S&P 500 Snapshot: Three-Day Fed-Driven Rally Ends

The global rally focused on central bank policy, the BOJ and especially the Fed's refusal to hike rates, came to an end today. Major global indexes in Asia, Europe and the US finished in the red. Our preferred benchmark for US equities, the S&P 500, opened in the shallow red, traded sideways and sold off to its -0.61% intraday low in the afternoon. A faint effort to trim the loss in the late afternoon couldn't gain traction and the index ended the session at -0.57%, ending a three day-rally. On a brighter note, the Fed rally lifted the S&P 500 to a 1.19% gain for the week.

The yield on the 10-year note closed at 1.62%, down one basis point from the previous close.

Here is a snapshot of past five sessions in the S&P 500.

Here is daily chart of the SPY ETF, which gives a better sense of investor participation. Trading volume was light, and after one day above its 50-day price moving average, the ETF ended the week balanced on that popular benchmark.

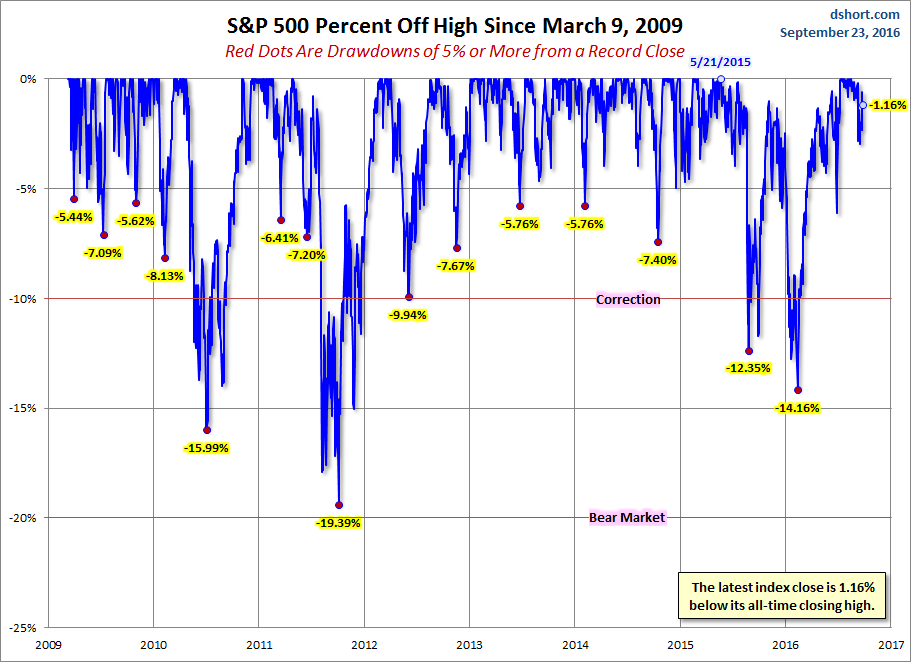

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

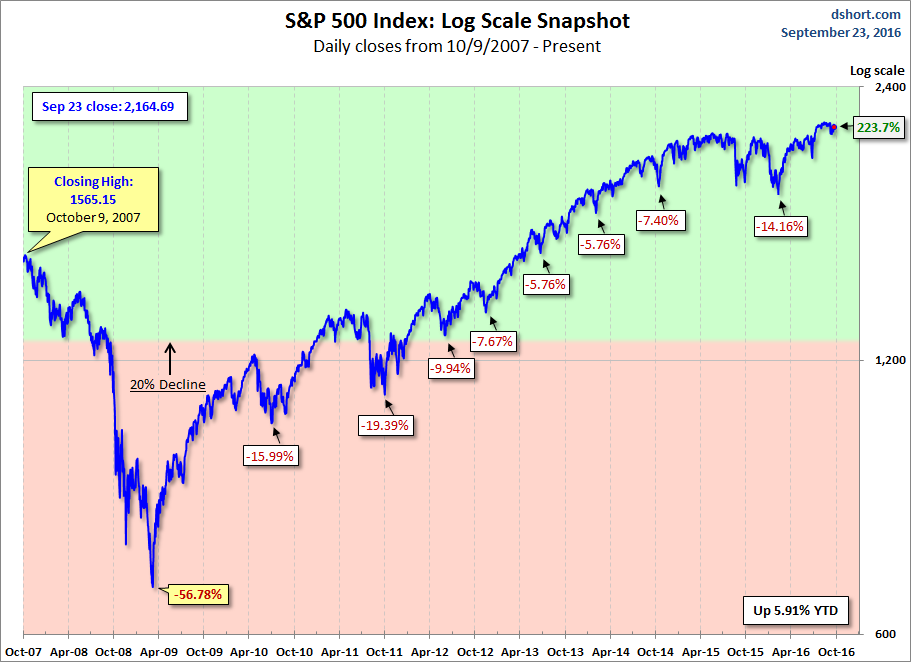

Here is a more conventional log-scale chart with drawdowns highlighted.

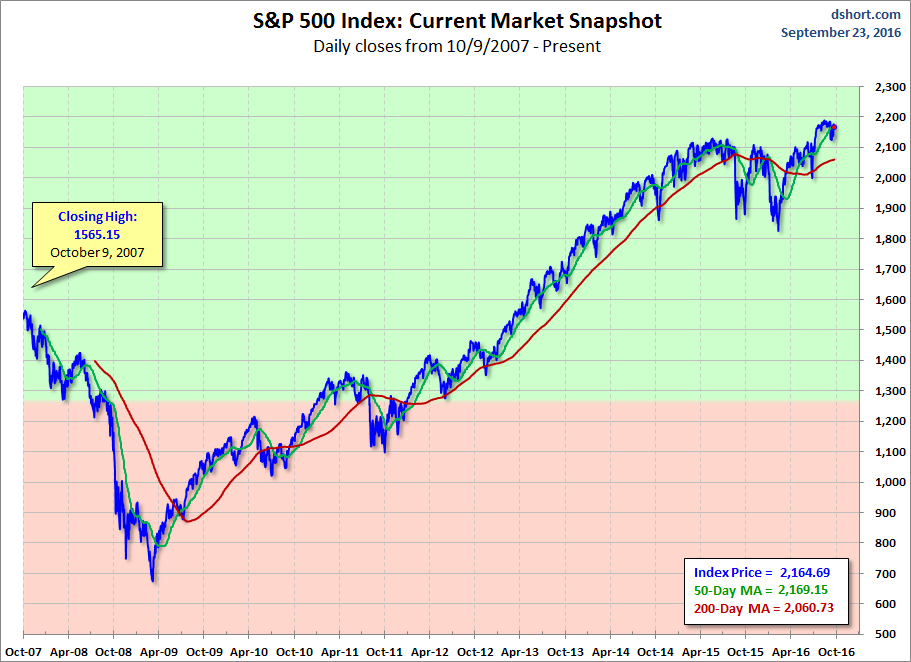

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

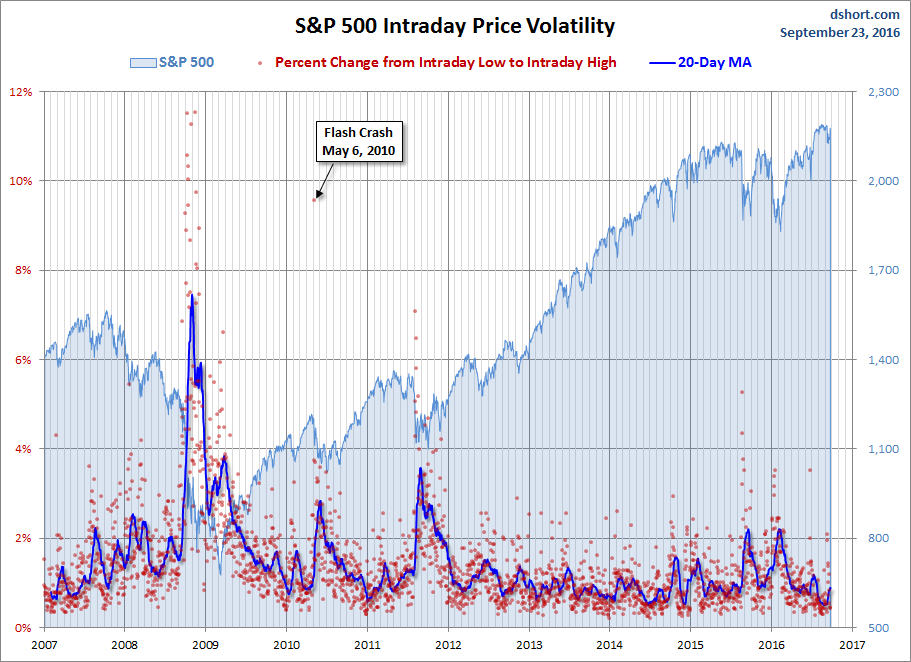

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.

Disclosure: None.

Thanks for sharing