S&P 500 Recovery, Goldman Sachs, Bank Of America Earnings

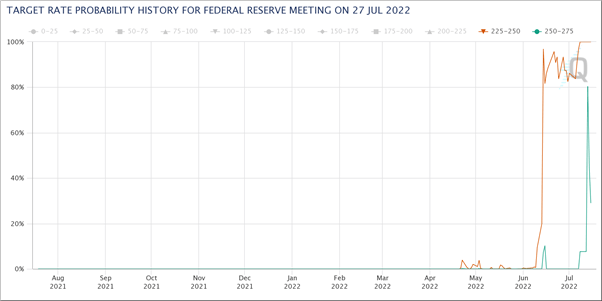

Despite volatile FX action with the USD breaking out to fresh record highs and US inflation rising to a whopping 9.1%, prompting markets to shift towards a 100bps hike Fed hawks maintain the view that 75bps is the base case, which helped equity markets close out last week on a firmer note, halving their weekly losses.

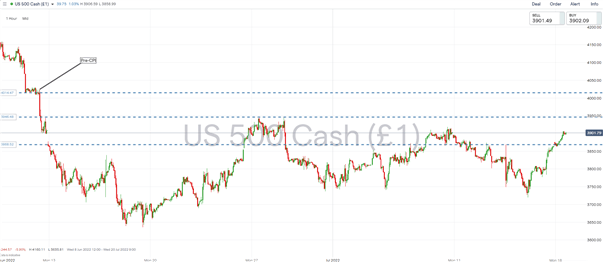

This is quite noteworthy that equities have taken the recent news in its stride. That said, as I have stated previously, the bias remains to fade bear market rallies. This week sees a slew of major risk events from Europe, notably the Nord Stream decision, as well as the ECB meeting, where the focus is firmly fixed on the Anti-fragmentation tool. S&P 500 topside resistance is situated at 3945-50 and 4015 ahead.

Probability of a 100bps Hike Falls to 30%

Source: CME

S&P 500 Chart: Hourly Time Frame

Source: Refinitiv

BAC Q2 Results

- EPS $0.73 vs Exp. 0.75

- Revenue $22.79bln vs Exp. 22.86bln

- Trading Revenue $4.00bln vs Exp. 4.01bln

- IB Revenue $1.13bln vs Exp. 1.31bln

BAC shares are down 0.3% pre-market at the time of writing

GS Q2 Results

- EPS $7.73 vs Exp. 6.65

- Revenue $11.86bln vs Exp. 10.67bln

- Trading Revenue $6.47bln vs Exp. 5.82bln

- IB Revenue $1.79bln vs Exp. 1.88bln

GS shares are up 3% pre-market at the time of writing

More By This Author:

Defining Week For The Euro: ECB Lift-Off, CPI And Bond Market JittersCrude Oil Update: Brent Propped Up By Uneventful Biden Trip And Uncertainty Around Nord Stream

AUD/USD At Key Technical Level As APAC Trading Kicks Off

Disclosure: See the full disclosure for DailyFX here.