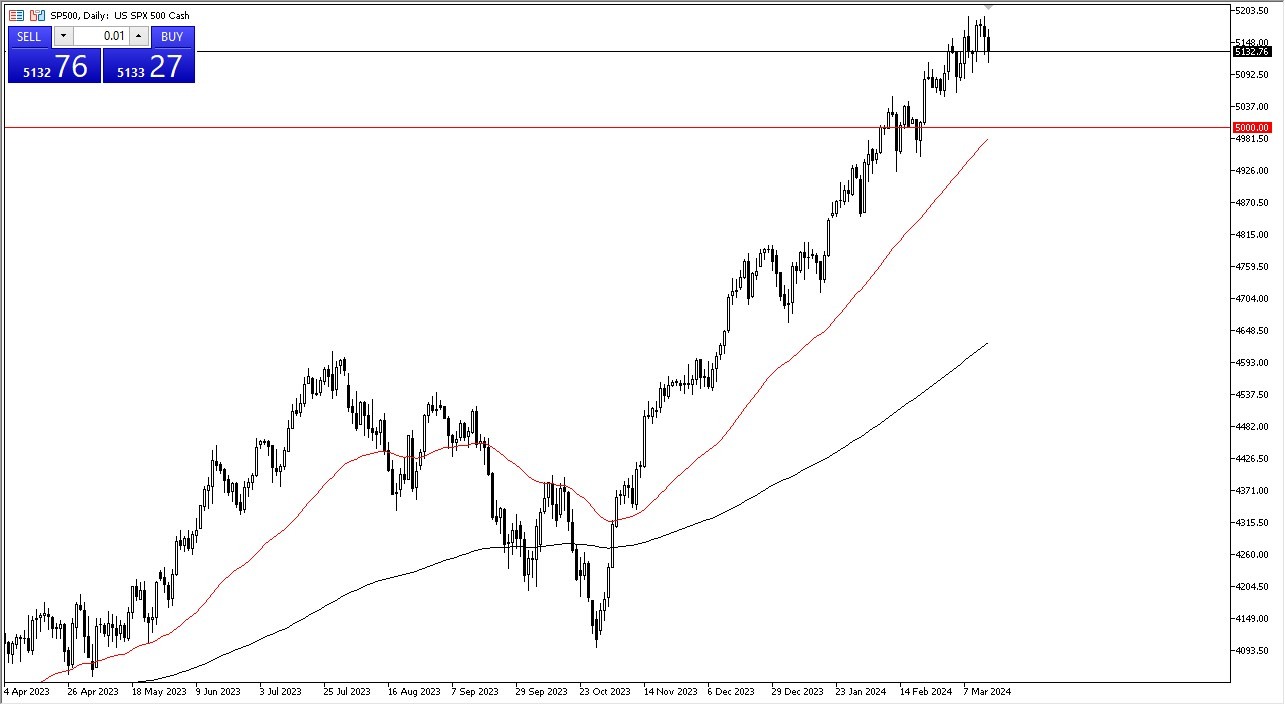

S&P 500 Forecast: Buy-On-Dip Strategy Prevails

- The S&P 500 initially fell pretty hard during the trading session on Friday.

- But later in the day, we have seen buyers come back in to try to pick things up. That might have been European panic.

- It may have been just the big sell order that triggered a bunch of algorithmic trading, we just don't know. But at this point we are in an uptrend and that has not changed.

Regardless, I think this ends up being a buy on the dip type of opportunity, and as long as we are above the 5000 level, I just don't see how you can be bearish of the S&P 500. And even if we did break down below the 5000 level, I don't know, that's the signal to start shorting either.

Technical Analysis for the S&P 500

The 50 day EMA is near the 5000 level and that of course attracts a certain amount of attention in and of itself. So, I think that's an area where traders might be attracted to the levels above. We have the 5200 level, which of course is a large round figure that a lot of people will be paying attention to. If we can break above the 5200 level, then I think you've got a real shot at whipping to the upside, which is something that the market is known to do.

Keep in mind that there's just a handful of stocks that drive the S&P 500. So as long as the Magnificent Seven or the Magnificent Four or five or whatever it is this week is doing well, the S&P 500 will go higher. In general, we continue to see more of a buy on the dip mentality in this channel. And the channel is still very much intact, despite the fact that Friday opened up so badly. Ultimately, I do think that we go higher and I'm just looking for bounces to take advantage of. I have no interest in shorting this market. This is a market that is obviously in a bit of a feedback loop, and therefore you cannot fight it any time soon.

More By This Author:

GBP/USD Forecast: Pulls Back to Test Crucial AreaPairs in Focus - Nasdaq 100, USD/JPY, USD/CAD, Bitcoin, EUR/USD, AUD/USD, Crude Oil, Silver

AUD/USD Forecast: Aussie Continues To Grind Away