S&P 500 Surges Above 4,000; Bonds Bid, Dollar Skids To Start The Quarter

Mission Accomplished?

S&P 500 tagged 4,000 at the cash open

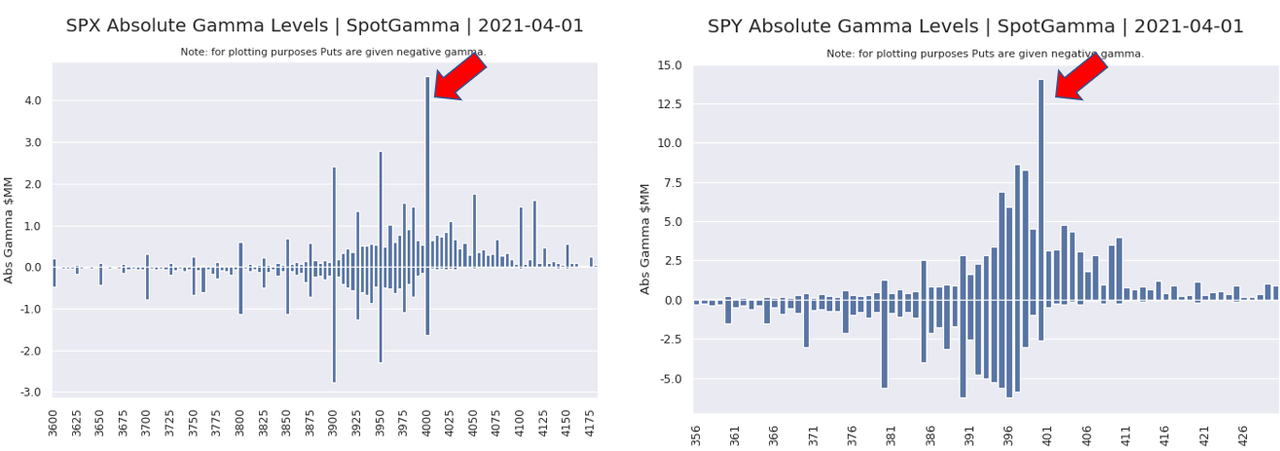

As SpotGamma noted this morning:

4000 is obviously the big number for today as it is the SPY/SPX Call Wall and therefore a resistance/magnet point. Our view is that the market likely does shift higher without the Call Wall rolling to a higher strike. As you can see below, at the moment there are currently no higher strikes approaching the size of 400/4000.

To the downside our Vol Trigger and gamma flips lines have shifted up to 3950, indicating that as critical support.

While stocks are surging, bonds are also bid to start the month with 10Y Yields down 5bps...

And for the second day in a row, the dollar has roundtripped, tumbling since the open of the Europe session...

Ahead of tomorrow's stock market holiday and payrolls print, one might think a derisking was in order, but this is opposite-land after all.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more