S&P 500 Bullish Wave Ongoing

S&P 500 held support level and passed EMA 20, EMA 50. A reasonable target of this move should be the resistance at the previous high at 3580, where likely it should meet a substantial amount of sell orders. Whereas before the upward move was led by Technology Sector (XLK), now the short term leading sectors are Industrial (XLI) and Financial (XLF).

(Click on image to enlarge)

In particular, the Financial Stock sector was one of the most depressed since March but now, profiting from an increase in Bond Yields, finally has exceeded EMA 200 days, showing that a possible major uptrend is about to come.

(Click on image to enlarge)

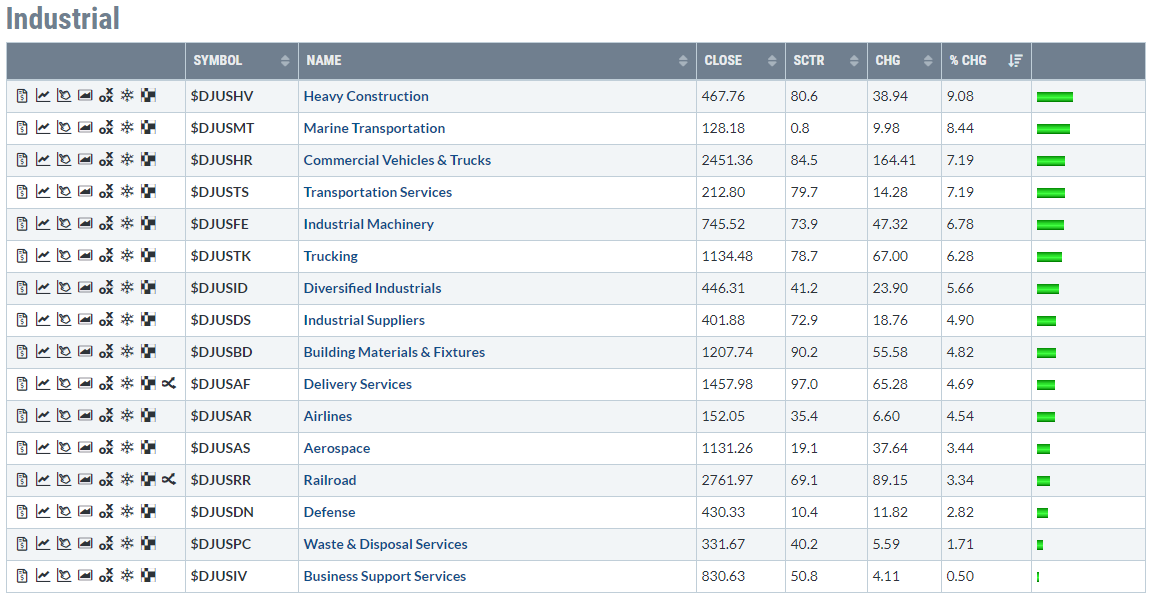

Regarding Industrial Stocks, this sector is showing great momentum, led by Heavy Construction and Transportation Industry (Marine, Trucks, and Service) as shown in the picture below. I think it’s possible that these strong industries lead the whole sector toward pre- COVID high even before the presidential election.

(Click on image to enlarge)

Also, Consumer Discretionary, Energy and Utilities sectors are contributing to this last week's rise while Communication Services Sector is the worst so far. Consumer Staples, which is the defensive sector "par excellence", is still lagging as, pointing out an overall trend to invest in more aggressive and profitable assets.

Conclusion

The market this week is still showing a “risk-on” tendency fueled by divestment by the Bond market and a contextual investment in cyclical sectors as Industrial and Discretionary. Bond divestment logical causes and increase in Bond Yields which impacts dividend-paying stocks as Consumer Staples. In conclusion, the overall market is approaching the electoral period with a positive and optimistic mood despite the growing concern for COVID's impact on economic recovery.

Certainly there is a cyclical nature to stock prices and growth, and certainly those traders who are able to buy low and sell high are doing just that, or will be shortly. Those who hold for the longer term should also be pleased with the growth. The theory is that this is how it should work.