S&P 500 Snapshot: Biggest Plunge Since June 24th

The historically unprecedented narrow trading range of the S&P 500 was snapped today by the biggest decline in 53 sessions. Today's closing loss of 2.45% was the largest since the 3.59% selloff on June 24th. Today's action essentially confirms the metaphor of an equity market infant nursing on mother Fed's breast. The selloff was triggered initially by hawkish remarks by the normally dovish Boston Fed President Eric Rosengren, a voting member of the FOMC. But more surprising was the announcement of an unannounced speech by even more dovish Lael Brainard at the open of the FOMC week, which runs counter to the general policy a silent Fed prior to the FOMC meeting end.

Interestingly, the yield on the 10-year note closed at at 1.67%, up six basis points from the previous close.

Here is a snapshot of past five sessions in the S&P 500.

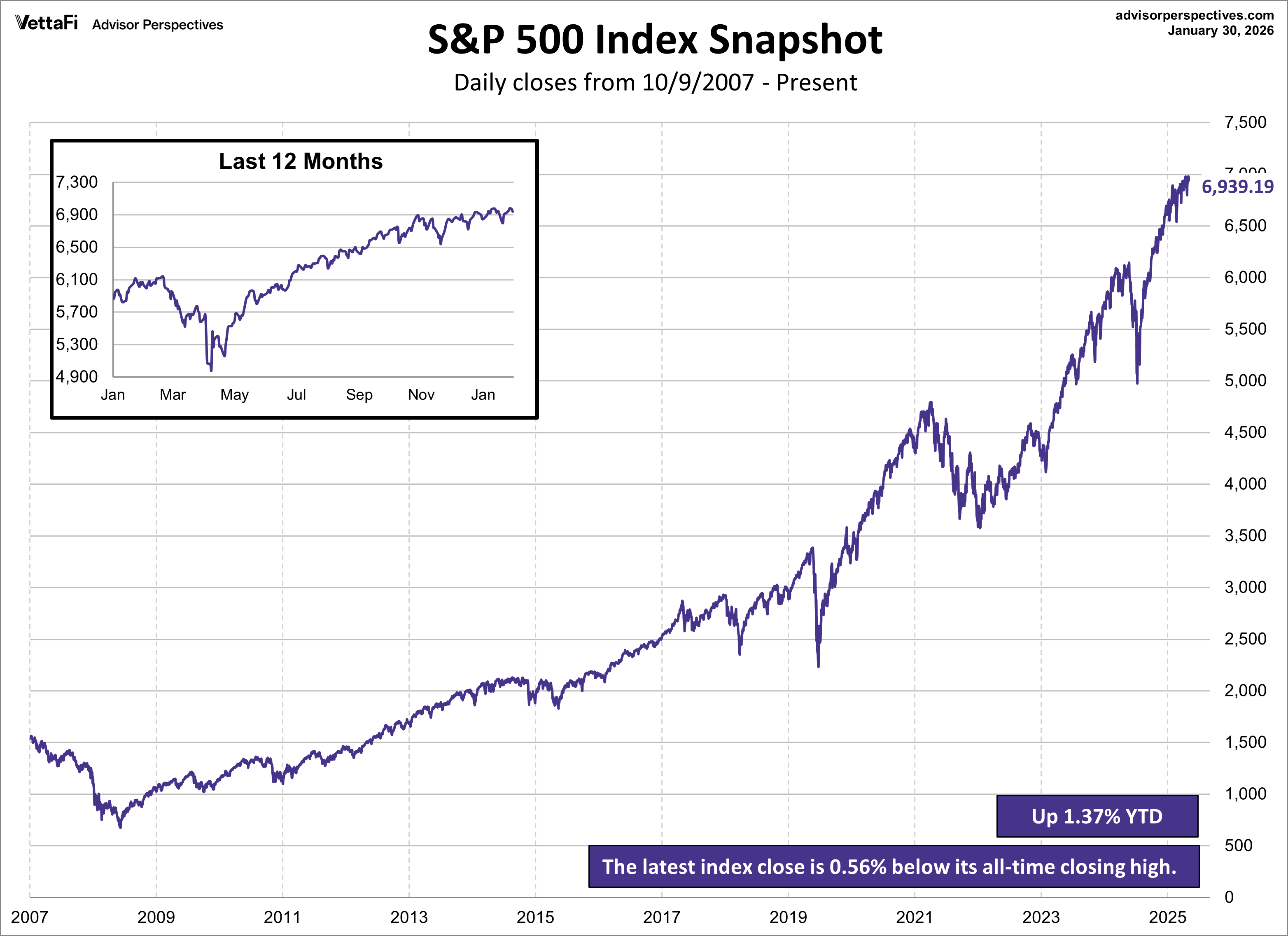

Here is daily chart of the index. Volume rose on today's decline but remains subdued by comparison to the two-day selloff in June. The index closed at its intraday low and is now below its 50-day moving average.

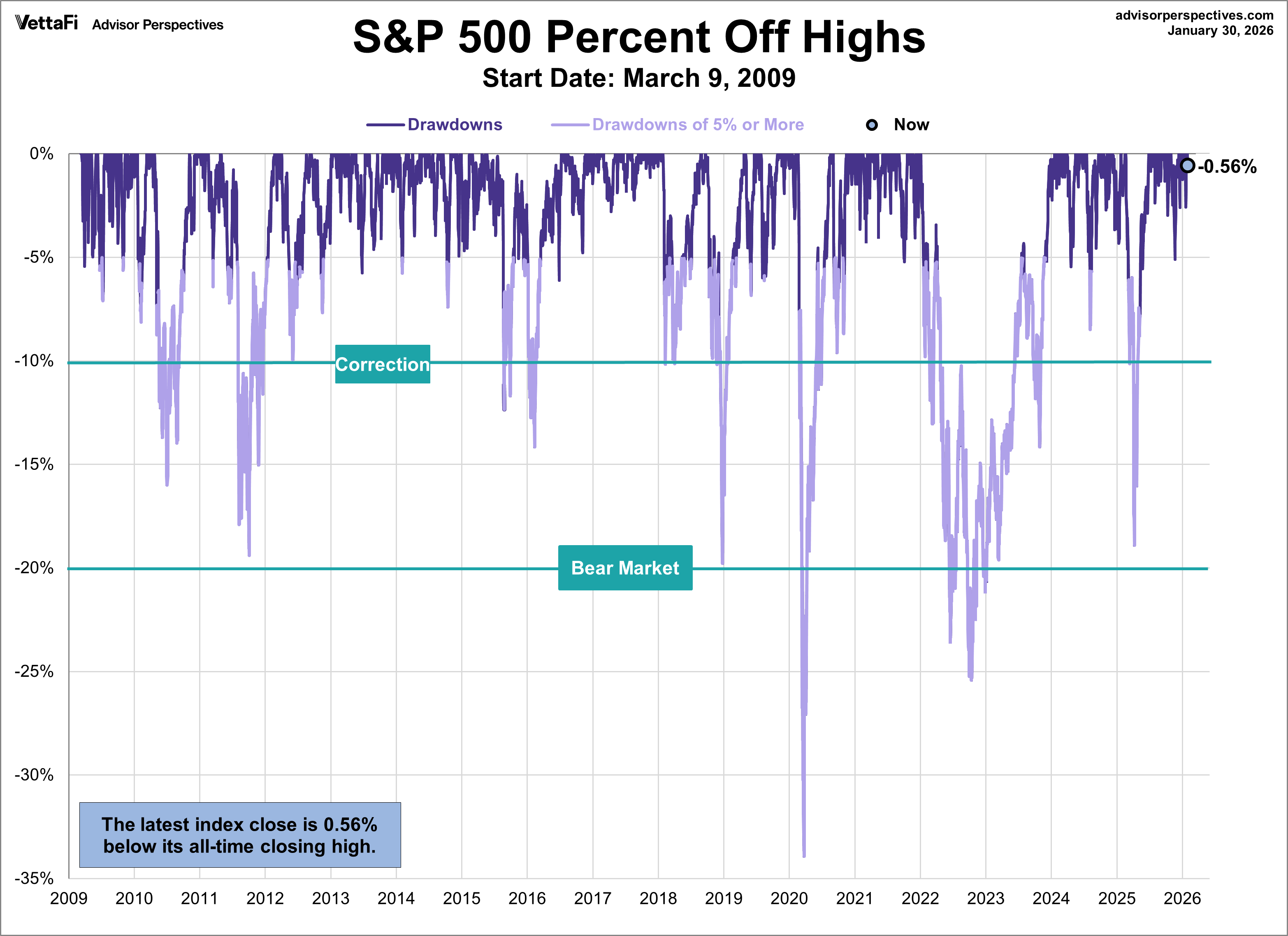

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

Here is a more conventional log-scale chart with drawdowns highlighted.

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.

Disclosure: none.

thanks for sharing