S&P 500 Snapshot: 9.29% Bounceback

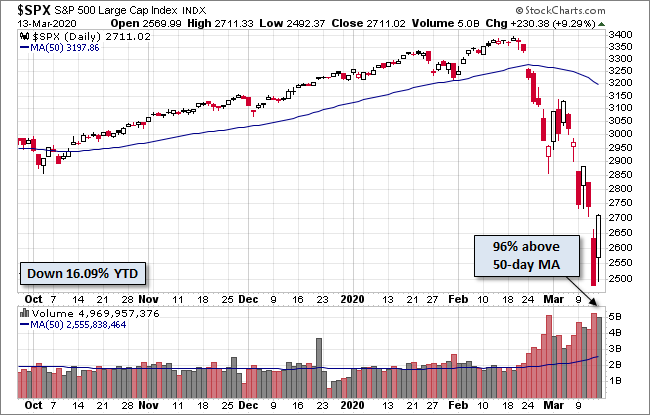

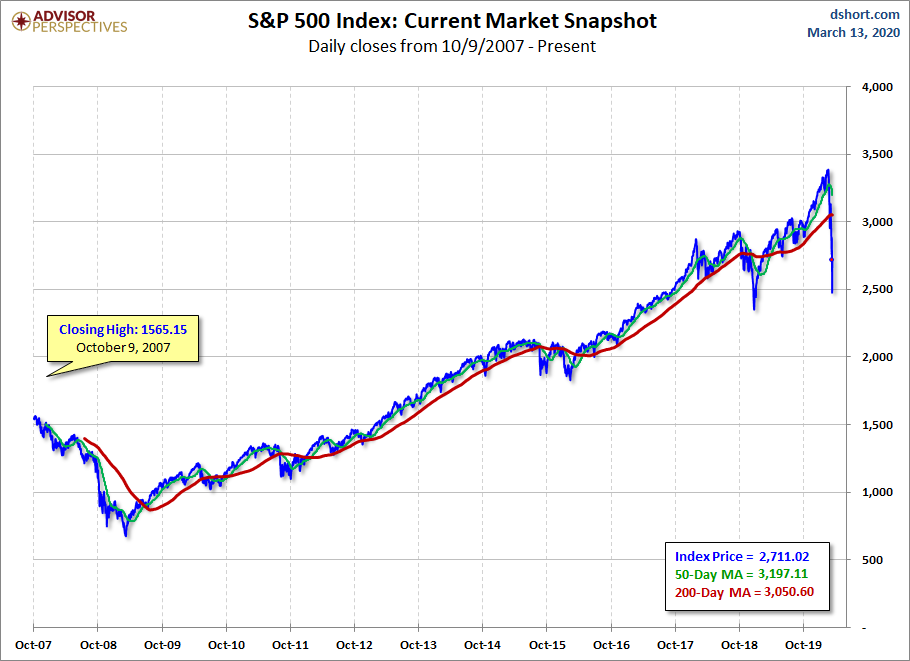

The S&P 500 bounced around Friday and ended with a rebound of 9.29%, bringing the index into non-bear territory again. It is down 16.09% YTD.

The U.S. Treasury puts the closing yield on the 10-year note at 0.94%, above its all-time low, which was on March 9. The two-year note is at 0.49%.

Here's a snapshot of the index going back to 2010.

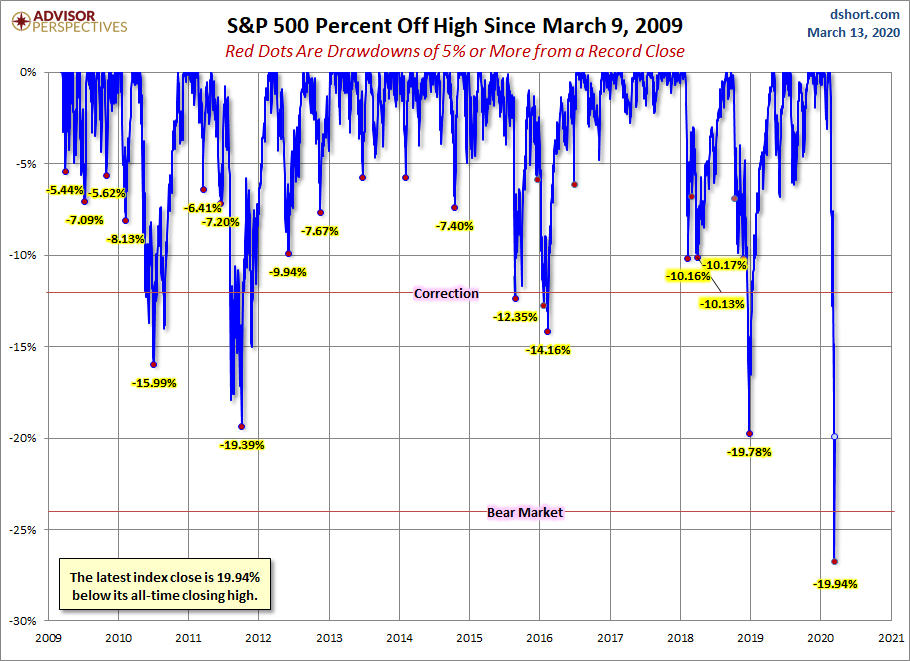

A Perspective on Drawdowns

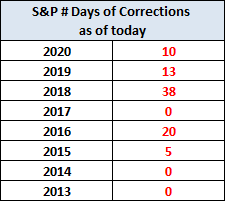

Here's a snapshot of record highs and selloffs since the 2009 trough.

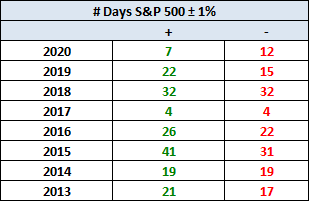

Here's a table with the number of days of a 1% or more change in either direction, and the number of days of corrections (down 10% or more from the record high) going back to 2013.

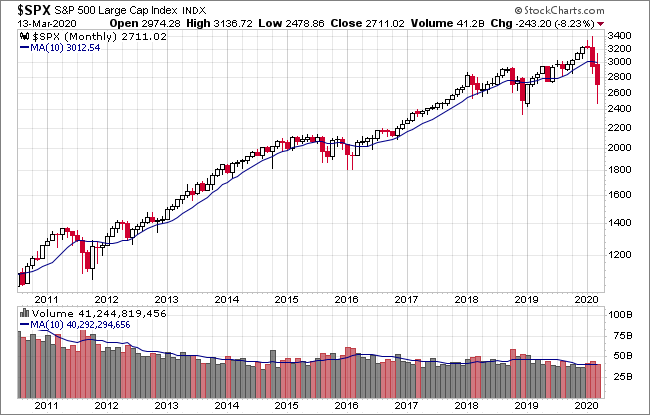

Here is a more conventional log-scale chart with drawdowns highlighted.

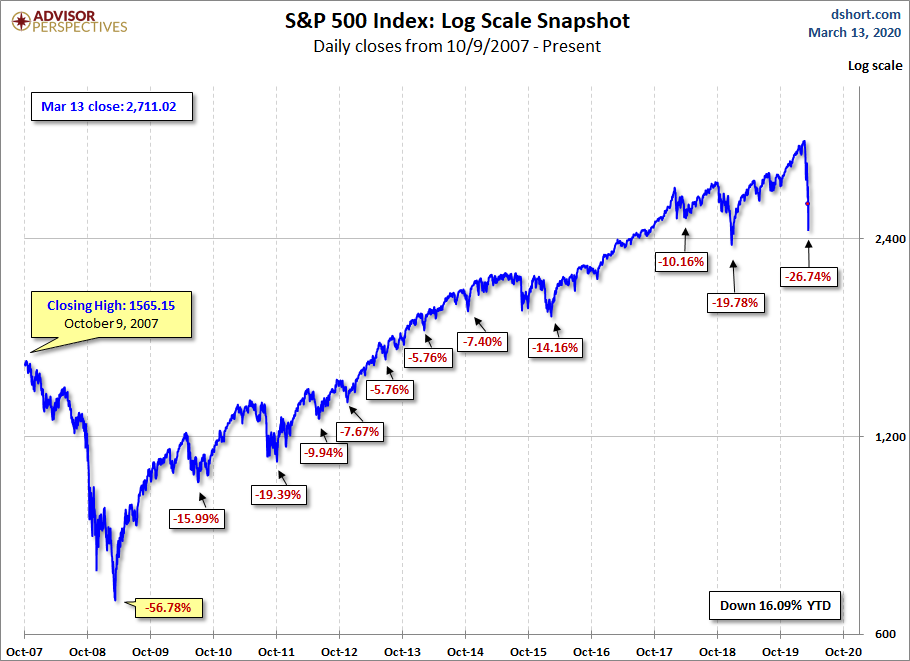

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

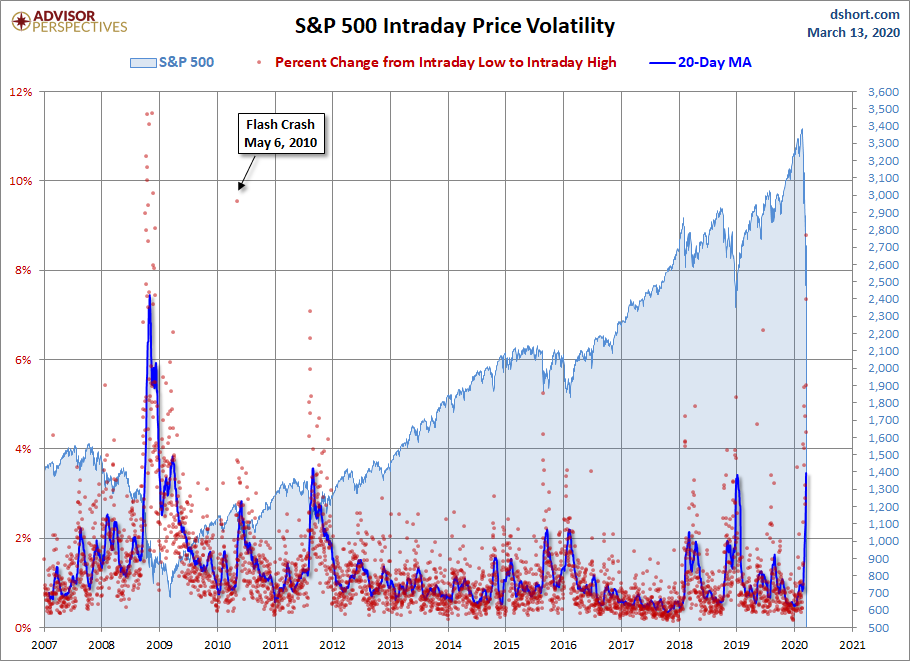

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.