SP 500 Forecast: Plunges After Consumer Price Index Surprise

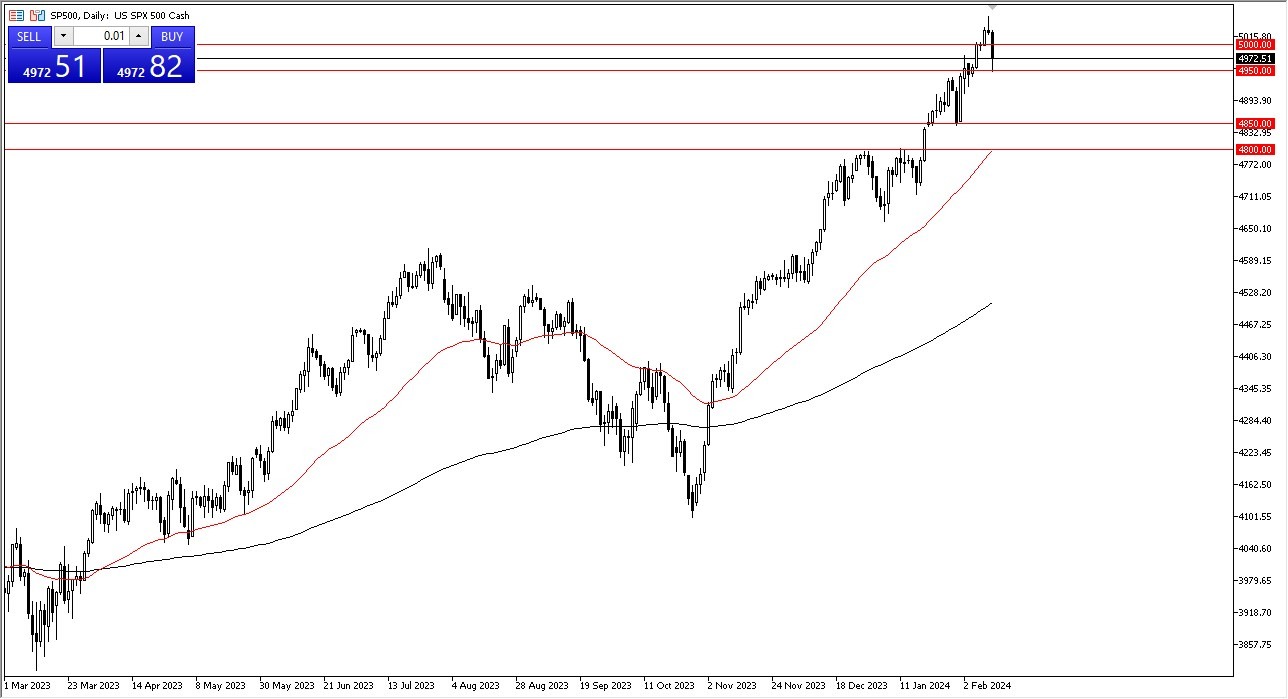

- The S&P 500 fell rather hard during the trading session on Tuesday, reaching down to the crucial 4950 level.

- This is an area that previously had been resistant, so it does make a certain amount of sense that it is offered support.

- The Consumer Price Index came out hotter than anticipated during the trading session, so I think it does make a certain amount of since the traders freaked out on the idea that perhaps the Federal Reserve won’t loosen monetary policy as quickly as they once thought.

Federal Reserve

The entire basis of the stock market these days is whether or not the Federal Reserve is going to loosen monetary policy. That’s been the case since the Great Financial Crisis 14 years ago, as traders have been trained to simply pay attention to Federal Reserve interest rate policy. As long as monetary policy is loose, the stock market does fairly well. After all, most traders now have never known what it’s like to trade in an inflationary environment, so we should continue to see a lot of schizophrenic behavior.

At this point, if we were to break down below the 4950 level, then we could have the market dropped down to the 4850 level, which is an area that has been significant support previously. The 50-Day EMA is hanging around the 4800 level, which was the previous resistance. The 50-Day EMA is an area that a lot of people will be paying attention to in order to determine the overall strength of the trend. The market is more likely than not to continue to be very noisy, but I do think that longer term we will have plenty of value hunters coming back into this market.

In general, this candlestick is rather negative, but I think if you have the opportunity to take advantage of “cheap contracts”, you probably should as the market has been so noisy, but it’s also been very bullish and I think that will continue to be the case going forward as traders around the world will be looking at this through the prism of trying to find cheap stocks in the United States. After all, there are a handful of stocks that drive the overall index, so keep an eye on the “magnificent 7” going forward as per usual.

More By This Author:

Silver Forecast: Plunges After Surprise CPI Reading In America

Silver Forecast: Continues To Trade In A Range

GBP/USD Forecast: British Pound Continues To Hover Around The 50-Day EMA

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more

The Markets recovered quiet a bit already.