S&P 500 Outlook Still Bullish Ahead Of The Fed’s Jackson Hole Speech

S&P 500 reached new all-time highs this week. Investors have bought every single dip to the bears’ frustration. With two days to go until the Fed’s Powell speech at the Jackson Hole Symposium, the index remains bullish.

Volatility declined significantly during the Jackson Hole Symposium week – as expected. Because the event is scheduled for the last two days of the week, investors prefer to stay put until the main speech, which will take place late on Friday.

All eyes are on the Fed’s message, and there are risks for both bulls and bears. On the one hand, the main topic is the tapering of asset purchases. If the Fed mentions anything about the tapering’s schedule, stocks are at risk of a correction.

On the other hand, the Fed may deliver a dovish surprise on the economic front. The Delta variant poses risks that were not assessed by the Fed at the last meeting. If that is the case, more stimulus is needed, thus, impacting the stocks.

Without much volatility, stocks hover around the highs. This is typical summer trading market behavior, with the prices rising on nothing at all and volatility reaching extremely low levels.

The relentless move higher in the U.S. equity markets has triggered similar behavior in the developed world. European equities are close to their records, with the Dax index in Germany leading the way. The FTSE 100 outlook remains bullish as well, with many investors looking at the U.K. stocks as undervalued compared to their peers.

Commodities are mixed – oil is up, back above $67, and threatening to break above $70 again, while gold was rejected from $1,800 once again.

The currency market is in hibernation as investors await the Fed’s message. Nevertheless, the U.S. dollar remains offered, further supporting the risk-on environment.

Economic Events to Consider Today

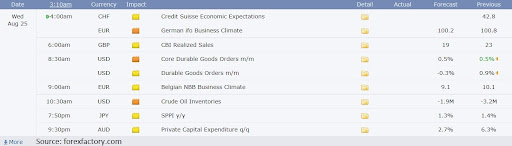

The day ahead will likely bring more of the same in terms of volatility and markets’ direction. In Europe, the Germany IFO Business Climate is expected at 100.2 compared to 100.8 in the previous month. In the United States, the core durable goods orders are expected to rise by 0.5%, just like the previous month.

Today’s Markets to Watch

Today’s markets to watch are S&P500, Salesforce, and the Royal Bank of Canada.

S&P 500

The bullish outlook for the S&P 500 index continues. Investors have bought every single dip during the summer months, so the index enters the Jackson Hole event consolidating against all-time highs.

Salesforce

Salesforce is about to release its quarterly earnings today. The market broke higher out of an ascending triangle just before the earnings, so the bias remains bullish here as well. Judging by the price action, Salesforce would rather attempt to make a new all-time high than correct.

Royal Bank of Canada

The stock market’s bullishness is even more reflected by the Royal Bank of Canada’s chart. The stock price is literally in a bullish trend since the 2020 dip, entering the quarterly earnings at the highs. As such, the bias remains unchanged as long as the price action remains in the rising channel.

Winners and Losers

U.S. equities remain strong, supported by a weak U.S. dollar.

Disclaimer: None of the content in this article should be viewed as investment advice or a recommendation to buy or sell. Past performance/statistics may not necessarily reflect future ...

more