S&P 500 And Nasdaq 100 Forecast - August 9, 2016

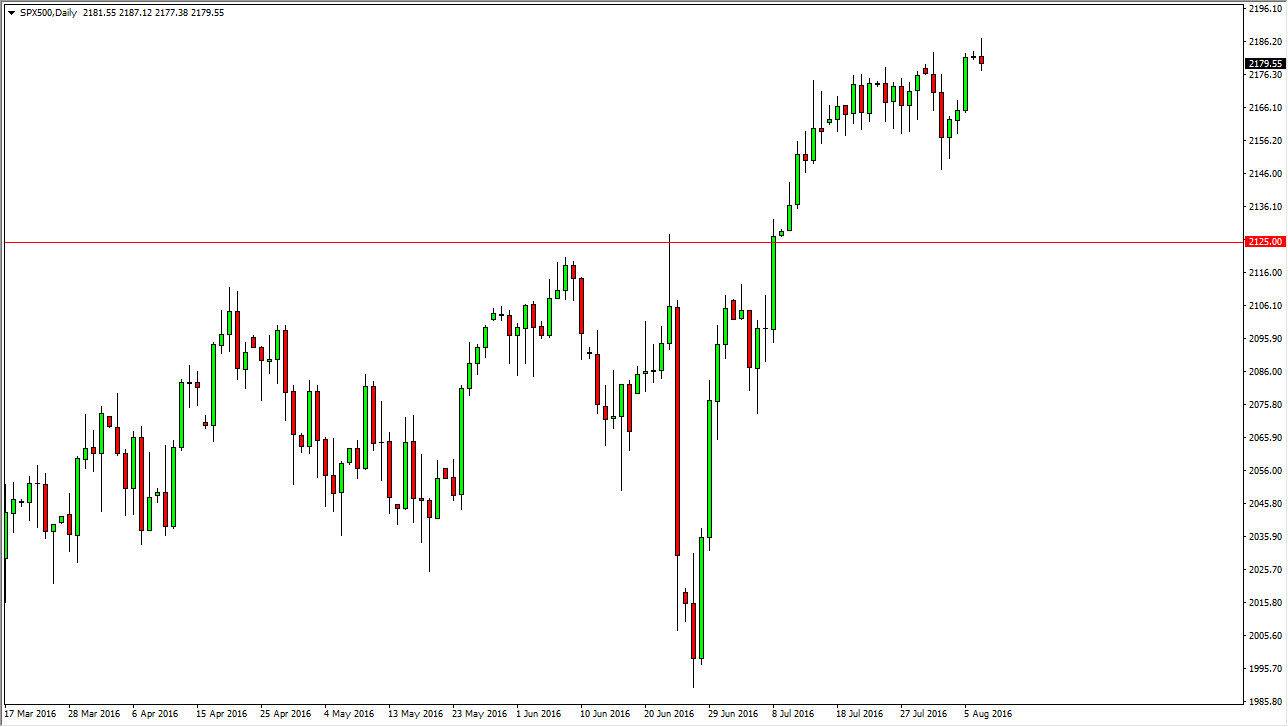

S&P 500

The S&P 500 initially tried to rally during the course of the day on Monday, but turned back around to form a bit of a shooting star. The shooting star of course is a negative sign, so pullback from here could very well be a buying opportunity based upon value, especially considering that the market has been so bullish lately. In fact, I believe that the 2150 level below is going to offer a bit of a “floor” in this market, so any pullback will more than likely form a supportive candle that I’ll be buying. On the other hand though, if we can break above the top of the shooting star, that would also be a very strong sign for buyers to continue jumping into this market and perhaps aim for the 2250 handle.

(Click on image to enlarge)

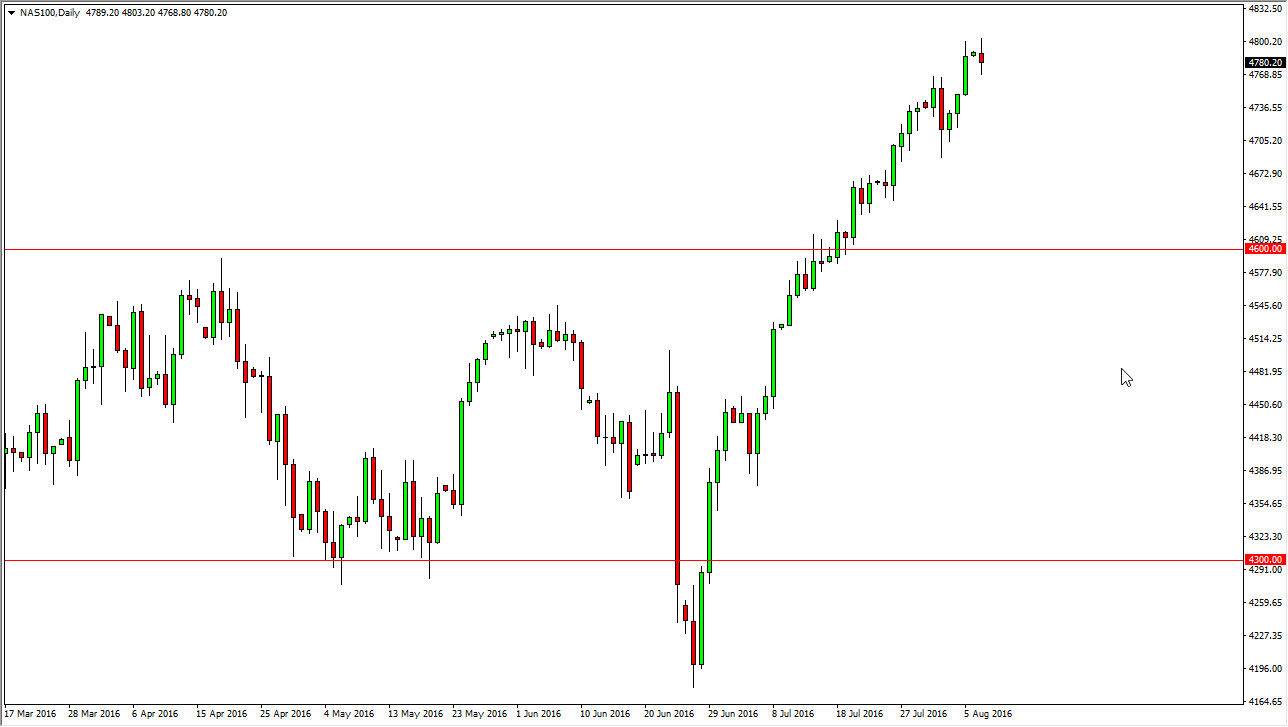

Nasdaq 100

The NASDAQ 100 went back and forth during the course of the session on Monday, forming a somewhat neutral candle. That being the case, the market looks as if we are trying to drop back a little bit to try to find some type of support. This is a market that has been grinding higher for some time, and with that being the case it’s only a matter of time before the markets find buyers below in what has been a very strong marketplace. The 4500 level at this point in time is the absolute “floor” in this market, but quite frankly I think the 4700 level will be massively supportive as well. In other words, this is not only a “buy only” market, but could continue to go much higher.

I have no interest in selling this market at this point in time, because quite frankly it has shown so much in the way of resiliency and people are starting to come to grips with the fact that the Federal Reserve cannot raise interest rates anytime soon, despite the strong jobs number on Friday.

(Click on image to enlarge)

Disclosure: None.

Thanks for sharing