S&P 500 Forecast: Pulling Back And Finding Value Hunters

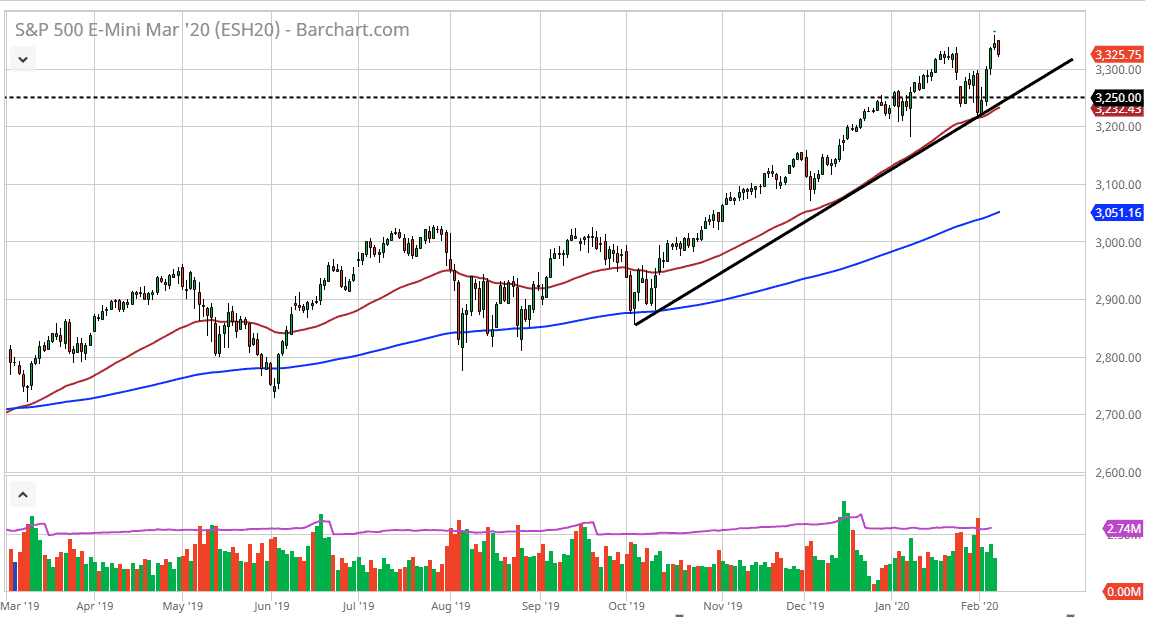

The S&P 500 has pulled back a bit during the trading session on Friday as the jobs numbers came out, but the market may have been a little overextended. That being said, the market is still very much in an uptrend and shorting the US indices has been tantamount to financial suicide for what seems like ages. At this point, the 50 day EMA is climbing right along with the uptrend line, and therefore it’s likely that the buyers will return on a pullback.

The 3300 level is, of course, a large, round, psychologically significant figure, and the top of a gap of two weeks ago. That being said, it could be an area where we could have buyers. However, if we break down below there it’s likely that the market will probably find plenty of support at the uptrend line which would coincide roughly with 3250 at the moment. We don’t have any signs of breaking down, although the Friday session has been a bit negative. The entire week itself was very bullish and the fact that we have made a fresh, new high tells the story more than anything else.

Earnings season will start to focus on tech companies next week, so there’s probably going to be more or less quite a bit of attention paid to the NASDAQ 100, but in the short term, it looks as if earnings season has been reasonably well for American companies. Looking at this chart, I think that dip is coming but it’s probably going to be short-lived at best, most dips in this market have been rather short as of late. The market breaking through this trend line would be significant, but I still think there are plenty of places underneath it that would hold plenty of buyers' interest. For example, the 3200 level would be an initial area of buying, followed by the 3100 level which would probably coincide with the 200 day EMA. In other words, I don’t have any interest in shorting this market anytime soon but will let you know if things change in my mind. The fundamentals line up quite nicely for stock markets, as Federal Reserve liquidity is almost assured, and the bond markets don’t offer any type of yield at this point, so money flows into stock markets by default. Beyond that, the US indices offer safety from other indices around the world.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more