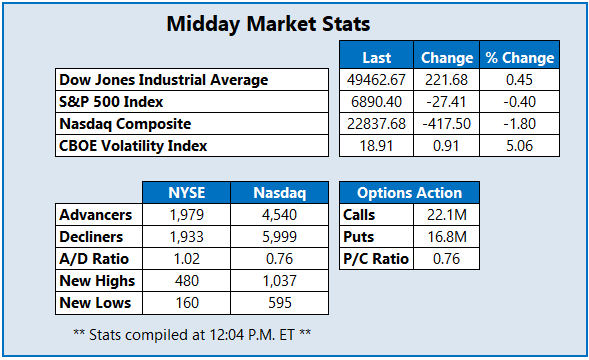

S&P 500 Slips, Nasdaq Drops As Traders Dump Chips

The S&P 500 is heading for its fifth loss in the last six sessions, as investors continue to rotate out of tech and weigh the latest labor market reading. The Nasdaq has breached 23,000, as chipmakers take a hit -- Advanced Micro Devices (AMD) is down over 15% after its weak forecast, dragging sector peers Broadcom (AVGO) and Micron (MU) lower. Despite the tech shuffle, the Dow is up 221 points, powered by strength in blue-chip consumer staples.

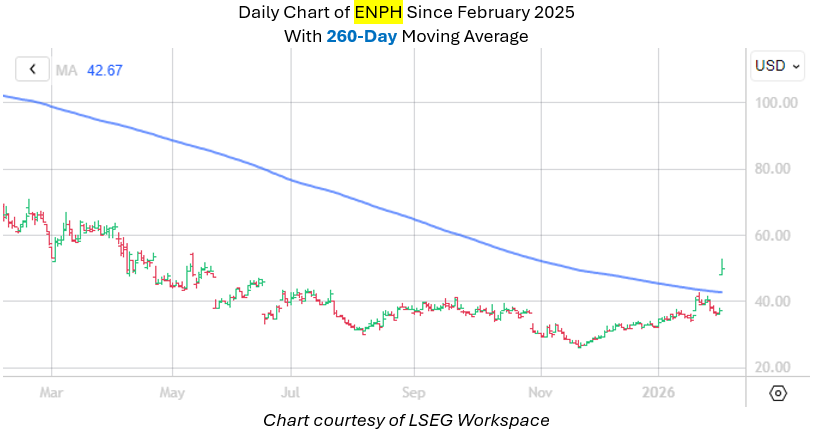

Options traders are piling into Enphase Energy Inc (Nasdaq: ENPH). At last look, over 81,000 calls have been exchanged today -- nine times the average intraday amount. The February 40 call is most popular, while new positions are opening up at the weekly 2/6 50-strike call. At last glance, shares are up 36.9% to trade at $51.02, and are 98.3% higher since its November lows.

(Click on image to enlarge)

Silicon Laboratories Inc (Nasdaq: SLAB) is among the top performers on the Nasdaq today after agreeing to a $7.5 billion buyout proposed by Texas Instruments (TXN) . At last check, the stock was up a whopping 49.3% to trade at $204.03, marking its best daily pop ever, after earlier hitting a three year high of $207.49.

AppLovin Corp (Nasdaq: APP) is one of worst stocks on the Nasdaq today as software stocks got caught in another selloff wave triggered by increasing AI competition. Shares were last seen off 15.8% at $388.98, and earlier tapped its lowest level since Aug. 6. Shares are down 41.1% for the year.

More By This Author:

Dow, Nasdaq Shed Triple Digits As Investors Rotate Out Of TechDow's Early Record Fades As Tech Turns South

Dow Surges As Traders Brush Off Bitcoin, Metals Meltdown