop of 29,000. Meanwhile, the ISM services' index rose to 54.4% last month, up 1.8 percentage points from November and higher than analyst expectations, indicating an expansion.

Chip behemoth Intel Corp (Nasdaq: INTC) is seeing an influx of unusual options activity today, with 776,000 calls and 224,000 puts across the tape so far-- four times the average intraday pace. Most popular are the weekly 1/9 46-strike call and the January 2026 45-strike call, with new positions being bought-to-open at the former. INTC is moving higher with the semiconductor sector, as investors weigh in on the CES event in Las Vegas, Nevada. Up 7.3% to trade at $42.97, at last check, Intel stock has added 119% over the past 12 months and earlier tapped a fresh annual peak of $44.57.

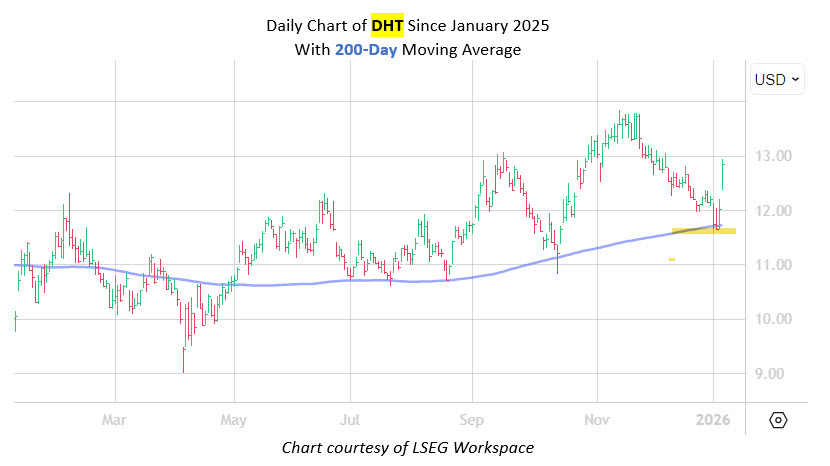

DHT Holdings Inc (NYSE: DHT), is one of the top stocks on the New York Stock Exchange (NYSE) today, last seen up 6.9% at $12.85. While the catalyst for today's bounce is unclear, DHT looks to be rebounding off the $11.50 floor and its 200-day moving average. This pullback came after the oil and gas name tapped a 13-year high of $13.85 on Nov. 13. Over the past 12 months, DHT has added 28%.

(Click on image to enlarge)

One of the worst NYSE performers today is Cleveland-Cliffs Inc (NYSE: CLF), last seen down 6.6% at $12.39. The equity was downgraded to "sector weight" from "equal weight" at KeyBanc, the analyst citing modestly higher costs and valuation. CLF has shed 11.6% over the past three months, but longer term has seen a 22% gain over the past 12 months.

More By This Author:

Dow Closes Above 49,000 With 484-Point PopDow Snags Another Record As Amazon Stock Leads Gains

Dow Notches Record Close With Help From Chevron