S&P 500 Snapshot: Five-Day Rally Ends With A Fractional Loss

The Brussels terrorist attack had surprisingly little impact on equity markets. The Euro STOXX 50 traded in a relatively narrow range and closed with a fractional 0.08% gain. The S&P 500 opened in the shallow red and sold off to its -0.54% intraday low about 20 minutes later. The index then traded higher in a couple of waves to a narrow range for about two hours starting near the end of the lunch hour, at which point afternoon selling dropped the index to its fractional -0.09% closing loss, snapping a five-day rally that had produced a relatively 1.77% gain.

The yield on the 10-year note closed at 1.94%, up two basis points from the previous close.

Here is a snapshot of past five sessions in the S&P 500.

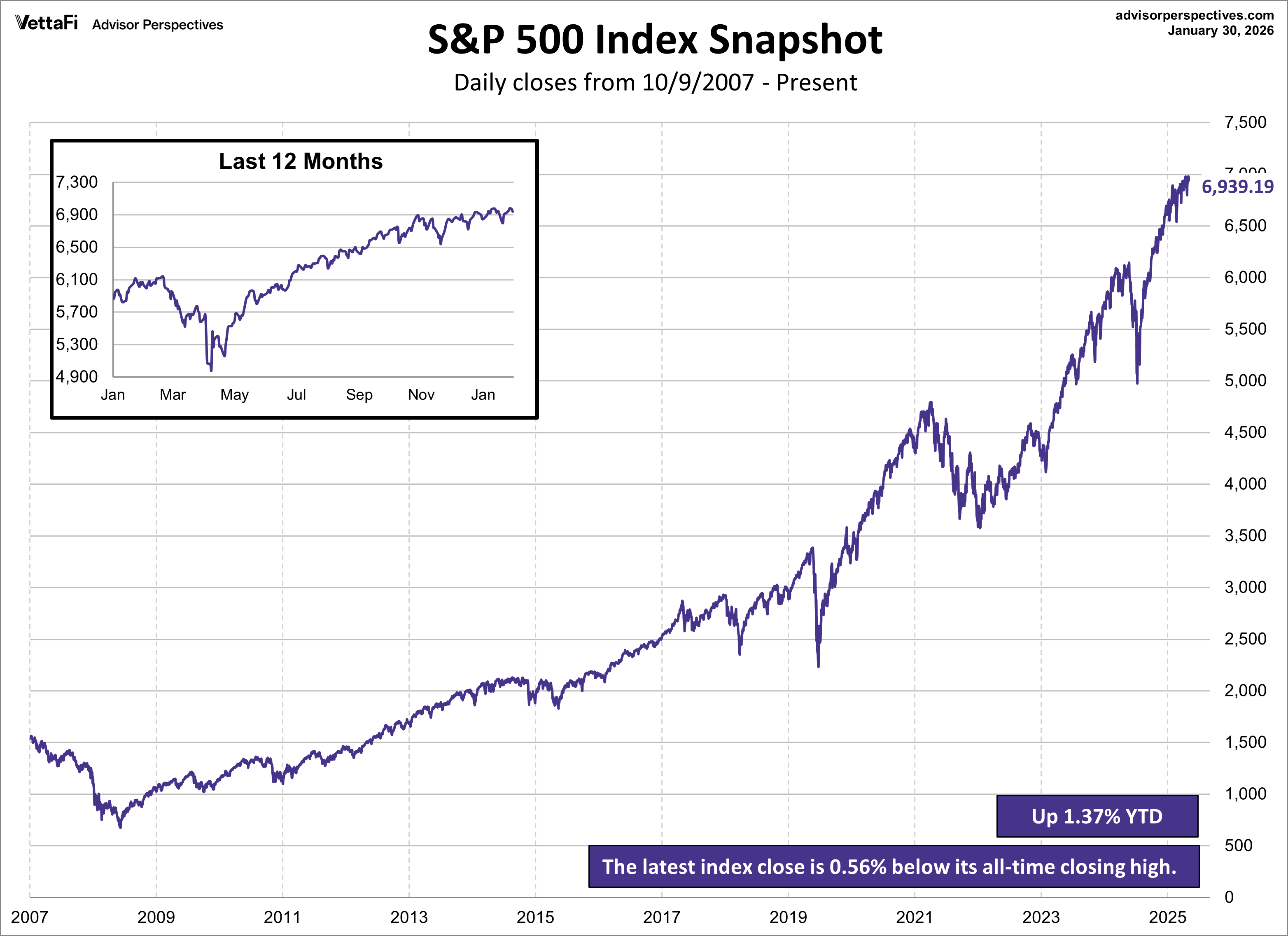

Here is a daily chart of the index. Volume was 35% below its 50-day moving average.

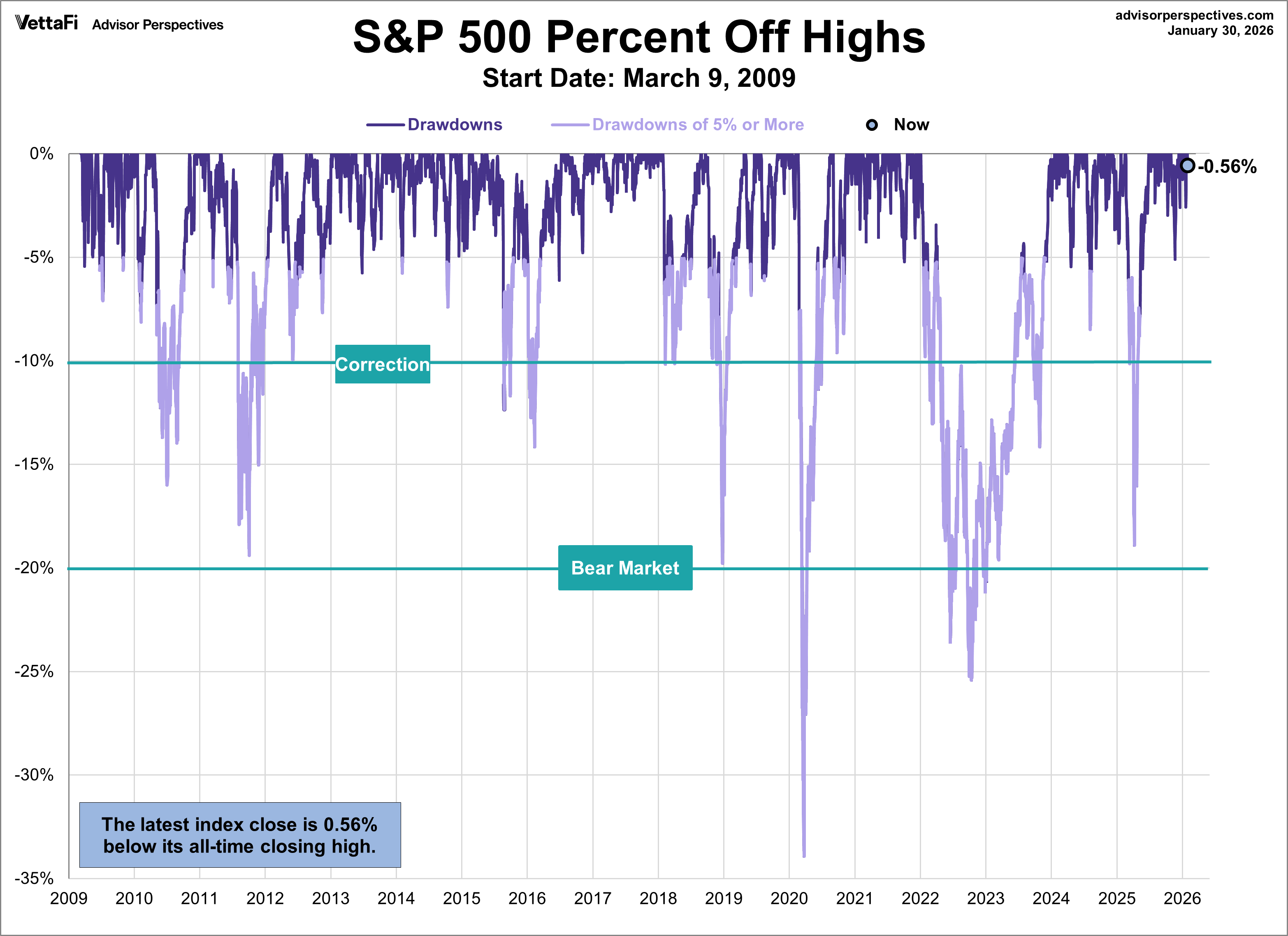

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

Here is a more conventional log-scale chart with drawdowns highlighted.

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.

Disclosure: None.

Sadly, terrorist attacks are becoming the norm. Unless an attack involves chemical, biological, or nuclear weapons, I don't think markets will react very strongly to future attacks. With the migrant crisis in Europe, it's almost a given that terrorists will make their way into the western world. If an increase in attacks on European soil threatens to increase the probability of Brexit, though, the S&P 500 (and others) will likely look a lot different in terms of losses.