S&P 500 Snapshot: 18 Days In Bear Territory

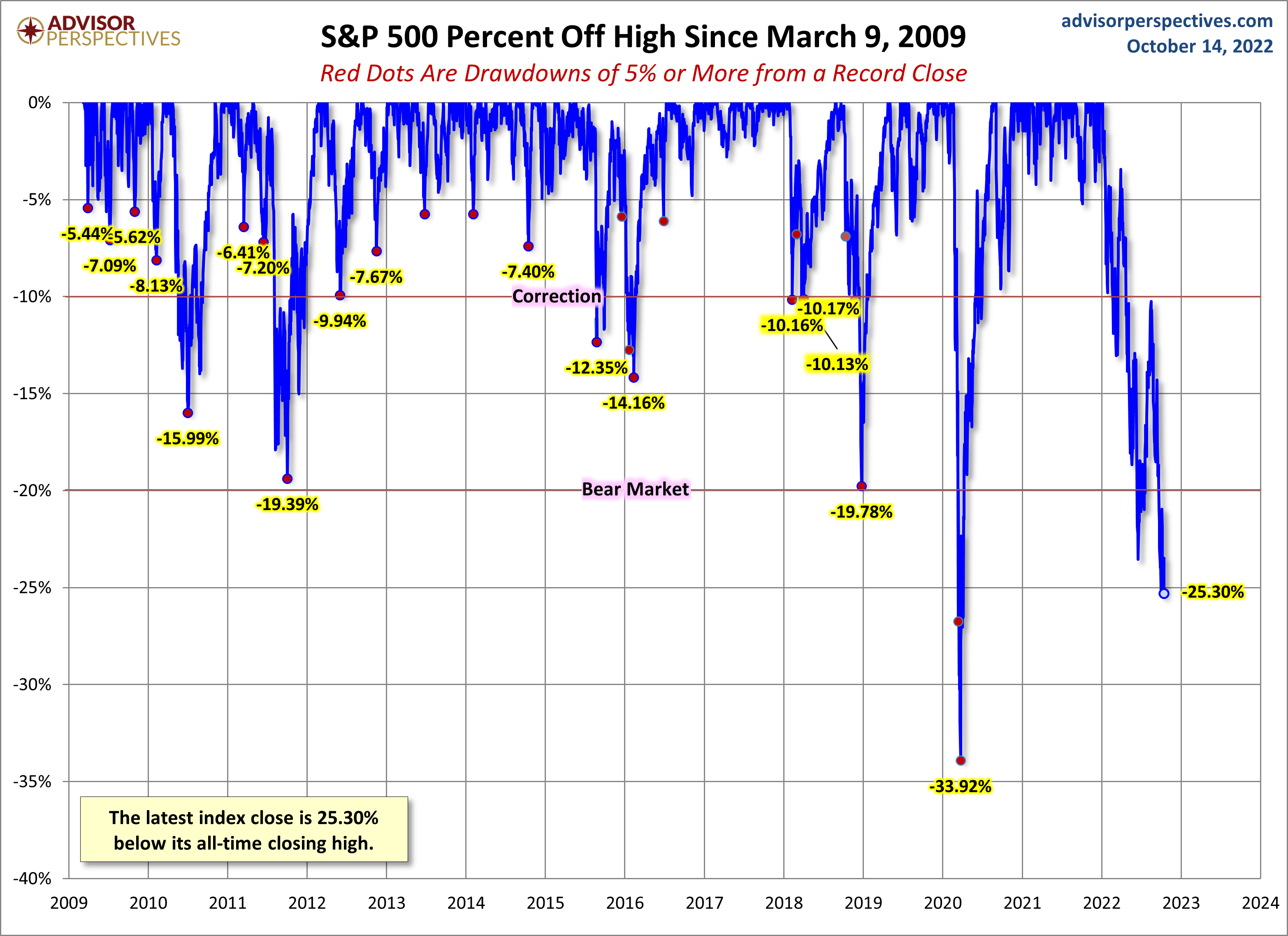

The S&P 500 is 25% below its record close and has closed in bear territory (more than 20% below its record close) for the last 18 consecutive business days. The index spent most of the week losing, closing Friday down 2.37% below Thursday's close.

(Click on image to enlarge)

The U.S. Treasury puts the closing yield on the 10-year note as of October 14 at 4.00% which is above its record low (0.52% on 8/4/2020). The 2-year note is at 4.48%. See our latest Treasury Snapshot here.

(Click on image to enlarge)

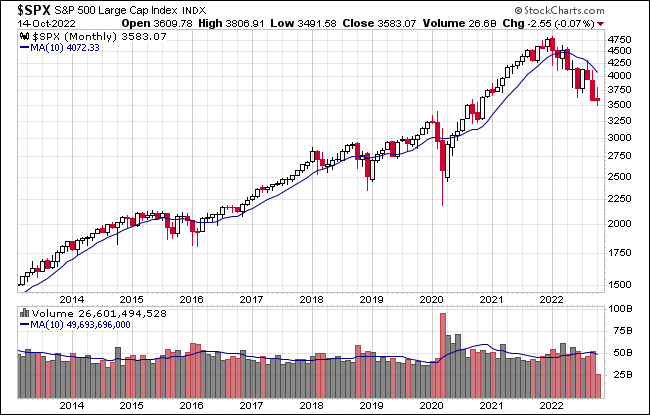

Here's a snapshot of the index going back to 2012.

(Click on image to enlarge)

A Perspective on Drawdowns

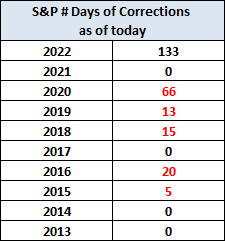

Here's a snapshot of record highs and selloffs since the 2009 trough. Note the recent selloffs in 2022.

(Click on image to enlarge)

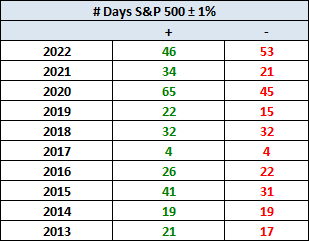

Here's a table with the number of days of a 1% or more change in either direction and the number of days of corrections (down 10% or more from the record high) going back to 2013.

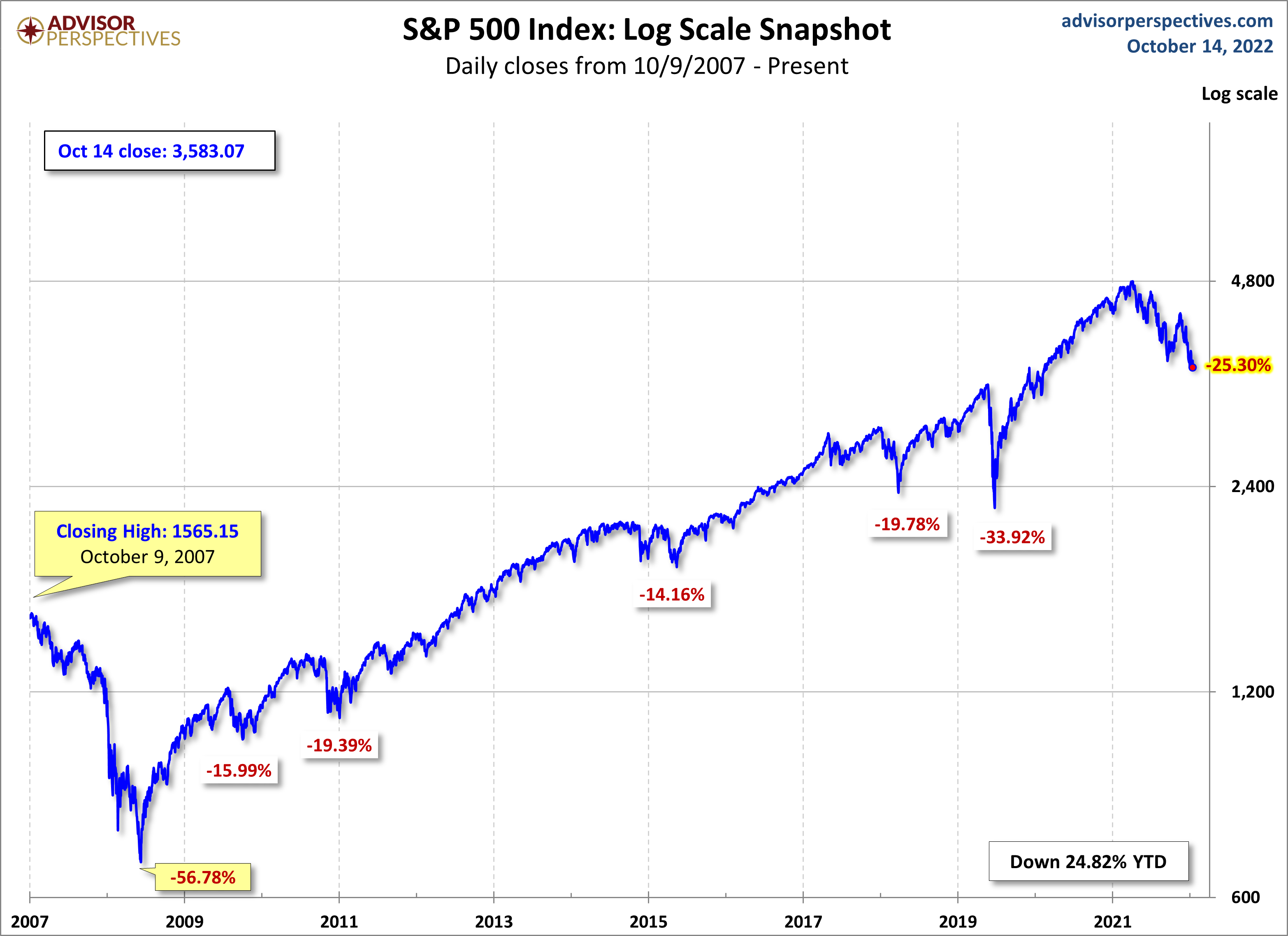

Here is a more conventional log-scale chart with drawdowns highlighted.

(Click on image to enlarge)

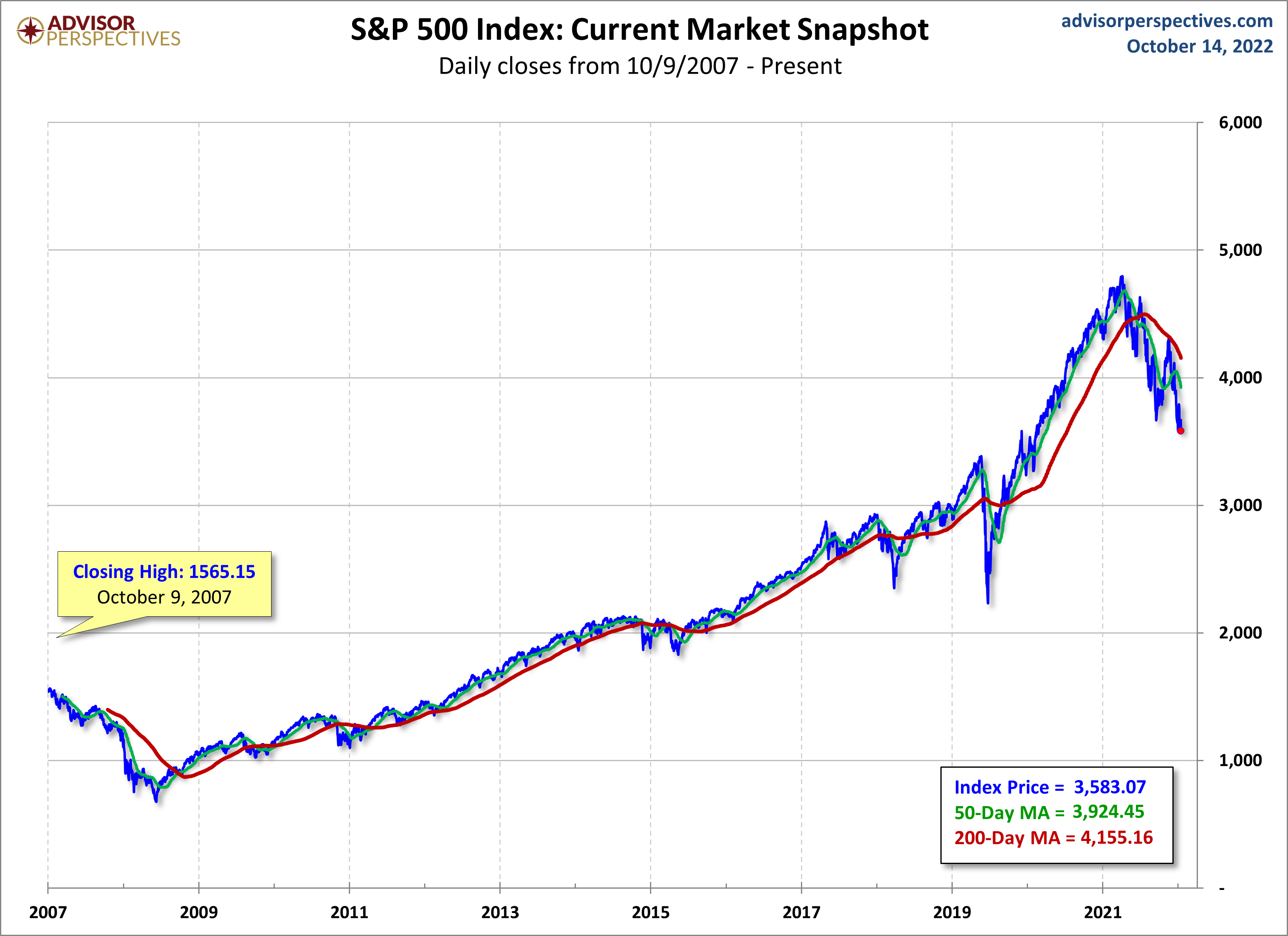

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

(Click on image to enlarge)

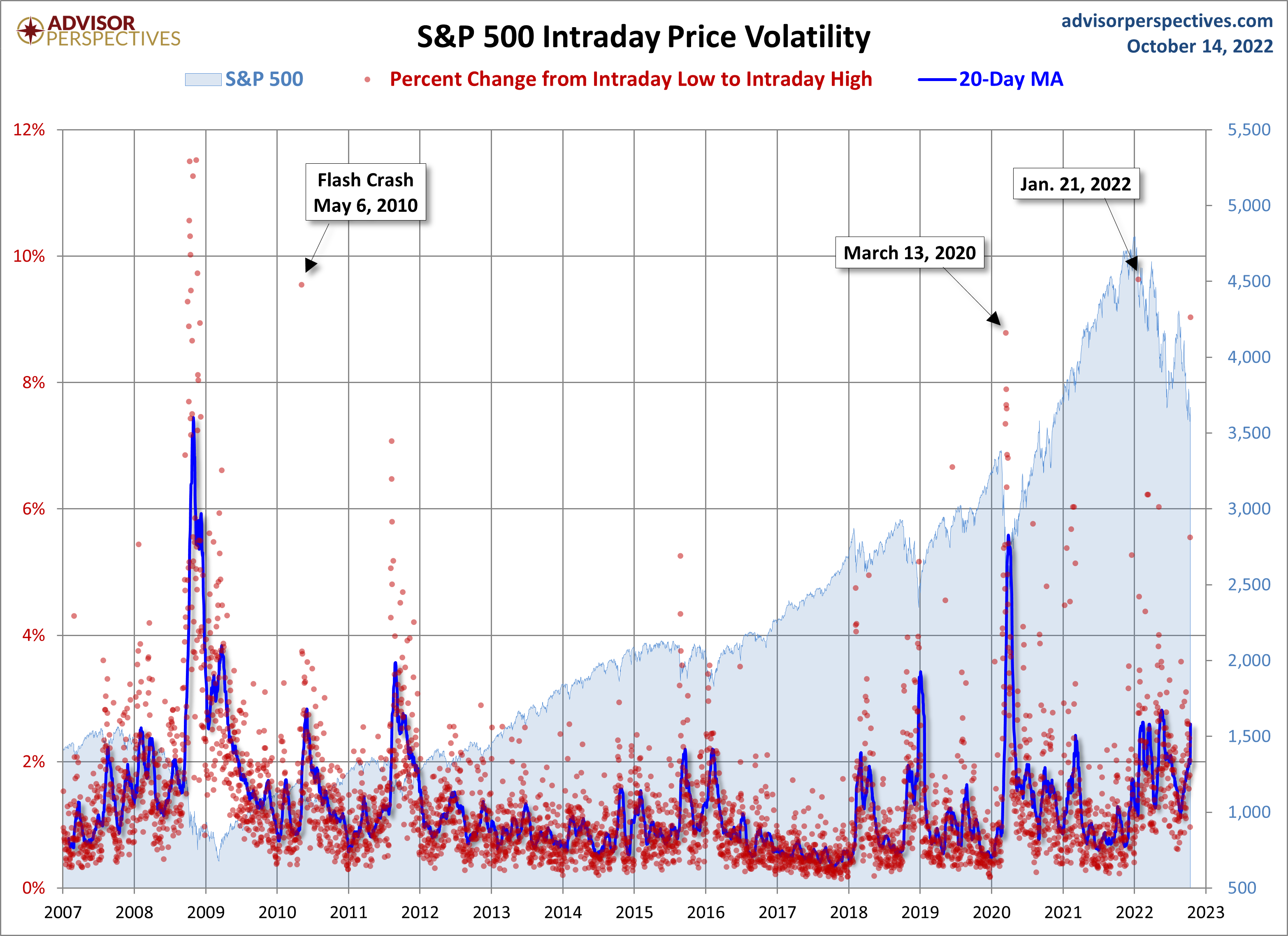

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.

(Click on image to enlarge)

More By This Author:

The Big Four: September Real Retail Sales Inches Down

Treasury Snapshot: 2-10 Spread At -0.48%

Michigan Consumer Sentiment Inches Up In October