S&P 500 Snapshot: Another Modest Gain On Weak Investor Participation

With the FOMC minutes behind us, most major global indexes posted modest gains today (the Nikkei's -1.55% plunge being the notable exception). Our benchmark S&P 500 resumed the upward trend that began around noon yesterday to its late morning high, sold off into the shallow red during the lunch hour and then rose to its 0.22% closing high, just 0.01 points off the intraday high. Investor participation in today's advance was light.

The yield on the 10-year note dropped a three BPs to close at 1.53%.

Here is a snapshot of past five sessions in the S&P 500.

As for that comment about weak investor particpation ... a daily chart of the SPY ETF shows trading volume 46% below its 50-day moving average. Another interesting statistic for this ETF: So far this year, trading volume on positive closes has averaged 105.8M shares. On negative closes the volume has averaged 15.5% higher at 122.2M shares

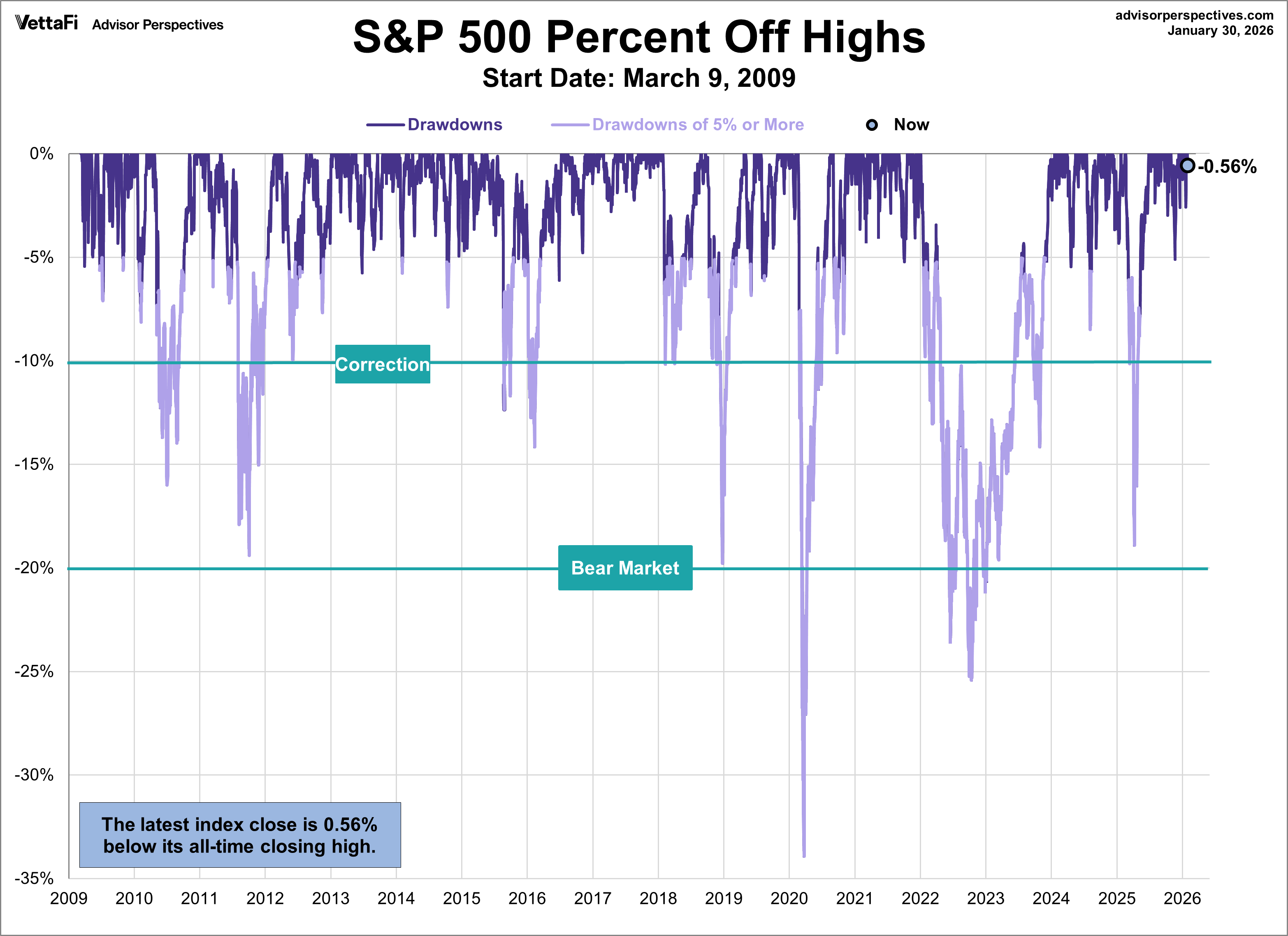

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

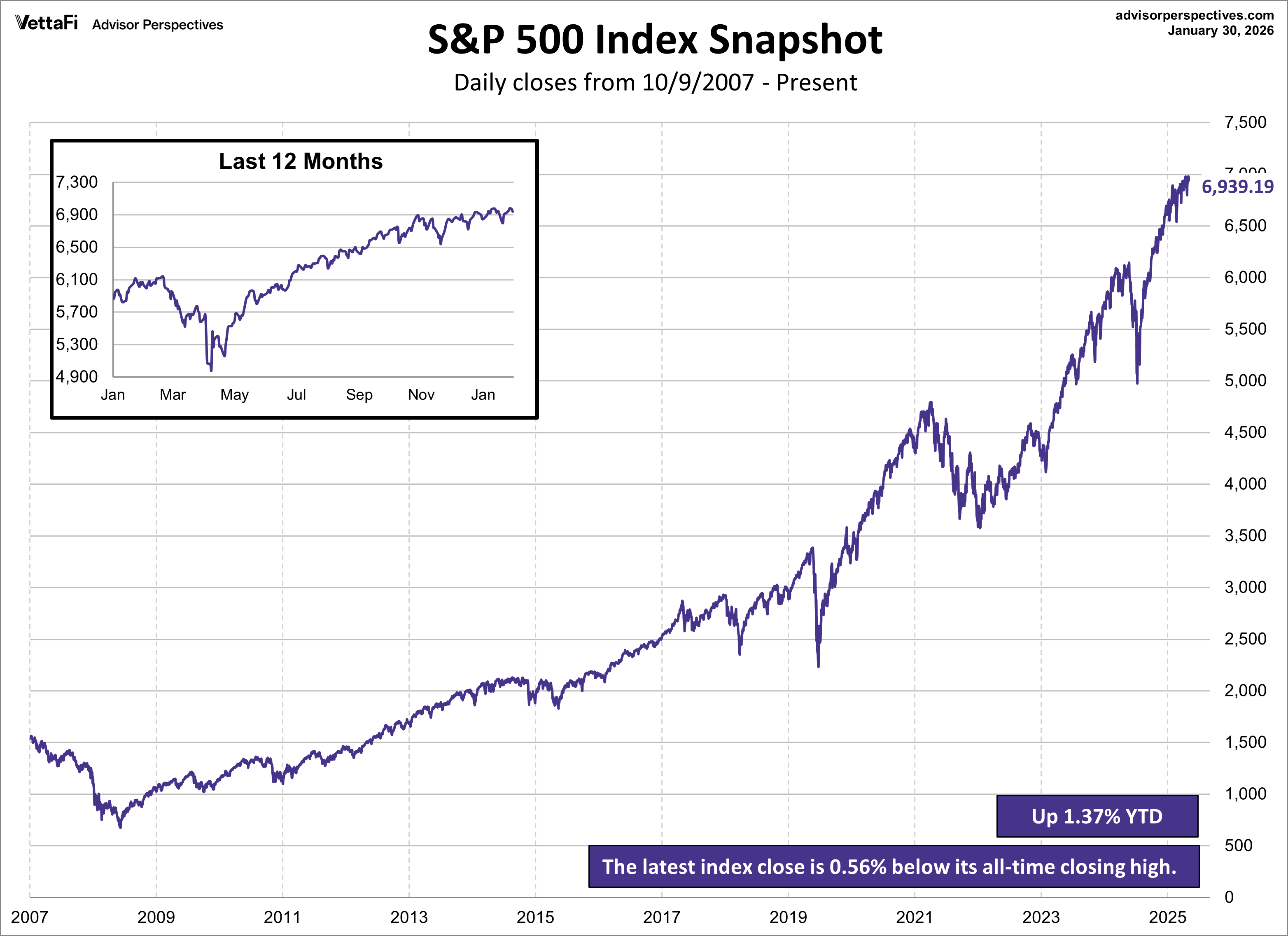

Here is a more conventional log-scale chart with drawdowns highlighted.

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.

Disclosure: None.

Thanks for sharing